Estate Paperwork Retention Period

Introduction to Estate Paperwork Retention

When it comes to managing an estate, whether it’s for personal, family, or business purposes, keeping track of paperwork is crucial. The retention period for estate paperwork varies depending on the type of document, its significance, and the legal requirements governing its storage. Understanding these aspects is vital to ensure compliance with regulations and to maintain organized records that can be easily accessed when needed. In this article, we will delve into the world of estate paperwork retention, exploring the different types of documents, their retention periods, and the importance of maintaining these records.

Types of Estate Paperwork

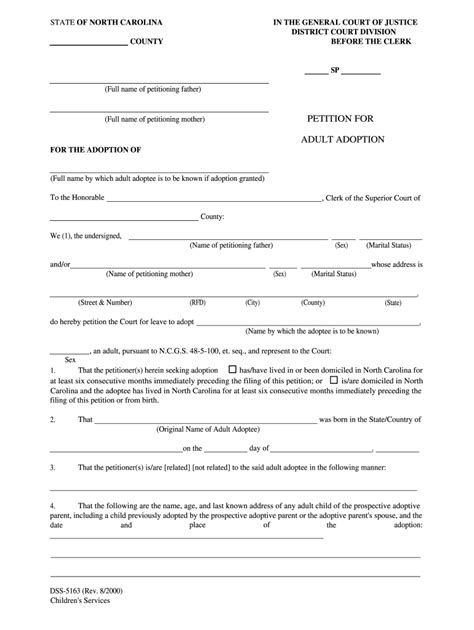

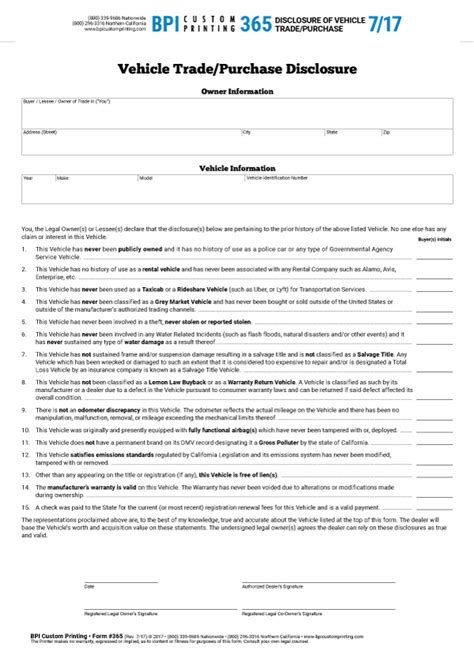

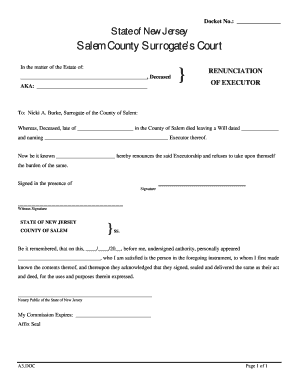

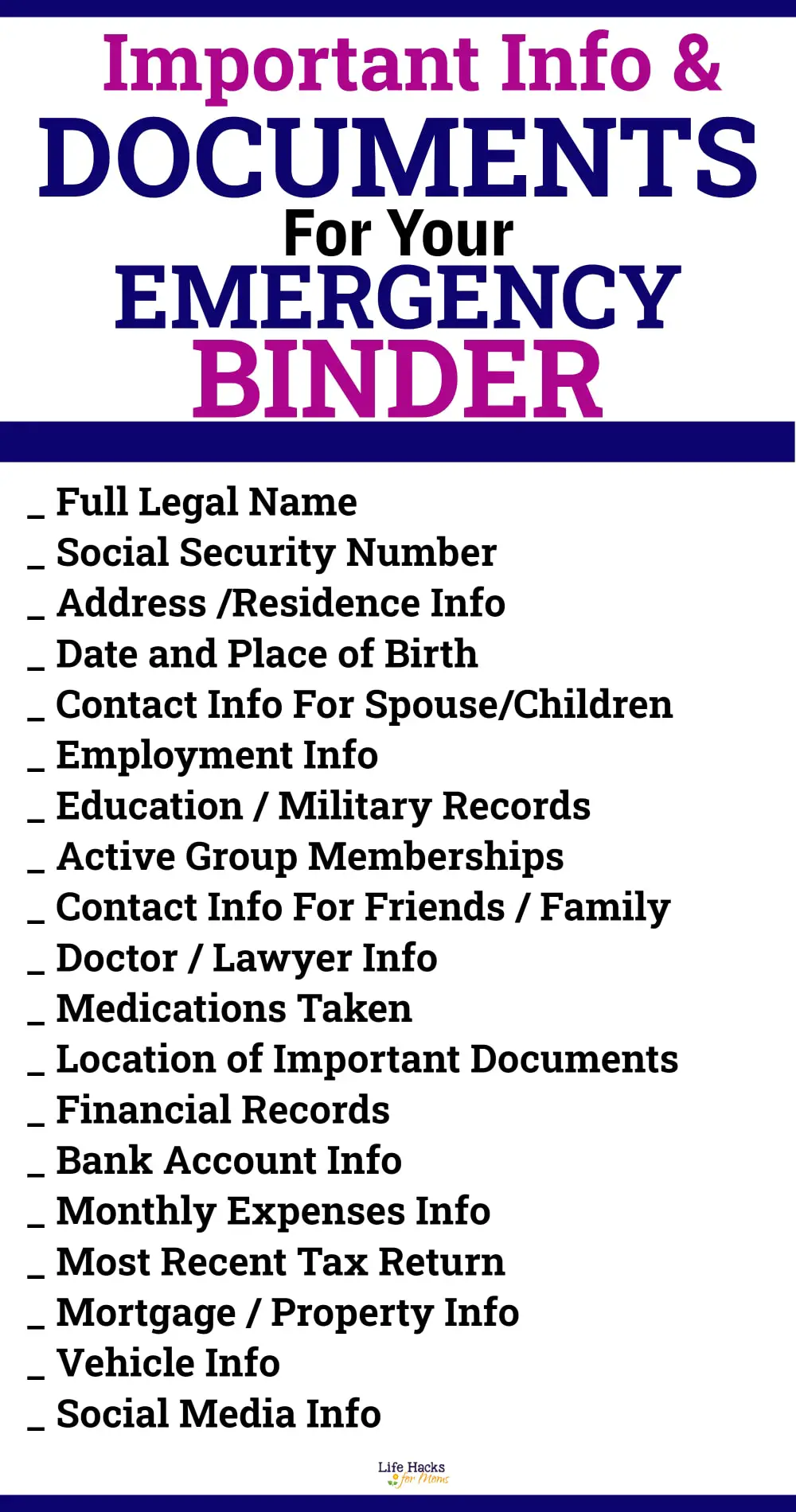

Estate paperwork encompasses a wide range of documents, each serving a specific purpose. These can include: - Wills and Trusts: Legal documents that outline how an individual’s assets should be distributed after their death. - Deeds and Titles: Documents proving ownership of properties and assets. - Tax Returns: Records of annual tax filings, which can be crucial for auditing and financial planning purposes. - Insurance Policies: Documents detailing insurance coverage for various assets and individuals. - Business Documents: For estates that include businesses, these can range from articles of incorporation to financial statements.

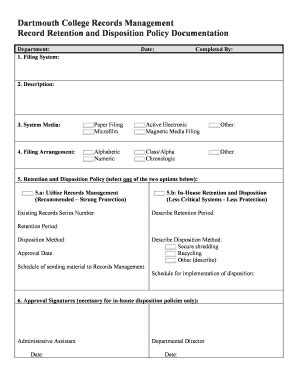

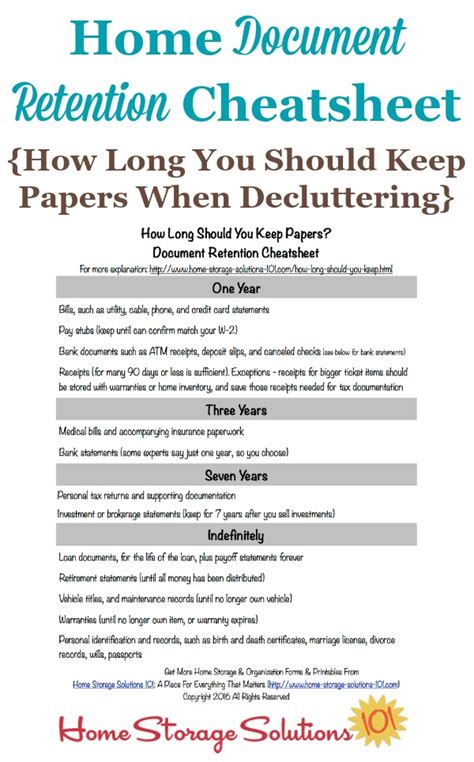

Retention Periods for Estate Paperwork

The retention period for estate paperwork can vary significantly. Here are some general guidelines: - Wills and Trusts: These documents should be kept indefinitely, as they are crucial for estate planning and distribution. - Deeds and Titles: Also, should be retained indefinitely, as they prove ownership and are necessary for future transactions. - Tax Returns: The IRS recommends keeping tax returns and supporting documents for at least three years in case of an audit. However, it’s advisable to keep them for seven years or more, considering the statute of limitations for tax audits. - Insurance Policies: Keep these documents for as long as the policy is in effect, plus an additional three to five years after the policy expires or is terminated. - Business Documents: The retention period can vary, but generally, financial statements and tax returns should be kept for seven years, while other documents like articles of incorporation should be retained indefinitely.

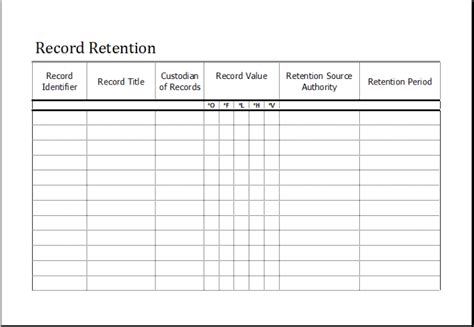

Importance of Organized Record Keeping

Maintaining organized estate paperwork is not just about compliance; it’s also about ensuring that all documents are easily accessible and understandable. This can simplify estate management, reduce the risk of disputes, and make the process of passing on assets to future generations smoother. Moreover, organized records can help in making informed financial decisions and in planning for the future.

Best Practices for Estate Paperwork Storage

Given the importance of estate paperwork, it’s crucial to store these documents securely. Here are some best practices: - Digital Storage: Consider scanning physical documents and storing them digitally. This not only saves space but also provides an additional layer of security against loss or damage. - Secure Locations: Store physical documents in a safe, secure location such as a fireproof safe or a safe deposit box at a bank. - Access Control: Limit access to these documents to authorized individuals to maintain confidentiality and prevent unauthorized changes.

Utilizing Technology for Estate Management

Technology can play a significant role in managing estate paperwork. Digital tools and software can help in organizing documents, setting reminders for important deadlines, and even facilitating collaboration among stakeholders. However, it’s essential to choose secure and reputable platforms to ensure the confidentiality and integrity of the estate paperwork.

📝 Note: When transitioning to digital storage, ensure that all scanned documents are of high quality and that the digital files are properly labeled and organized for easy retrieval.

Conclusion and Final Thoughts

In conclusion, managing estate paperwork requires a thoughtful approach to document retention, organization, and security. By understanding the types of estate paperwork, their respective retention periods, and implementing best practices for storage and management, individuals can ensure that their estate is well-organized and compliant with legal requirements. This not only simplifies estate management but also provides peace of mind, knowing that all necessary documents are secure and easily accessible when needed.

What is the recommended retention period for tax returns?

+

The IRS recommends keeping tax returns and supporting documents for at least three years in case of an audit. However, it’s advisable to keep them for seven years or more, considering the statute of limitations for tax audits.

How should wills and trusts be stored?

+

Wills and trusts should be kept in a secure location such as a fireproof safe or a safe deposit box at a bank. Digital copies can also be stored securely, but the original documents should be kept safe.

What are the benefits of digital storage for estate paperwork?

+

Digital storage provides an additional layer of security against loss or damage, saves physical space, and can facilitate easier access and organization of documents.