5 Forms for 1099 Hire

Introduction to 1099 Hire Forms

When you hire independent contractors or freelancers, it’s essential to have the right paperwork in place to ensure compliance with tax laws and regulations. One of the critical forms you’ll need to use is the 1099 form, which reports income earned by non-employees. In this article, we’ll explore the different types of 1099 forms you may need to use when hiring independent contractors.

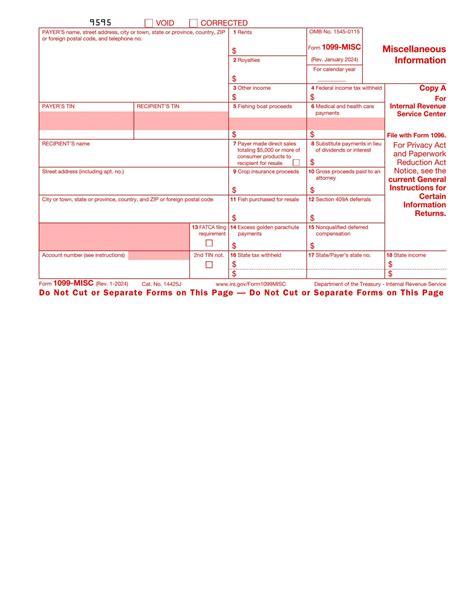

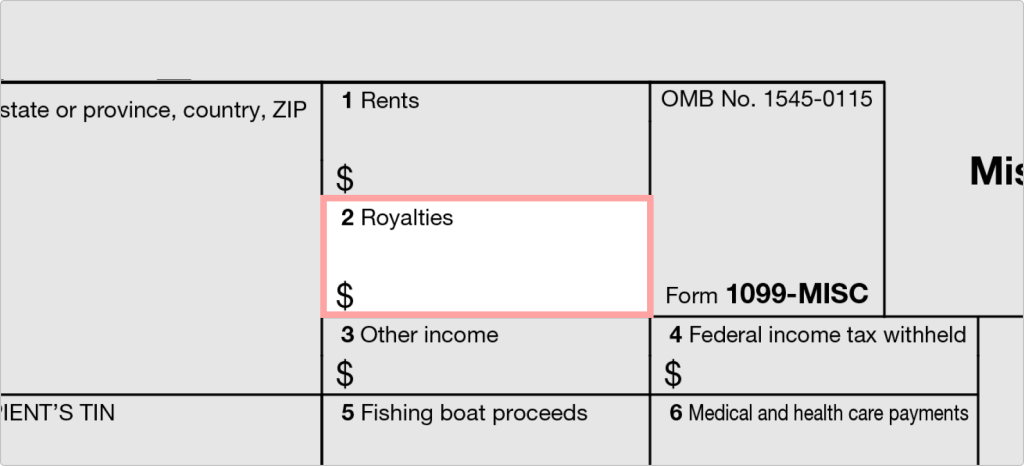

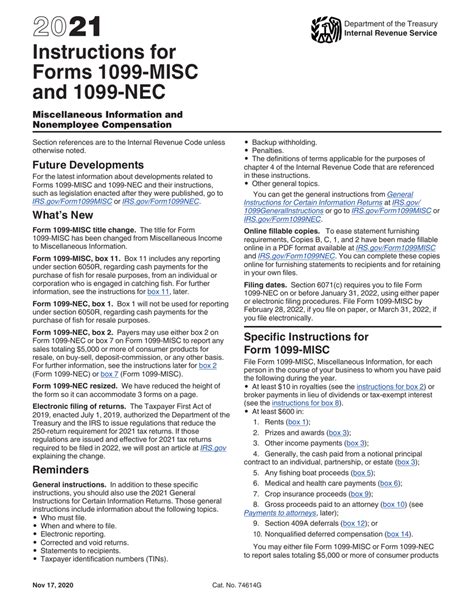

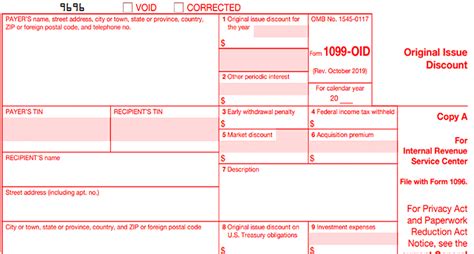

Types of 1099 Forms

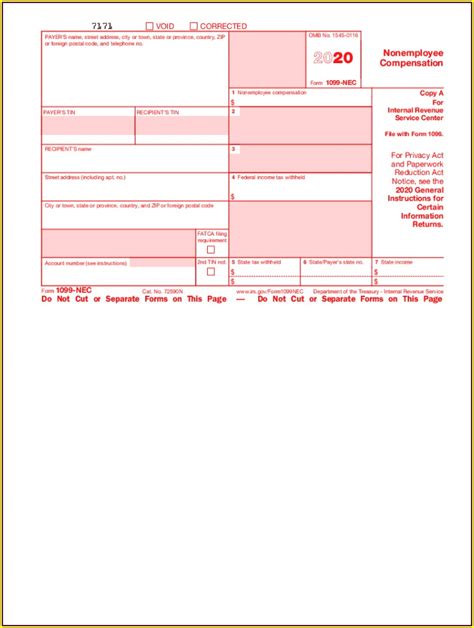

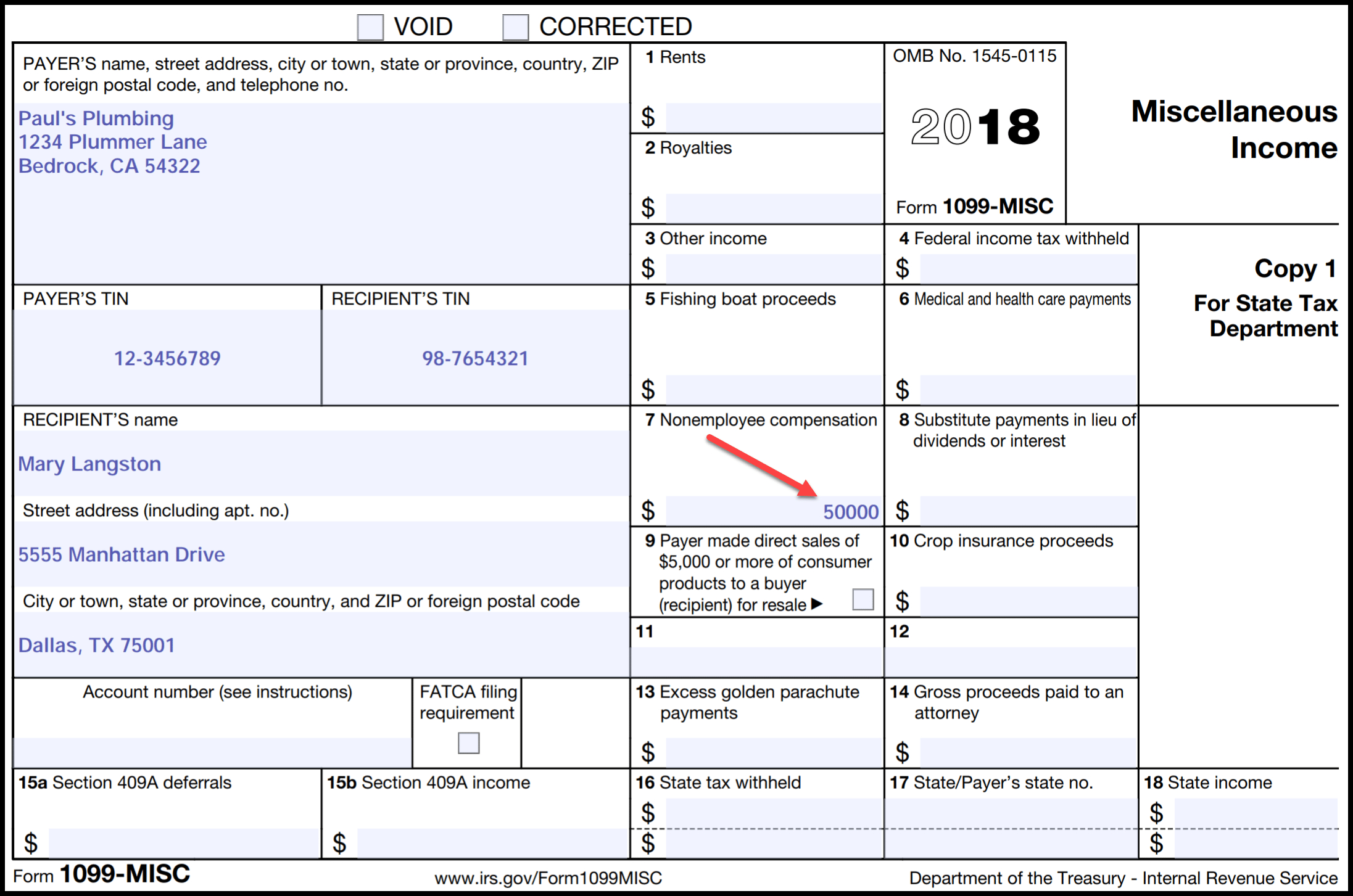

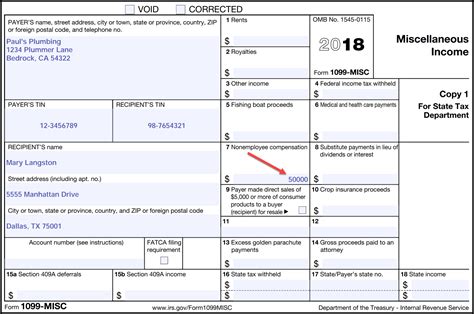

There are several types of 1099 forms, each designed for specific purposes. Here are five common forms you may need to use: * 1099-MISC: This form is used to report miscellaneous income, such as freelance work, consulting fees, and other non-employee compensation. * 1099-INT: This form is used to report interest income, such as interest earned on investments. * 1099-DIV: This form is used to report dividend income, such as dividends earned on stock investments. * 1099-B: This form is used to report proceeds from broker and barter exchange transactions, such as stock sales. * 1099-K: This form is used to report payment card and third-party network transactions, such as credit card payments.

When to Use 1099 Forms

You’ll need to use 1099 forms when you hire independent contractors or freelancers and pay them $600 or more in a calendar year. This includes payments for services such as: * Freelance writing or design work * Consulting or coaching services * Contract labor or construction work * Rent or royalty payments

📝 Note: You'll need to provide a 1099 form to the independent contractor by January 31st of each year, and file a copy with the IRS by February 28th.

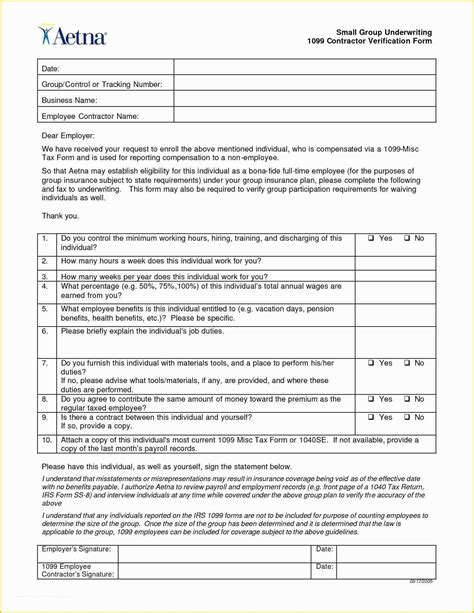

How to Fill Out 1099 Forms

Filling out 1099 forms can seem daunting, but it’s relatively straightforward. Here are the basic steps: * Gather information: Collect the independent contractor’s name, address, and tax identification number (such as a Social Security number or Employer Identification Number). * Determine the type of income: Identify the type of income you’re reporting, such as miscellaneous income or interest income. * Calculate the income: Calculate the total amount of income you paid to the independent contractor during the calendar year. * Complete the form: Fill out the 1099 form with the required information, including the independent contractor’s information, the type and amount of income, and your business information.

Table: 1099 Form Requirements

| Form Type | Purpose | Filing Deadline |

|---|---|---|

| 1099-MISC | Miscellaneous income | January 31st |

| 1099-INT | Interest income | February 28th |

| 1099-DIV | Dividend income | February 28th |

| 1099-B | Broker and barter exchange transactions | February 28th |

| 1099-K | Payment card and third-party network transactions | February 28th |

Best Practices for 1099 Forms

To ensure compliance with tax laws and regulations, follow these best practices: * Keep accurate records: Keep detailed records of payments made to independent contractors, including dates, amounts, and types of income. * Use the correct form: Use the correct 1099 form for the type of income you’re reporting. * File on time: File 1099 forms with the IRS and provide copies to independent contractors by the required deadlines. * Double-check information: Verify the accuracy of information on 1099 forms, including independent contractor information and income amounts.

In summary, using the right 1099 forms is crucial when hiring independent contractors or freelancers. By understanding the different types of 1099 forms, when to use them, and how to fill them out, you can ensure compliance with tax laws and regulations. Remember to keep accurate records, use the correct form, file on time, and double-check information to avoid errors and penalties.

What is the purpose of a 1099 form?

+

The purpose of a 1099 form is to report income earned by non-employees, such as independent contractors or freelancers.

When do I need to provide a 1099 form to an independent contractor?

+

You need to provide a 1099 form to an independent contractor by January 31st of each year, if you paid them $600 or more in the previous calendar year.

What types of income are reported on a 1099 form?

+

1099 forms report various types of income, including miscellaneous income, interest income, dividend income, and proceeds from broker and barter exchange transactions.