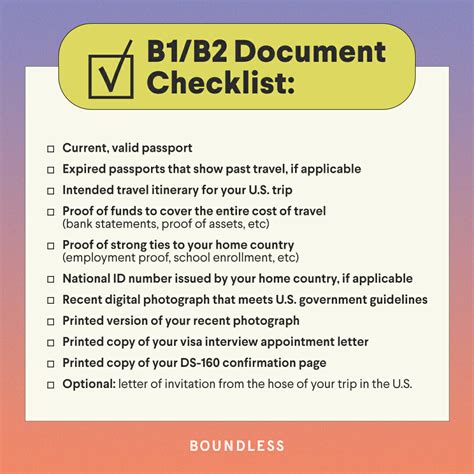

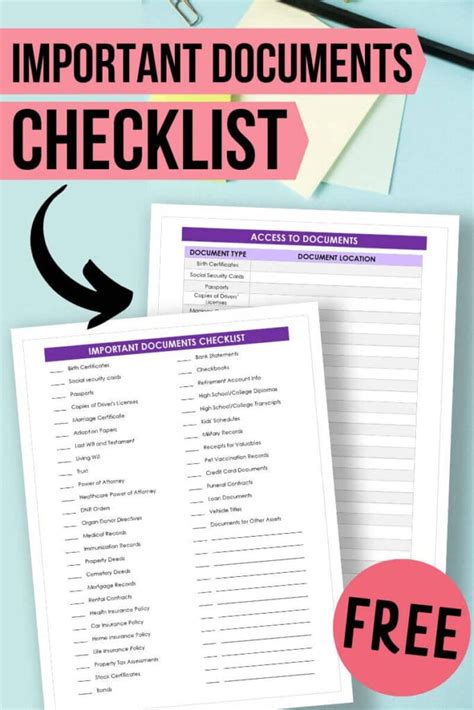

5 Documents Needed

Introduction to Essential Documents

When it comes to legal, financial, and personal matters, having the right documents in place can make a significant difference. These documents not only help in organizing one’s affairs but also ensure that wishes are respected and rights are protected. In this article, we will explore five crucial documents that everyone should consider having. Understanding the importance and function of each document can provide peace of mind and financial security.

1. Last Will and Testament

A Last Will and Testament is a legal document that outlines how a person wants their assets to be distributed after they pass away. It allows individuals to decide who inherits their property, appoint guardians for minor children, and even specify funeral arrangements. Without a will, the distribution of assets is determined by state law, which might not align with the deceased person’s wishes.

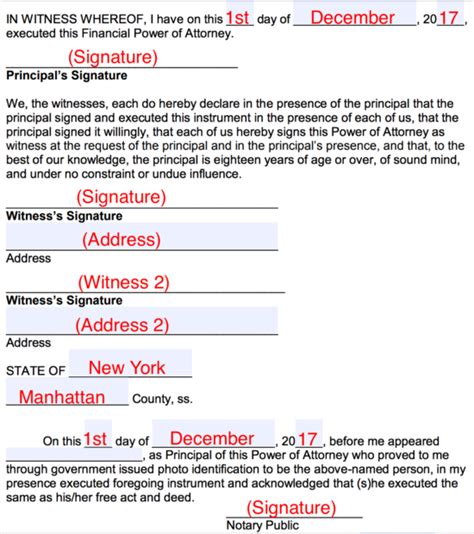

2. Power of Attorney

A Power of Attorney (POA) is a document that grants someone the authority to act on another person’s behalf in legal or financial matters. This can be particularly useful if someone becomes incapacitated and cannot make decisions for themselves. There are different types of POA, including general, special, and durable, each serving different purposes and offering varying levels of authority.

3. Advance Directive

An Advance Directive is a document that specifies the type of medical care an individual wants to receive if they become unable to make decisions for themselves. This can include a Living Will, which outlines preferences for end-of-life care, and a Healthcare Proxy or Durable Power of Attorney for Healthcare, which appoints someone to make medical decisions on the person’s behalf.

4. Insurance Policies

Insurance Policies, such as life insurance, disability insurance, and long-term care insurance, provide financial protection against various risks. These policies can help ensure that loved ones are financially secure and that unexpected expenses do not lead to financial hardship. Understanding the coverage and limitations of each policy is crucial for making informed decisions.

5. Trusts

A Trust is a legal arrangement where one party (the settlor) gives another party (the trustee) the right to manage property or assets for the benefit of a third party (the beneficiary). Trusts can be used to manage assets during one’s lifetime and after death, offering benefits such as avoiding probate, reducing estate taxes, and protecting assets from creditors.

📝 Note: It is essential to review and update these documents periodically to ensure they continue to reflect one's current wishes and circumstances.

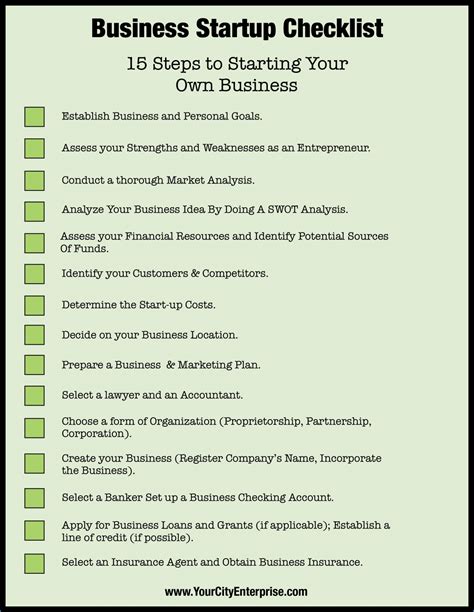

In terms of organizing these documents, consider the following steps: - Creation: Work with a legal professional to draft the documents. - Signing and Witnessing: Ensure all documents are properly signed and witnessed according to the laws of your jurisdiction. - Storage: Keep the original documents in a safe place, such as a fireproof safe or a safe deposit box, and make sure your executor or appointed individuals know where to find them. - Updating: Review and update the documents as necessary, especially after significant life events.

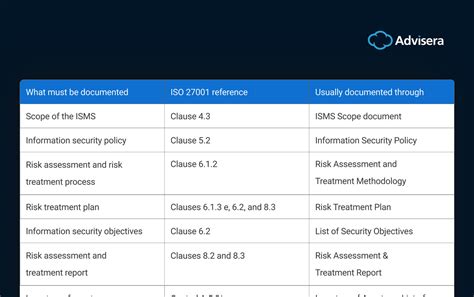

The following table summarizes the key documents and their purposes:

| Document | Purpose |

|---|---|

| Last Will and Testament | Distribute assets after death |

| Power of Attorney | Grant authority for legal/financial decisions |

| Advance Directive | Specify medical care preferences |

| Insurance Policies | Provide financial protection |

| Trusts | Manage assets for beneficiaries |

To finalize the process of securing your future and the future of your loved ones, it’s crucial to understand that these documents are not one-time tasks but rather part of an ongoing process of financial and legal planning. Regularly reviewing and updating them ensures they remain relevant and effective.

In final consideration, having the right documents in place is about more than just legal compliance; it’s about ensuring that your wishes are respected, your loved ones are protected, and your legacy is managed according to your intentions. By taking the time to understand and prepare these essential documents, you can face the future with greater confidence and peace of mind.

What is the primary purpose of a Last Will and Testament?

+

The primary purpose of a Last Will and Testament is to outline how a person wants their assets to be distributed after they pass away, ensuring their wishes are respected.

Why is it important to have a Power of Attorney?

+

Having a Power of Attorney is important because it allows someone to act on your behalf in legal or financial matters if you become incapacitated, ensuring your affairs are managed according to your wishes.

What is the difference between a Living Will and a Healthcare Proxy?

+

A Living Will outlines your preferences for end-of-life medical care, while a Healthcare Proxy appoints someone to make medical decisions on your behalf if you are unable to do so.