After Death Paperwork Retention Period

Introduction to After Death Paperwork Retention

When a loved one passes away, the last thing on your mind is likely to be paperwork and administrative tasks. However, these tasks are essential to ensure that the deceased person’s estate is managed correctly, and their wishes are respected. One crucial aspect of this process is understanding the retention period for after-death paperwork. In this article, we will delve into the world of after-death paperwork, exploring what documents are involved, why they are necessary, and how long you should keep them.

Understanding After Death Paperwork

After death paperwork encompasses a wide range of documents, including but not limited to: - Will and testament: The legal document that outlines how the deceased wanted their assets to be distributed. - Letters of administration: If the deceased did not leave a will, these letters are granted by a court to appoint someone to manage the estate. - Death certificate: An official document issued to certify the death of an individual. - Probate documents: The legal process of managing the estate of a deceased person, which involves proving the validity of a will. - Tax returns: The deceased’s final tax returns, as well as any tax returns related to the estate. - Beneficiary designations: Documents that specify who will receive benefits from life insurance policies, retirement accounts, and other investments.

These documents are crucial for several reasons: - They ensure that the deceased person’s assets are distributed according to their wishes. - They provide a legal framework for managing the estate. - They are necessary for tax purposes and to avoid any legal or financial complications.

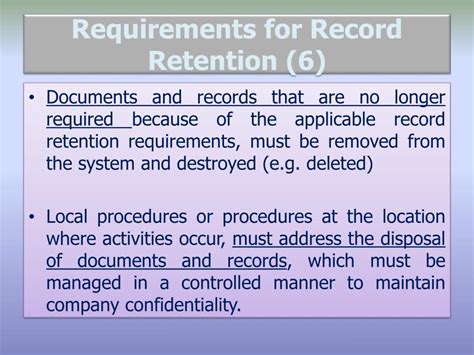

Retention Period for After Death Paperwork

The retention period for after-death paperwork can vary significantly depending on the type of document and the country or state’s legal requirements. Here are some general guidelines: - Wills and testaments: These should be kept permanently, as they are crucial for understanding the deceased person’s wishes regarding their estate. - Death certificates: Also, keep these permanently, as they are often required for various legal and administrative purposes. - Probate documents: The retention period for these documents can vary, but it is generally recommended to keep them for at least 6 years after the probate process is completed. - Tax returns: The IRS recommends keeping tax returns and related documents for at least 3 years in case of an audit. However, for estate tax purposes, it is advisable to keep them for 6 years or more. - Beneficiary designations: These documents should be kept until the benefits have been paid out and the account or policy has been closed.

It’s essential to understand that these are general guidelines, and the specific retention period for after-death paperwork can vary based on individual circumstances and local laws.

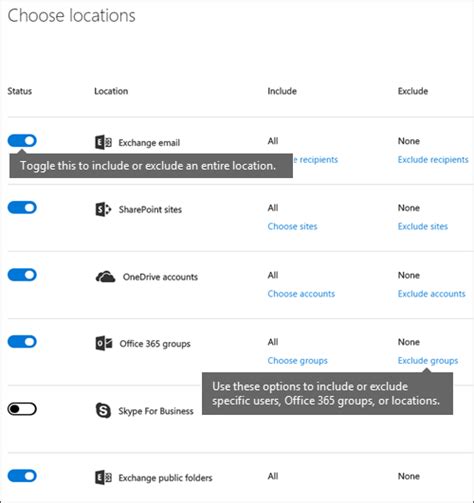

Best Practices for Managing After Death Paperwork

To manage after-death paperwork effectively, consider the following best practices: - Organize documents: Keep all relevant documents in a safe, easily accessible place, such as a fireproof safe or a secure online storage service. - Make digital copies: Scan paper documents and save them digitally to ensure they are not lost or damaged. - Inform relevant parties: Ensure that all relevant parties, including beneficiaries, executors, and institutions holding assets, are informed about the deceased person’s passing and the status of their estate. - Seek professional advice: If you are unsure about any aspect of the process, consider seeking advice from a legal or financial professional.

💡 Note: Always check local laws and regulations regarding the retention of after-death paperwork, as requirements can vary significantly.

Conclusion and Final Thoughts

In conclusion, managing after-death paperwork is a critical aspect of ensuring that a deceased person’s estate is handled correctly and their wishes are respected. Understanding the types of documents involved, their importance, and the recommended retention periods is essential for navigating this complex process. By following best practices and seeking professional advice when needed, you can ensure that the estate is managed efficiently and that all legal and financial obligations are met. This will not only help in avoiding potential legal issues but also provide peace of mind during a difficult time.

What documents are typically involved in after-death paperwork?

+

Typically, after-death paperwork includes wills and testaments, letters of administration, death certificates, probate documents, tax returns, and beneficiary designations.

How long should I keep after-death paperwork?

+

The retention period varies depending on the document type and local laws. Generally, wills, death certificates, and tax returns should be kept permanently or for at least 6 years after the probate process or tax audit period.

What are the best practices for managing after-death paperwork?

+

Best practices include organizing documents securely, making digital copies, informing relevant parties, and seeking professional advice when necessary.