Commission Only Subcontractors Workers Comp

Understanding Commission-Only Subcontractors and Workers’ Compensation

In the world of independent contracting, commission-only subcontractors are individuals who work on a project-by-project basis and are paid solely based on the sales or revenue they generate. This arrangement can be beneficial for both the subcontractor and the company, as it allows for flexibility and can motivate the subcontractor to perform at a high level. However, when it comes to workers’ compensation, the situation can become more complex.

Workers’ Compensation: An Overview

Workers’ compensation is a type of insurance that provides financial benefits to employees who are injured on the job or become ill as a result of their work. The specific rules and regulations surrounding workers’ compensation vary by state, but in general, it is designed to help employees cover medical expenses and lost wages resulting from work-related injuries or illnesses. For traditional employees, workers’ compensation is typically provided by the employer.

Commission-Only Subcontractors and Workers’ Compensation

The question of whether commission-only subcontractors are eligible for workers’ compensation is a nuanced one. In many cases, these individuals are considered independent contractors rather than employees, which means they are not entitled to traditional employment benefits like workers’ compensation. However, the specific circumstances of the working arrangement can affect this classification. Factors such as the level of control the company has over the subcontractor’s work, the provision of equipment or training, and the degree to which the subcontractor is economically dependent on the company can all influence whether the subcontractor is considered an employee or an independent contractor for purposes of workers’ compensation.

Determining Employee vs. Independent Contractor Status

To determine whether a commission-only subcontractor is eligible for workers’ compensation, it is necessary to examine the nature of the working relationship. The following factors are often considered: - Control over work: Does the company dictate how the work is performed, or does the subcontractor have autonomy? - Equipment and training: Does the company provide the necessary tools and training, or is the subcontractor responsible for these? - Economic dependence: Is the subcontractor financially dependent on the company, or do they have the ability to work for other clients and negotiate their own rates? - Permanency of the relationship: Is the working relationship ongoing, or is it project-based?

Implications for Commission-Only Subcontractors

For commission-only subcontractors, understanding their status regarding workers’ compensation is crucial. If classified as independent contractors, they may not be eligible for workers’ compensation through the company. In such cases, they might need to consider private insurance options to protect themselves in case of work-related injuries or illnesses. On the other hand, if they are deemed employees, they would typically be covered under the company’s workers’ compensation policy.

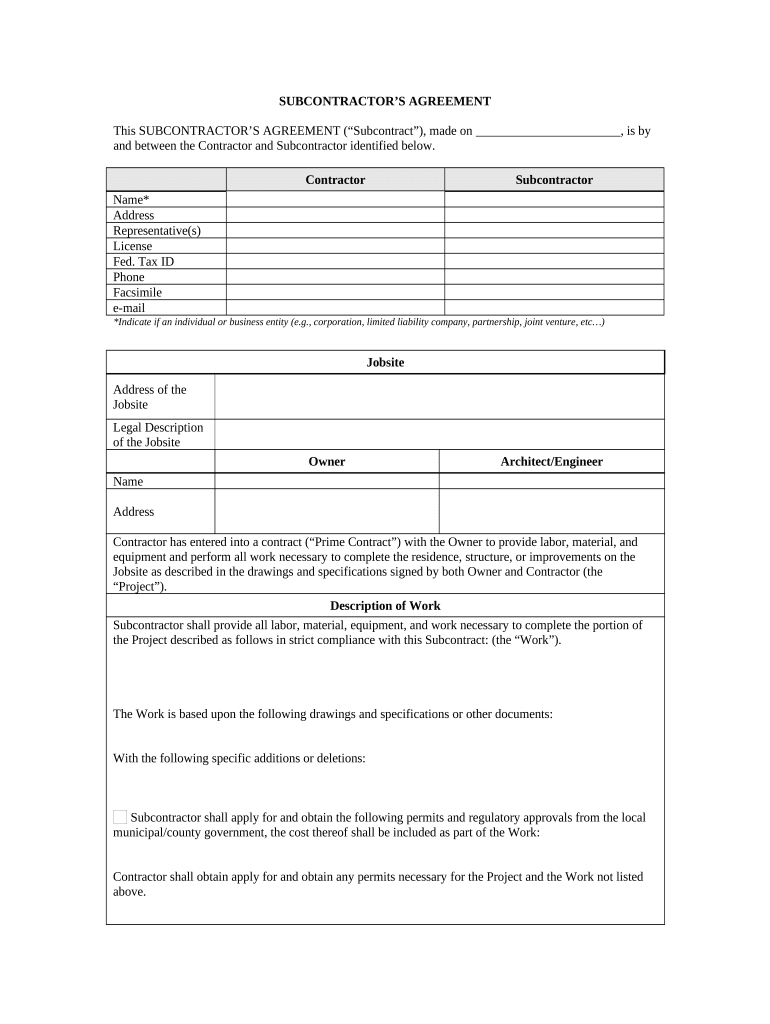

Best Practices for Companies

Companies that work with commission-only subcontractors should: - Clearly define the terms of the working relationship in a contract. - Ensure compliance with all relevant laws and regulations regarding workers’ compensation and independent contractor status. - Consider offering voluntary workers’ compensation insurance as a benefit to subcontractors, even if they are not legally required to do so.

💡 Note: Companies should consult with legal and insurance professionals to understand their specific obligations and options regarding workers' compensation for commission-only subcontractors.

Conclusion and Future Directions

The relationship between commission-only subcontractors and workers’ compensation is complex and influenced by a variety of factors. As the gig economy continues to grow, understanding and navigating these issues will become increasingly important for both companies and independent contractors. By being aware of the laws, regulations, and best practices surrounding workers’ compensation, all parties can better protect themselves and ensure a fair and safe working environment.

Are commission-only subcontractors always considered independent contractors?

+

No, the classification of commission-only subcontractors as independent contractors or employees depends on the specific circumstances of their working arrangement, including factors like control over work, provision of equipment, and economic dependence.

Can commission-only subcontractors purchase their own workers’ compensation insurance?

+

Yes, commission-only subcontractors who are classified as independent contractors may be able to purchase private workers’ compensation insurance policies to protect themselves in case of work-related injuries or illnesses.

How do companies determine whether to offer workers’ compensation to commission-only subcontractors?

+

Companies should consult with legal and insurance professionals to understand their obligations and options regarding workers’ compensation for commission-only subcontractors. This may involve assessing the nature of the working relationship and the applicable laws and regulations.