5 Solo 401k Forms

Introduction to Solo 401k Forms

When it comes to retirement planning for self-employed individuals or small business owners, the Solo 401k plan is an attractive option. It offers high contribution limits, flexibility in investment choices, and the ability to make tax-deductible contributions. However, to establish and manage a Solo 401k plan, several forms must be completed and filed with the appropriate authorities. In this article, we will delve into the details of five key Solo 401k forms that are essential for the setup, administration, and compliance of a Solo 401k plan.

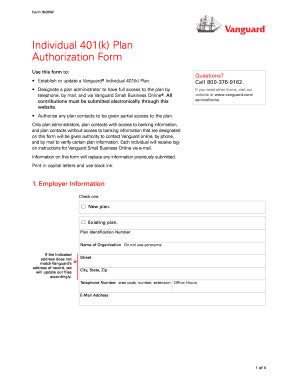

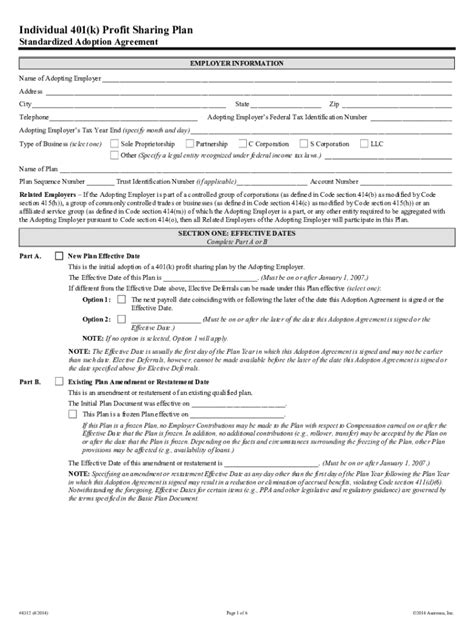

Form 1: Adoption Agreement

The Adoption Agreement is the foundational document of a Solo 401k plan. It outlines the terms of the plan, including the name of the plan, the plan sponsor (the business or self-employed individual), the plan administrator (often the same as the sponsor), and the trustee (who holds the plan assets). This form also specifies the type of contributions allowed (e.g., employee salary deferrals, employer contributions), the vesting schedule for employer contributions, and the loan provisions, if any. The Adoption Agreement must be signed by the plan sponsor, and it serves as the plan document that guides the operation of the Solo 401k.

Form 2: Plan Document

While closely related to the Adoption Agreement, the Plan Document provides a detailed outline of the plan’s operational rules and provisions. It includes information on eligibility, contributions, investments, distributions, and plan administration. The Plan Document must comply with ERISA (Employee Retirement Income Security Act of 1974) and IRS regulations. It is essential for ensuring that the plan operates in accordance with the law and for providing participants with a clear understanding of their rights and responsibilities under the plan.

Form 3: Trust Agreement

The Trust Agreement is another critical document for a Solo 401k plan. It establishes a trust to hold the plan assets, ensuring that these assets are separate from the business or personal assets of the plan sponsor. This separation is crucial for protecting the plan assets from creditors and for maintaining the tax benefits associated with the plan. The Trust Agreement names the trustee responsible for managing the trust and outlines the trustee’s duties and responsibilities. It also specifies how trust assets are to be invested, managed, and distributed.

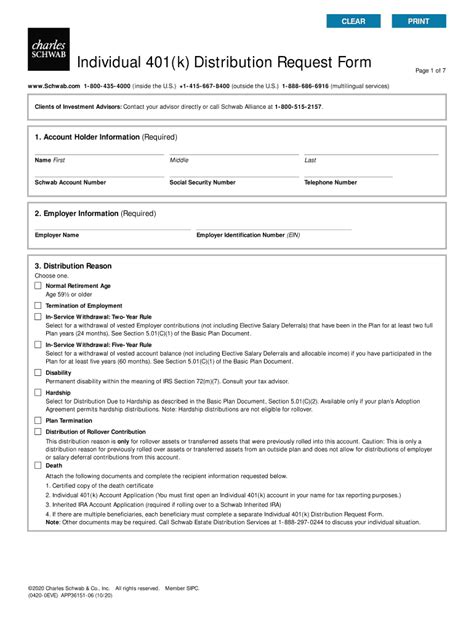

Form 4: Participant Loan Application

One of the benefits of a Solo 401k plan is the ability for participants to take loans from their plan accounts. The Participant Loan Application form is used when a participant wishes to borrow from their plan assets. This form requires the participant to specify the loan amount, the purpose of the loan (though this may not be required for all plans), the repayment terms, and the interest rate. The plan document must allow for loans, and the loan must comply with IRS regulations, including limits on the amount that can be borrowed and the repayment period.

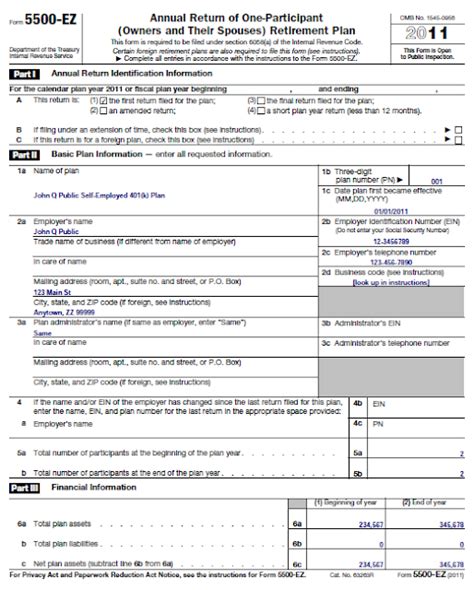

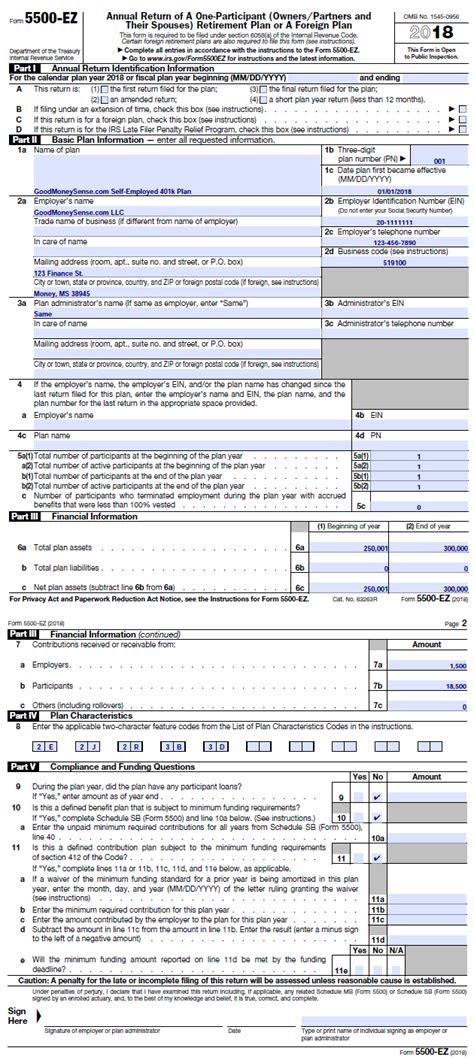

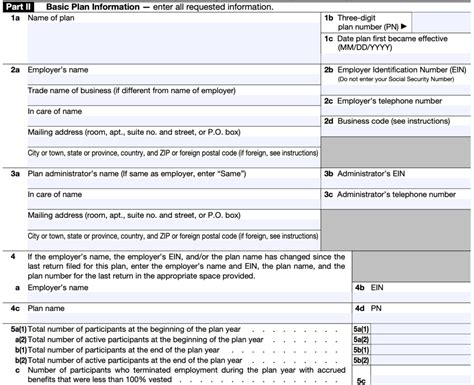

Form 5: Annual Form 5500

The Annual Form 5500 is a critical compliance form for Solo 401k plans. It is filed annually with the IRS to report the plan’s financial condition, investments, and operations. The form requires detailed information about the plan, including participant data, asset values, income and expenses, and administrative fees. Filing the Form 5500 is mandatory for most plans, although some smaller plans may be exempt. The deadline for filing Form 5500 is typically the last day of the seventh month following the plan year (e.g., July 31st for a calendar-year plan). Failure to file this form on time can result in significant penalties.

📝 Note: It is crucial to consult with a tax professional or a retirement plan specialist to ensure that all necessary forms are properly completed and filed, and that the Solo 401k plan remains in compliance with all relevant laws and regulations.

In summary, establishing and maintaining a Solo 401k plan involves several key forms and documents. Understanding the purpose and requirements of each form is essential for plan sponsors and administrators to ensure compliance and to provide a valuable retirement benefit to participants. Whether setting up a new plan or managing an existing one, it is vital to carefully review and complete all necessary forms to avoid potential issues and penalties.

What is the primary purpose of the Adoption Agreement in a Solo 401k plan?

+

The primary purpose of the Adoption Agreement is to outline the terms of the Solo 401k plan, including the type of contributions allowed, the vesting schedule, and the loan provisions, serving as the foundational document of the plan.

Why is the Trust Agreement important for a Solo 401k plan?

+

The Trust Agreement is important because it establishes a trust to hold the plan assets, ensuring they are separate from the business or personal assets of the plan sponsor, thereby protecting the plan assets from creditors and maintaining the plan’s tax benefits.

What is the deadline for filing the Annual Form 5500 for a Solo 401k plan?

+

The deadline for filing the Annual Form 5500 is typically the last day of the seventh month following the plan year, such as July 31st for a calendar-year plan.