Keep Tax Paperwork Years

Importance of Keeping Tax Paperwork for Years

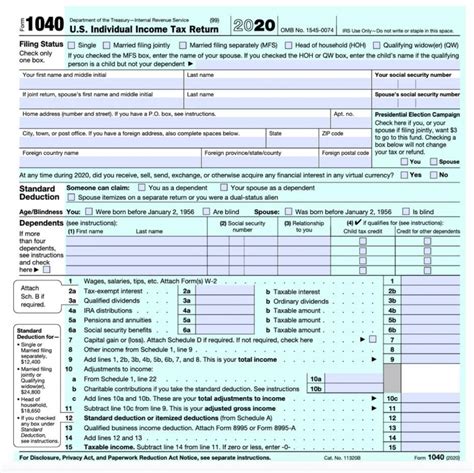

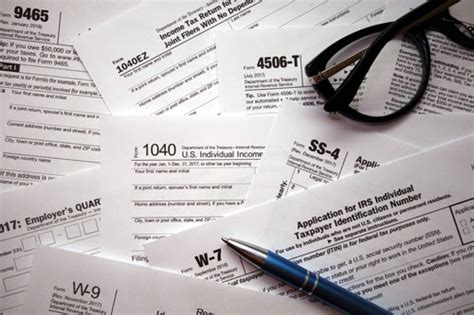

When it comes to tax paperwork, many individuals and businesses struggle with the decision of how long to keep their documents. The Internal Revenue Service (IRS) provides guidelines on the retention period for tax-related documents, but it’s essential to understand the reasons behind these recommendations. Keeping tax paperwork for years can be beneficial in various situations, including audits, amendments, and future reference.

Why Keep Tax Paperwork?

There are several reasons why it’s crucial to keep tax paperwork for an extended period: * Audits: In case of an audit, having your tax paperwork readily available can help you respond to the IRS’s requests and avoid potential penalties. * Amendments: If you need to file an amended return, you’ll require access to your original tax paperwork to ensure accuracy and completeness. * Future Reference: Keeping tax paperwork can help you track your financial progress, identify trends, and make informed decisions about your tax strategy. * Supporting Deductions: In case of an audit or inquiry, having documentation to support your deductions can help you avoid disallowances and potential penalties.

What Tax Paperwork to Keep

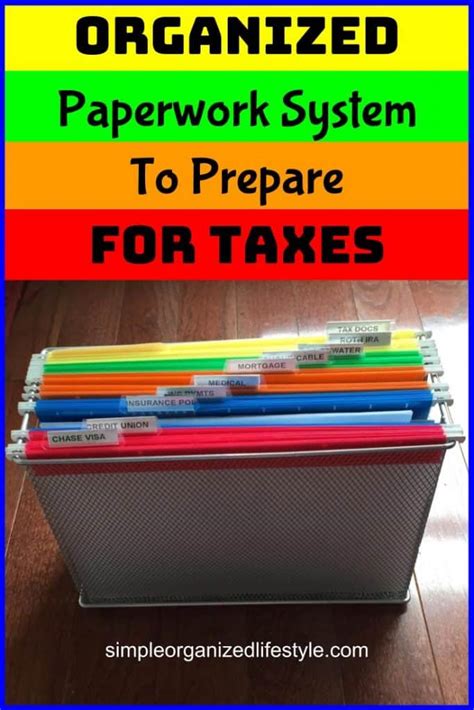

It’s essential to keep the following tax-related documents for an extended period: * Tax Returns: Keep copies of your tax returns, including all supporting documentation, such as W-2s, 1099s, and receipts. * Receipts and Invoices: Keep receipts and invoices for business expenses, charitable donations, and medical expenses. * Bank Statements: Keep bank statements and cancelled checks to support your income and expenses. * Investment Records: Keep records of your investments, including stocks, bonds, and mutual funds.

How Long to Keep Tax Paperwork

The IRS recommends keeping tax paperwork for at least three years from the date of filing. However, it’s recommended to keep tax paperwork for seven years or more in case of: * Audits: The IRS can audit your return up to three years from the date of filing, but in cases of fraud or substantial errors, they can go back further. * Amendments: You can file an amended return up to three years from the date of filing, but having documentation for seven years or more can help support your claims. * Future Reference: Keeping tax paperwork for an extended period can help you track your financial progress and make informed decisions about your tax strategy.

| Document Type | Retention Period |

|---|---|

| Tax Returns | At least 3 years |

| Receipts and Invoices | At least 3 years |

| Bank Statements | At least 3 years |

| Investment Records | Permanently |

📝 Note: It's essential to keep tax paperwork for an extended period to ensure you can respond to audits, file amendments, and track your financial progress.

In summary, keeping tax paperwork for years is crucial for individuals and businesses. It’s recommended to keep tax paperwork for at least three years, but having documentation for seven years or more can provide additional benefits. By keeping tax paperwork, you can ensure you’re prepared for audits, amendments, and future reference.

What is the recommended retention period for tax returns?

+

The IRS recommends keeping tax returns for at least three years from the date of filing.

What type of documents should I keep to support my deductions?

+

You should keep receipts, invoices, and bank statements to support your deductions.

How long should I keep investment records?

+

You should keep investment records permanently to track your financial progress and make informed decisions about your tax strategy.