5 Adoption Tax Papers

Understanding the Adoption Tax Papers Process

The adoption process can be complex and emotionally challenging, but one aspect that adoptive parents should be aware of is the adoption tax papers. These papers are crucial for claiming the Adoption Tax Credit, which can help offset the costs associated with adopting a child. In this article, we will delve into the details of adoption tax papers, their importance, and how to navigate the process.

What are Adoption Tax Papers?

Adoption tax papers refer to the documentation required to claim the Adoption Tax Credit on your tax return. This credit is designed to help adoptive parents recoup some of the expenses incurred during the adoption process, such as agency fees, attorney fees, and travel expenses. The credit can be claimed for both domestic and international adoptions.

Eligibility for Adoption Tax Credit

To be eligible for the Adoption Tax Credit, you must meet certain requirements: * The adoption must be of a qualified child, which includes a child under the age of 18 or a child of any age who is physically or mentally incapable of self-care. * You must have qualified adoption expenses, which include expenses related to the adoption, such as agency fees, attorney fees, and travel expenses. * Your modified adjusted gross income (MAGI) must be below a certain threshold, which varies from year to year. * You must have a taxable income, as the credit is non-refundable.

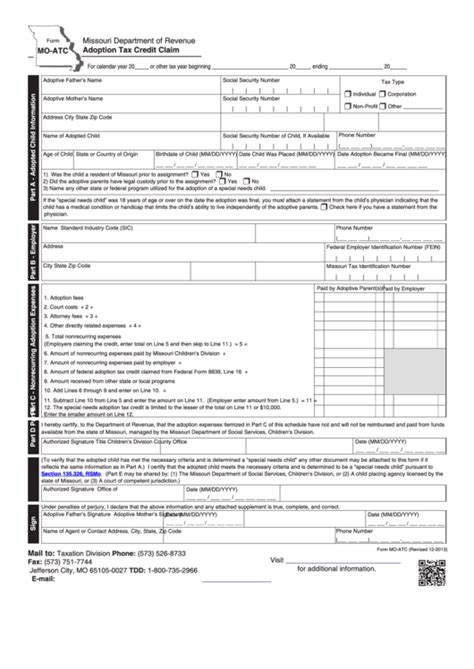

Required Adoption Tax Papers

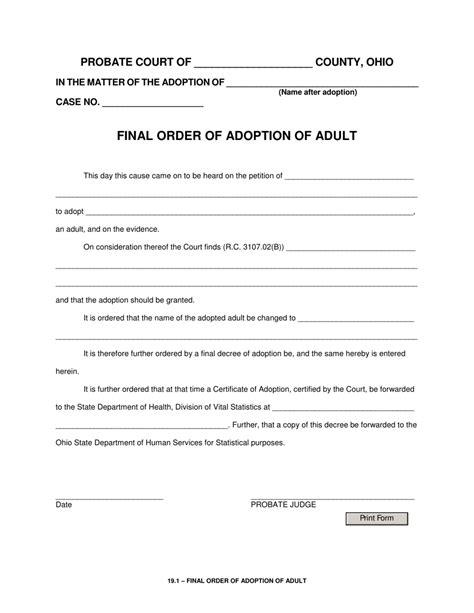

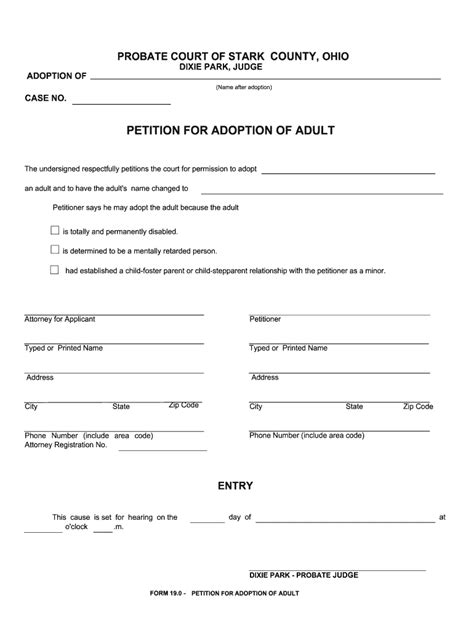

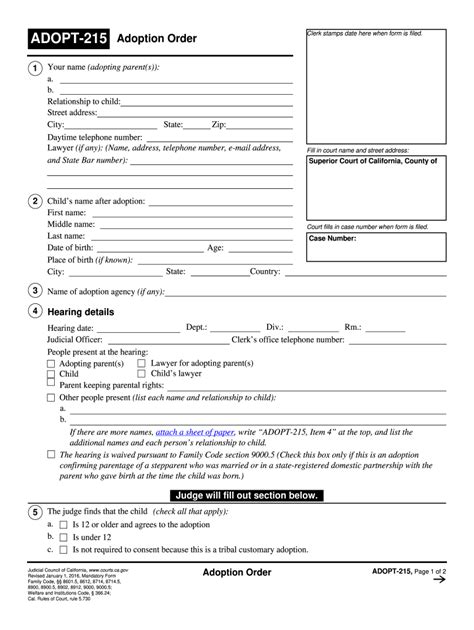

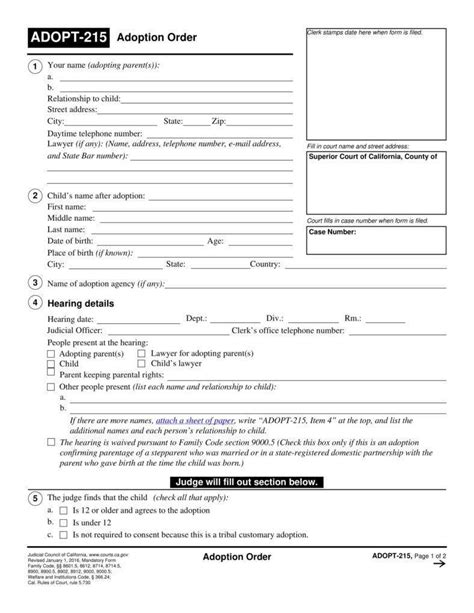

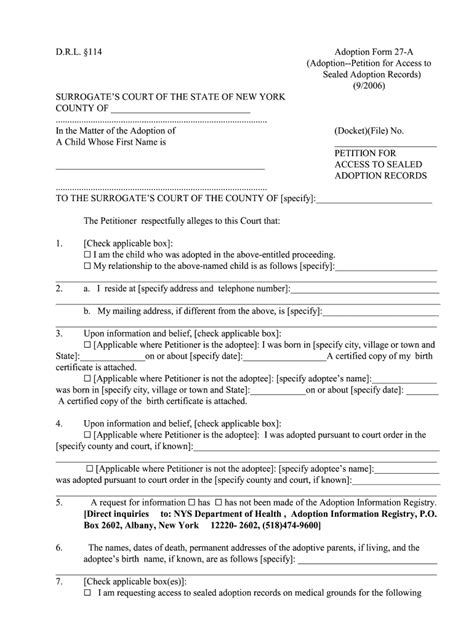

To claim the Adoption Tax Credit, you will need to gather the following adoption tax papers: * Form 8839: This is the form used to claim the Adoption Tax Credit. You will need to complete this form and attach it to your tax return. * Receipts and invoices: You will need to provide documentation of your qualified adoption expenses, such as receipts and invoices from the adoption agency, attorney, and other service providers. * Court documents: You will need to provide a copy of the final adoption decree or other court documents that verify the adoption. * Identification documents: You may need to provide identification documents, such as a birth certificate or passport, to verify the child’s identity.

How to Claim the Adoption Tax Credit

To claim the Adoption Tax Credit, follow these steps: * Complete Form 8839 and attach it to your tax return. * Provide documentation of your qualified adoption expenses, such as receipts and invoices. * Attach a copy of the final adoption decree or other court documents to your tax return. * Claim the credit on Line 12 of Form 1040.

📝 Note: It is essential to keep accurate and detailed records of your adoption expenses, as you will need to provide documentation to support your claim for the Adoption Tax Credit.

Benefits of Adoption Tax Papers

The adoption tax papers are essential for claiming the Adoption Tax Credit, which can provide significant financial benefits to adoptive parents. The credit can help offset the costs associated with adopting a child, making it more affordable for families to grow through adoption.

Common Mistakes to Avoid

When claiming the Adoption Tax Credit, it is essential to avoid common mistakes, such as: * Inaccurate or incomplete documentation: Make sure to provide accurate and complete documentation of your qualified adoption expenses. * Missing or incomplete court documents: Ensure that you have a copy of the final adoption decree or other court documents to verify the adoption. * Incorrect MAGI: Ensure that your modified adjusted gross income (MAGI) is below the threshold to be eligible for the credit.

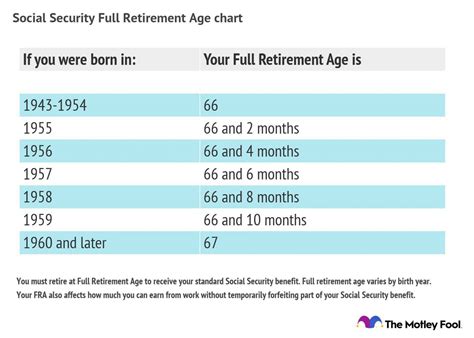

| Year | Maximum Credit | MAGI Threshold |

|---|---|---|

| 2022 | $14,890 | $266,980 |

| 2023 | $15,950 | $279,666 |

Conclusion and Final Thoughts

In conclusion, adoption tax papers are a crucial aspect of the adoption process, and understanding the requirements and benefits can help adoptive parents navigate the process with confidence. By providing accurate and complete documentation, adoptive parents can claim the Adoption Tax Credit and offset some of the costs associated with adopting a child. Remember to avoid common mistakes and seek professional help if needed to ensure a smooth and successful adoption process.

What is the maximum Adoption Tax Credit for 2023?

+

The maximum Adoption Tax Credit for 2023 is 15,950.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What is the MAGI threshold for the Adoption Tax Credit in 2023?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>The MAGI threshold for the Adoption Tax Credit in 2023 is 279,666.

What documentation is required to claim the Adoption Tax Credit?

+

To claim the Adoption Tax Credit, you will need to provide documentation of your qualified adoption expenses, such as receipts and invoices, as well as a copy of the final adoption decree or other court documents.