5 Ways to Stop Identity Theft

Introduction to Identity Theft

Identity theft is a serious crime that occurs when someone uses your personal information, such as your name, social security number, or credit card details, without your permission. This can lead to financial loss, damage to your credit score, and even legal problems. In today’s digital age, it’s easier than ever for thieves to obtain and misuse your personal information. However, there are steps you can take to protect yourself and reduce the risk of becoming a victim of identity theft.

Understanding the Risks of Identity Theft

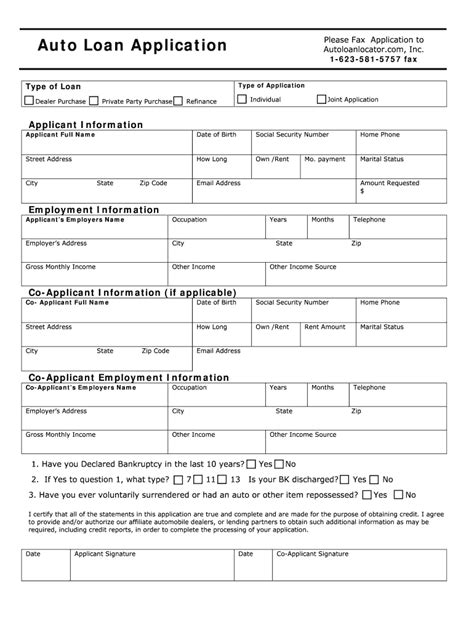

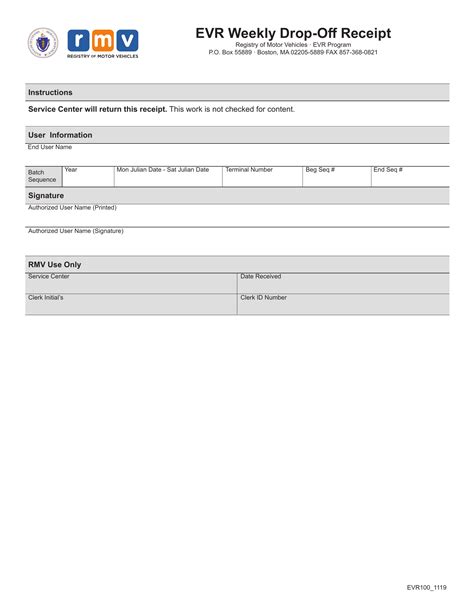

Identity theft can happen to anyone, and it’s essential to be aware of the risks and take proactive measures to prevent it. Some common ways that identity thieves obtain personal information include: * Phishing scams: fake emails or messages that trick you into revealing sensitive information * Data breaches: unauthorized access to companies’ databases that store personal information * Physical theft: stealing of wallets, purses, or other physical documents that contain personal information * Online hacking: breaking into computers or mobile devices to steal personal information

5 Ways to Stop Identity Theft

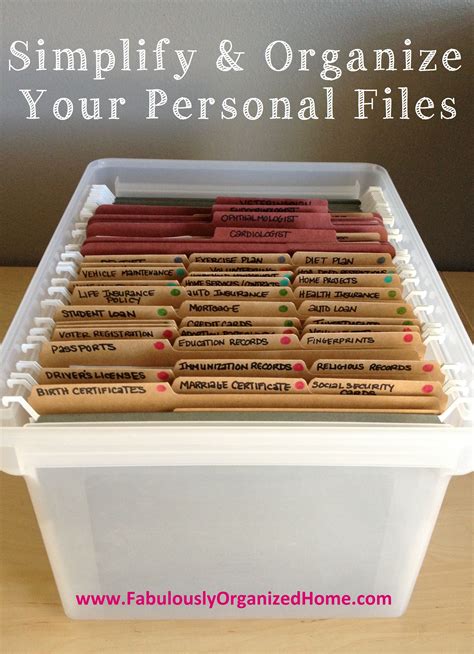

Here are five ways to protect yourself from identity theft: * Monitor your credit report: Check your credit report regularly to detect any suspicious activity. You can request a free credit report from each of the three major credit reporting agencies (Experian, Equifax, and TransUnion) once a year. * Use strong passwords: Use unique and complex passwords for all your online accounts, and avoid using the same password for multiple accounts. * Be cautious with personal information: Be careful when sharing personal information, especially online. Avoid using public computers or public Wi-Fi to access sensitive information. * Use two-factor authentication: Enable two-factor authentication (2FA) whenever possible, which requires both a password and a verification code sent to your phone or email. * Shred sensitive documents: Shred any documents that contain personal information, such as bank statements, credit card offers, or tax returns.

Additional Tips to Prevent Identity Theft

In addition to the above methods, here are some more tips to help prevent identity theft: * Keep your software up to date: Regularly update your operating system, browser, and other software to ensure you have the latest security patches. * Use a reputable antivirus program: Install and regularly update antivirus software to protect against malware and other online threats. * Avoid using public Wi-Fi for sensitive activities: Avoid using public Wi-Fi to access sensitive information, such as online banking or credit card accounts. * Use a password manager: Consider using a password manager to generate and store unique, complex passwords for all your online accounts.

🚨 Note: It's essential to be vigilant and monitor your accounts regularly to detect any suspicious activity.

What to Do If You’re a Victim of Identity Theft

If you’re a victim of identity theft, it’s essential to act quickly to minimize the damage. Here are some steps to take: * Contact the credit reporting agencies: Inform the three major credit reporting agencies (Experian, Equifax, and TransUnion) and request a fraud alert on your credit report. * Notify your bank and credit card companies: Inform your bank and credit card companies of the identity theft and request that they freeze your accounts. * File a police report: File a police report and obtain a copy of the report, as you may need it to prove that you’re a victim of identity theft. * Monitor your accounts closely: Keep a close eye on your accounts and credit report to detect any further suspicious activity.

| Credit Reporting Agency | Phone Number | Website |

|---|---|---|

| Experian | 1-866-200-6020 | www.experian.com |

| Equifax | 1-800-685-5000 | www.equifax.com |

| TransUnion | 1-800-916-8800 | www.transunion.com |

In summary, protecting yourself from identity theft requires a combination of being aware of the risks, taking proactive measures to prevent it, and knowing what to do if you’re a victim. By following the tips outlined above, you can reduce the risk of identity theft and protect your personal information.

To recap, the key points to remember are to monitor your credit report, use strong passwords, be cautious with personal information, use two-factor authentication, and shred sensitive documents. Additionally, keeping your software up to date, using a reputable antivirus program, and avoiding public Wi-Fi for sensitive activities can also help prevent identity theft. If you’re a victim of identity theft, it’s essential to act quickly and contact the credit reporting agencies, notify your bank and credit card companies, file a police report, and monitor your accounts closely.

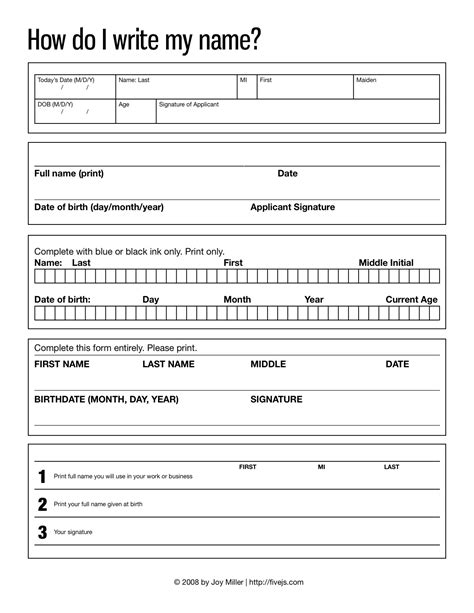

What is identity theft?

+

Identity theft is a serious crime that occurs when someone uses your personal information, such as your name, social security number, or credit card details, without your permission.

How can I protect myself from identity theft?

+

You can protect yourself from identity theft by monitoring your credit report, using strong passwords, being cautious with personal information, using two-factor authentication, and shredding sensitive documents.

What should I do if I’m a victim of identity theft?

+

If you’re a victim of identity theft, you should contact the credit reporting agencies, notify your bank and credit card companies, file a police report, and monitor your accounts closely.