Ebay Sale Paperwork Requirements

Understanding Ebay Sale Paperwork Requirements

When selling items on Ebay, it’s essential to understand the paperwork requirements to ensure a smooth and legal transaction. Ebay, as a platform, has specific guidelines and regulations that sellers must follow to comply with laws and protect both buyers and sellers. In this article, we will delve into the details of Ebay sale paperwork requirements, including the necessary documents, record-keeping, and tax implications.

Registration and Licensing

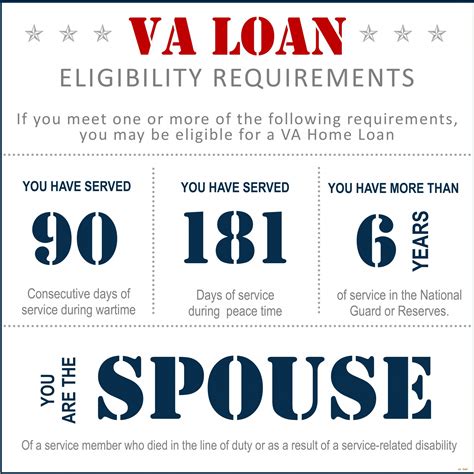

Before starting to sell on Ebay, you need to register for an account and obtain any necessary licenses and permits. This includes registering for a sales tax permit if you’re selling taxable goods. It’s crucial to check with your state’s revenue agency to determine if you need a sales tax permit. Additionally, if you’re selling restricted or regulated items, such as firearms or pharmaceuticals, you may need to obtain special licenses or permits.

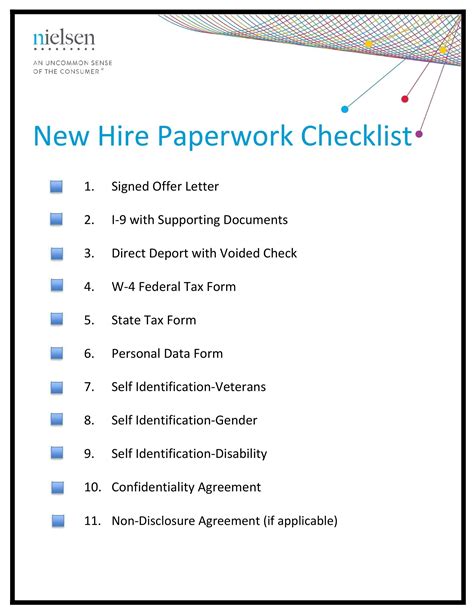

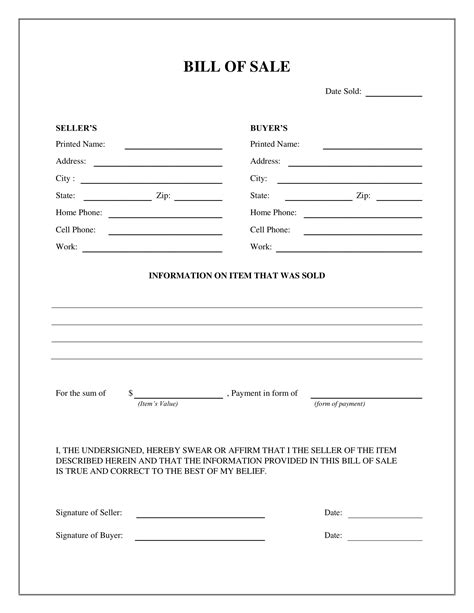

Necessary Documents

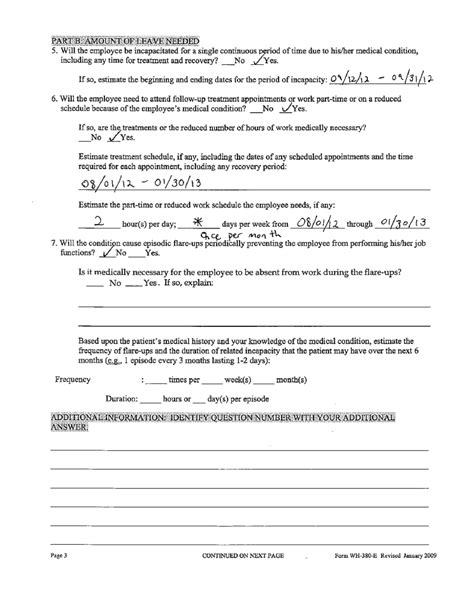

When selling on Ebay, you’ll need to keep records of the following documents: * Sales receipts * Invoices * Payment records * Shipping records * Product descriptions and images * Warranty or guarantee information (if applicable) These documents will help you track your sales, manage your inventory, and provide proof of sale in case of disputes or audits.

Record-Keeping

Proper record-keeping is essential for Ebay sellers. You should keep accurate and detailed records of all your sales, including: * Date of sale * Item description and price * Buyer’s name and contact information * Payment method and amount * Shipping details (including tracking numbers) * Any communication with the buyer These records will help you manage your business, track your income and expenses, and comply with tax laws.

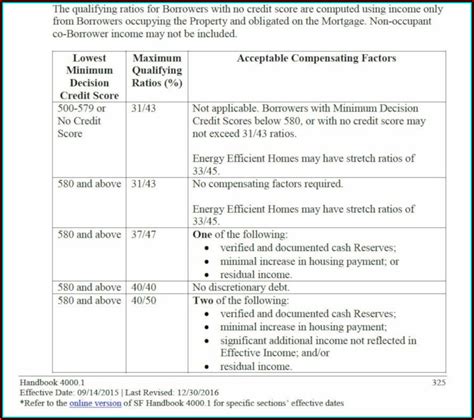

Tax Implications

As an Ebay seller, you’re considered self-employed and are required to report your income and expenses on your tax return. You may need to file additional tax forms, such as Schedule C (Form 1040) or Form 1099-MISC. It’s recommended that you consult with a tax professional to ensure you’re meeting your tax obligations. You may also be eligible for tax deductions, such as business use of your home or expenses related to shipping and packaging.

International Sales

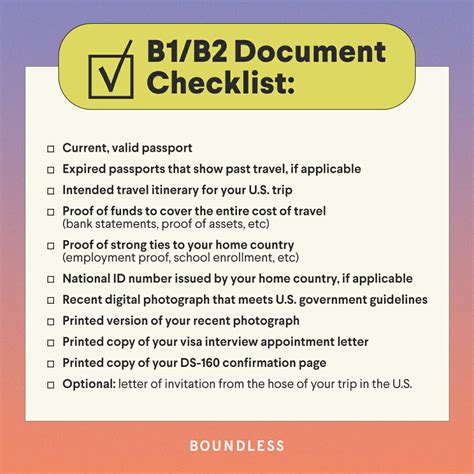

If you’re selling internationally, you’ll need to comply with additional regulations and paperwork requirements. This includes: * Obtaining an Export License (if required) * Completing customs forms and declarations * Paying duties and taxes (if applicable) * Complying with international shipping regulations It’s essential to research the specific requirements for the countries you’re selling to and ensure you’re complying with all relevant laws and regulations.

📝 Note: As an Ebay seller, it's your responsibility to ensure you're complying with all relevant laws and regulations, including those related to sales tax, licensing, and international trade.

Best Practices

To ensure a smooth and successful selling experience on Ebay, follow these best practices: * Keep accurate and detailed records of all sales and transactions * Respond promptly to buyer inquiries and resolve any disputes quickly * Provide clear and detailed product descriptions and images * Use trackable shipping methods and provide tracking numbers to buyers * Comply with all relevant laws and regulations, including those related to sales tax and licensing

| Document | Description |

|---|---|

| Sales Receipt | A record of the sale, including date, item description, and price |

| Invoice | A detailed bill for the sale, including payment terms and shipping information |

| Payment Record | A record of the payment, including date, amount, and payment method |

In summary, understanding Ebay sale paperwork requirements is crucial for a successful and compliant selling experience. By registering for an account, obtaining necessary licenses and permits, keeping accurate records, and complying with tax laws and international regulations, you can ensure a smooth and profitable selling experience on Ebay. Remember to always follow best practices, including keeping detailed records, responding promptly to buyer inquiries, and providing clear product descriptions and images.

What documents do I need to keep as an Ebay seller?

+

You should keep records of sales receipts, invoices, payment records, shipping records, product descriptions and images, and warranty or guarantee information (if applicable).

Do I need to obtain a sales tax permit to sell on Ebay?

+

Yes, if you’re selling taxable goods, you may need to obtain a sales tax permit. Check with your state’s revenue agency to determine if you need a sales tax permit.

What are the tax implications of selling on Ebay?

+

As an Ebay seller, you’re considered self-employed and are required to report your income and expenses on your tax return. You may need to file additional tax forms, such as Schedule C (Form 1040) or Form 1099-MISC. Consult with a tax professional to ensure you’re meeting your tax obligations.