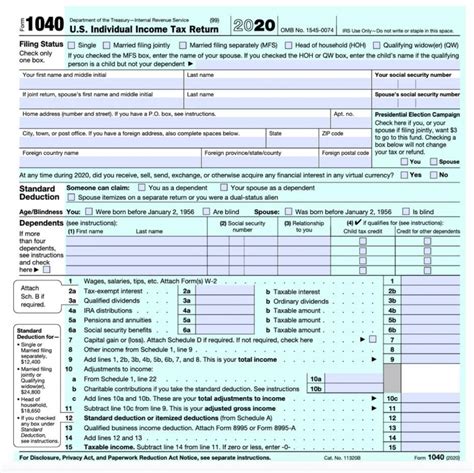

Find Withholdings Line

Understanding Tax Withholdings

When it comes to managing your finances, understanding tax withholdings is crucial. Tax withholdings refer to the amount of money that is deducted from your income and paid to the government as a prepayment of your tax liability. The goal of tax withholdings is to ensure that you are paying the correct amount of taxes throughout the year, rather than having to pay a large sum when you file your tax return.

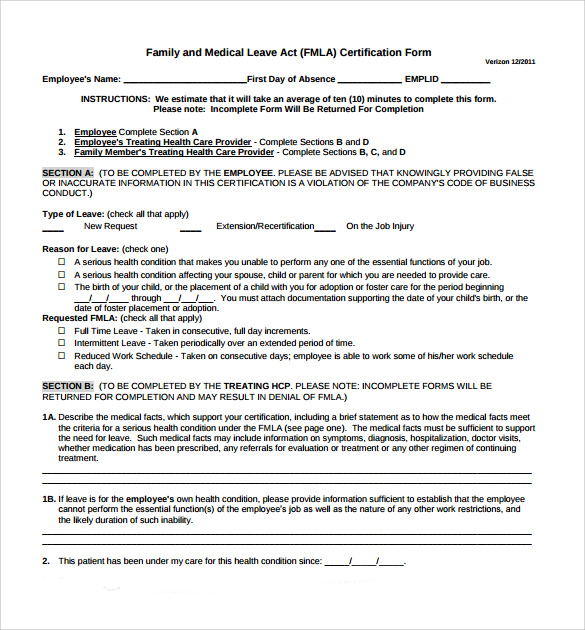

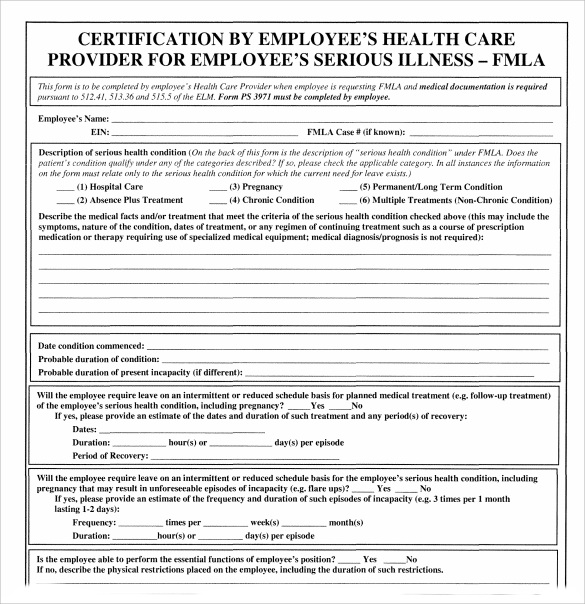

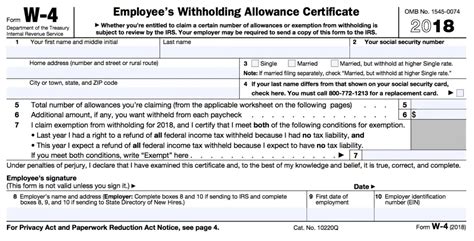

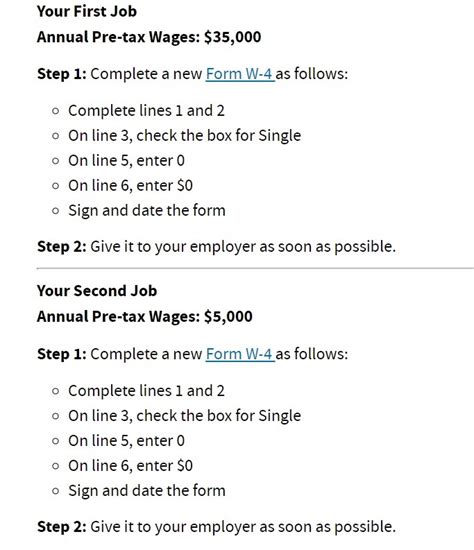

In the United States, for example, employers are required to withhold federal income taxes from their employees' wages. The amount of taxes withheld depends on the employee's income level, filing status, and the number of allowances claimed on their W-4 form. The W-4 form is used to determine the amount of taxes to be withheld from an employee's paycheck. It's essential to accurately complete the W-4 form to avoid underwithholding or overwithholding of taxes.

How to Find Withholdings Line on Your Pay Stub

To find the withholdings line on your pay stub, follow these steps: * Look for the section labeled “Deductions” or “Withholdings” * Check for the line item that says “Federal Income Tax” or “State Income Tax” * The amount listed next to this line item is the amount of taxes that has been withheld from your paycheck * You can also check your pay stub for other types of withholdings, such as Social Security taxes or Medicare taxes

It's essential to review your pay stub regularly to ensure that the correct amount of taxes is being withheld. If you notice any errors or discrepancies, contact your employer's payroll department to have them corrected.

Types of Tax Withholdings

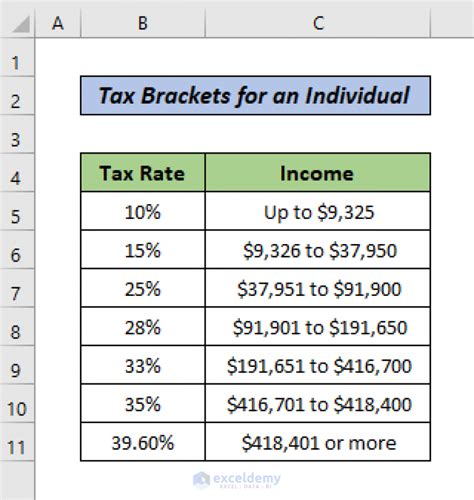

There are several types of tax withholdings, including: * Federal income tax withholdings: These are the taxes withheld from your paycheck and paid to the federal government. * State income tax withholdings: These are the taxes withheld from your paycheck and paid to your state government. * Local income tax withholdings: Some cities and counties also impose income taxes, which may be withheld from your paycheck. * Social Security taxes: These are the taxes withheld from your paycheck to fund Social Security and Medicare.

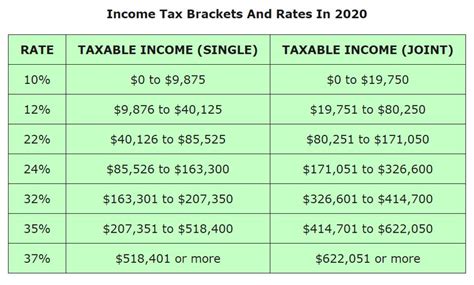

| Type of Tax | Withholding Rate |

|---|---|

| Federal Income Tax | 10%-37% |

| State Income Tax | 0%-13% |

| Social Security Tax | 6.2% |

| Medicare Tax | 1.45% |

📝 Note: The withholding rates listed in the table are subject to change, and you should consult with a tax professional or financial advisor to ensure you are meeting your tax obligations.

As you can see, understanding tax withholdings is crucial for managing your finances effectively. By reviewing your pay stub and understanding the different types of tax withholdings, you can ensure that you are paying the correct amount of taxes throughout the year.

In the end, it’s all about finding the right balance and ensuring that you are meeting your tax obligations. By taking the time to understand tax withholdings and reviewing your pay stub regularly, you can avoid any potential issues and ensure that you are on the right track financially.

What is the purpose of tax withholdings?

+

The purpose of tax withholdings is to ensure that you are paying the correct amount of taxes throughout the year, rather than having to pay a large sum when you file your tax return.

How do I find the withholdings line on my pay stub?

+

To find the withholdings line on your pay stub, look for the section labeled “Deductions” or “Withholdings” and check for the line item that says “Federal Income Tax” or “State Income Tax”.

What types of tax withholdings are there?

+

There are several types of tax withholdings, including federal income tax withholdings, state income tax withholdings, local income tax withholdings, Social Security taxes, and Medicare taxes.