-

7 Tax Record Tips

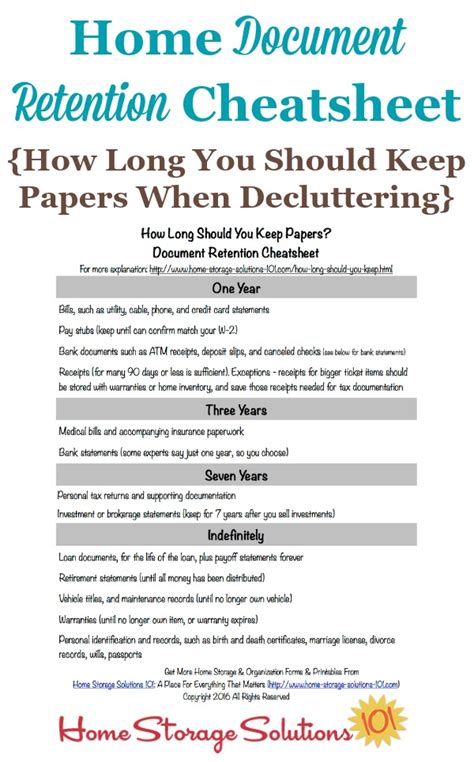

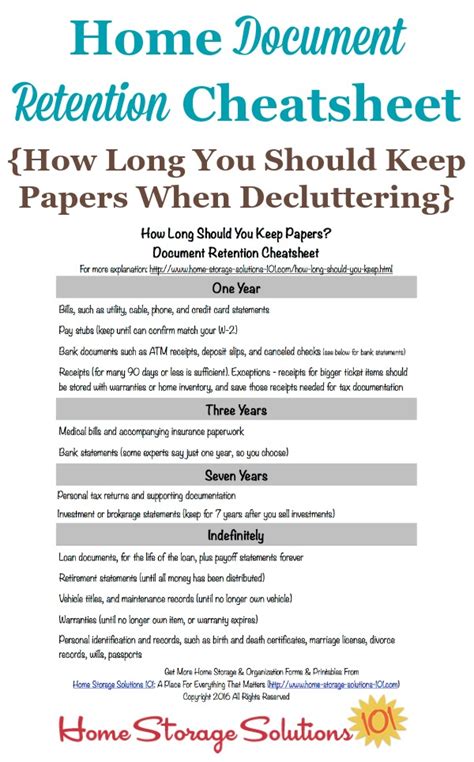

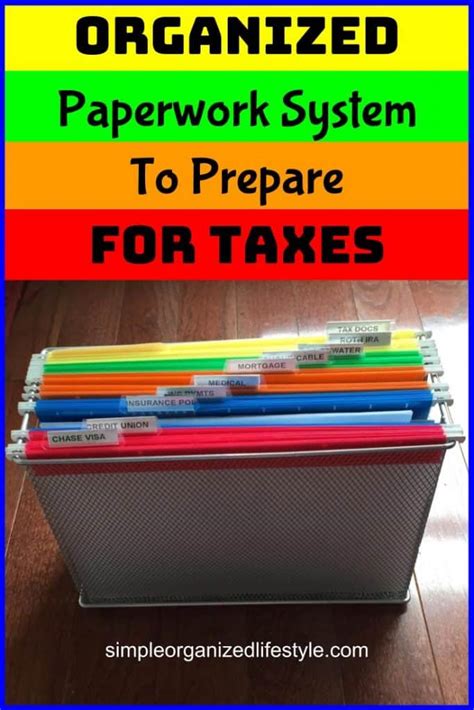

Learn how long to keep tax return paperwork, including receipts, invoices, and W-2 forms, to ensure compliance with IRS regulations and potential audits, understanding tax record retention and document storage guidelines.

Read More » -

After Death Paperwork Retention Period

Discover how long to keep paperwork after someone dies, including probate documents, tax returns, and estate planning records, to ensure efficient estate settlement and minimize tax liabilities.

Read More » -

Estate Paperwork Retention Guidelines

Discover how long to keep estate paperwork, including wills, trusts, and probate documents, to ensure secure inheritance planning, estate administration, and tax compliance, while minimizing storage and reducing paperwork clutter.

Read More » -

Keep Tax Paperwork Years

Keep tax paperwork for 3-7 years, depending on audit risk, including receipts, W-2 forms, and 1099s, to ensure compliance with IRS regulations and maintain accurate financial records for tax deductions and credits.

Read More » -

Estate Paperwork Retention Period

Discover how long to keep estate paperwork, including probate documents, tax records, and inheritance papers, to ensure compliance with regulations and preserve legacy, considering factors like wills, trusts, and estate planning.

Read More »