5 VA Loan Papers

Understanding the VA Loan Process: Essential Papers to Know

The VA loan process can be complex and overwhelming, especially for first-time homebuyers. One of the most critical aspects of this process is understanding the various papers and documents required to secure a VA loan. In this article, we will delve into the world of VA loans, exploring the five essential papers that play a crucial role in this process.

Introduction to VA Loans

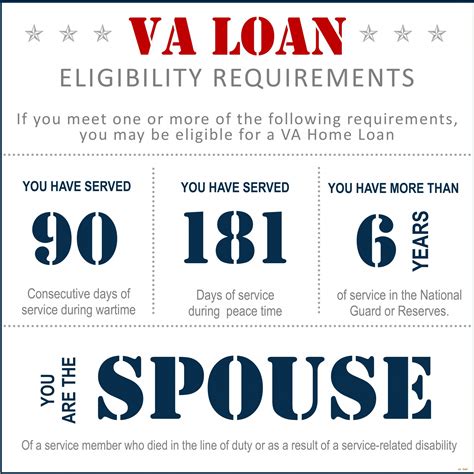

VA loans are a type of mortgage loan guaranteed by the United States Department of Veterans Affairs (VA). These loans are designed to help eligible veterans, active-duty personnel, and surviving spouses purchase, build, or refinance a home. VA loans offer several benefits, including lower interest rates, lower monthly payments, and no private mortgage insurance (PMI) requirements. To take advantage of these benefits, borrowers must navigate the VA loan process, which involves submitting various papers and documents.

The 5 Essential VA Loan Papers

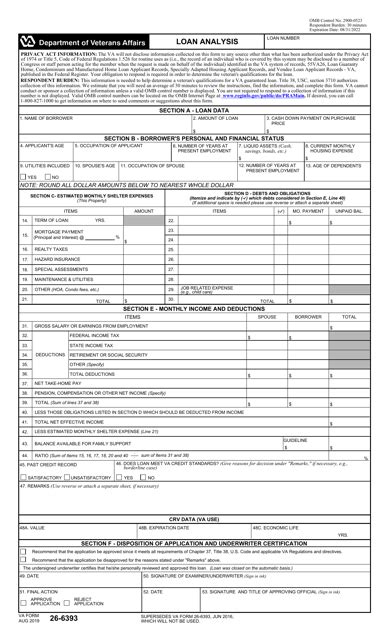

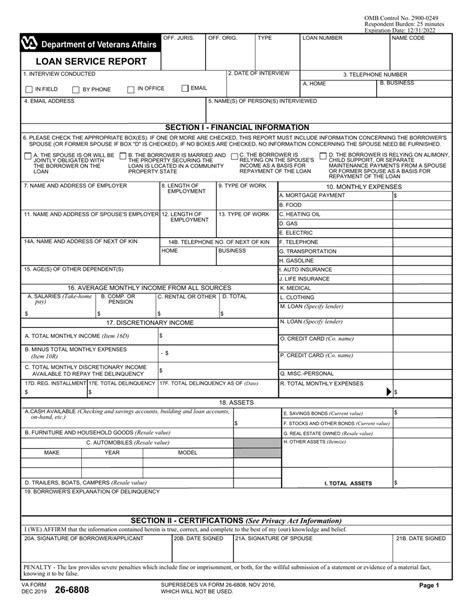

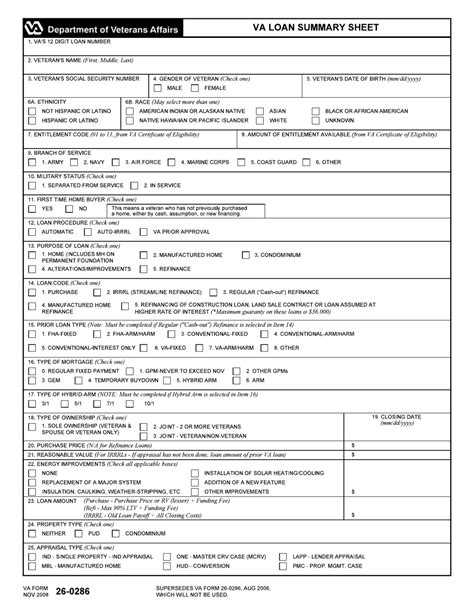

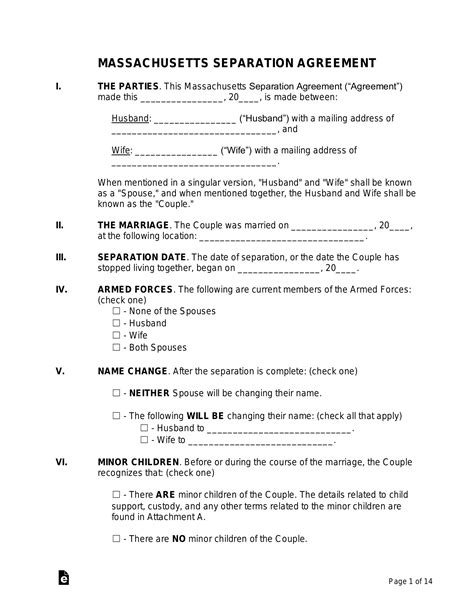

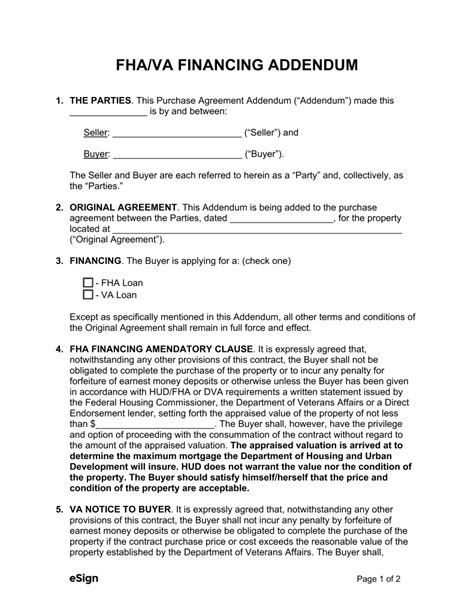

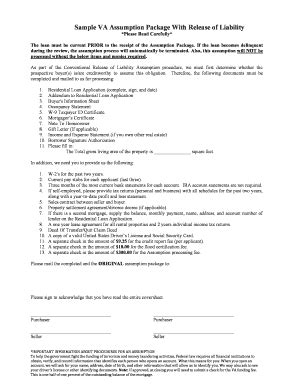

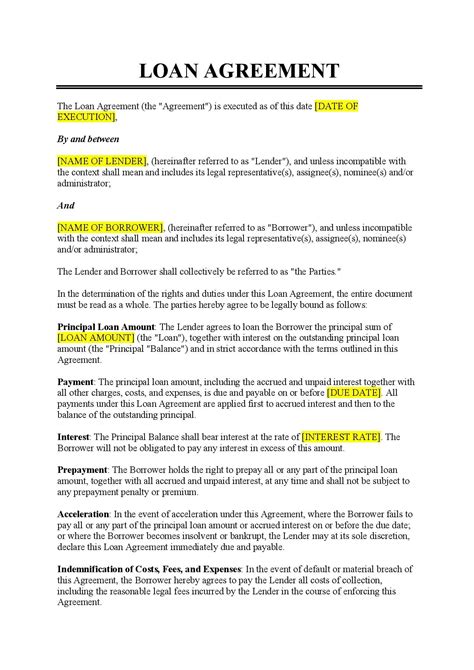

The following five papers are essential to the VA loan process: * Certificate of Eligibility (COE): This document confirms the borrower’s eligibility for a VA loan. It can be obtained through the VA’s eBenefits portal or by mail. * DD Form 214: This document, also known as the Certificate of Release or Discharge from Active Duty, is required to verify the borrower’s military service. * VA Form 26-1880: This form, also known as the Request for Certificate of Eligibility, is used to apply for a COE. * Loan Application: This document is used to apply for the VA loan and provides detailed information about the borrower’s financial situation. * Appraisal Report: This report provides an independent assessment of the property’s value and is used to determine the loan amount.

Importance of Accurate Paperwork

Accurate and complete paperwork is crucial to the VA loan process. Inaccurate or incomplete paperwork can lead to delays or even loan denials. Borrowers should carefully review and verify all information before submitting their papers. It is also essential to work with a reputable lender who is experienced in VA loans to ensure a smooth and efficient process.

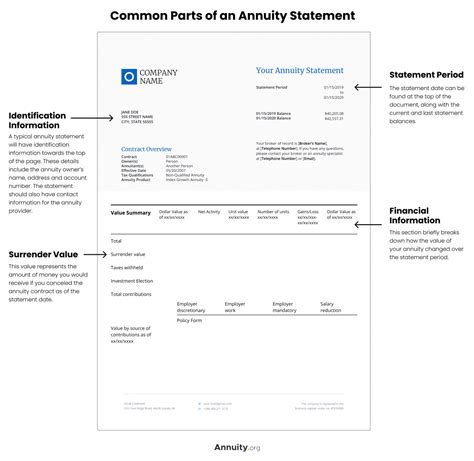

VA Loan Paperwork Requirements

The VA loan paperwork requirements may vary depending on the lender and the borrower’s individual circumstances. However, the following documents are typically required: * Identification documents: Borrowers must provide identification documents, such as a driver’s license or passport. * Income documents: Borrowers must provide income documents, such as pay stubs and W-2 forms. * Credit reports: Borrowers must provide credit reports, which are used to evaluate their creditworthiness. * Property documents: Borrowers must provide property documents, such as the property deed and title report.

📝 Note: Borrowers should carefully review and understand all paperwork requirements to ensure a smooth and efficient VA loan process.

VA Loan Paperwork Submission

Once all the necessary paperwork has been gathered, borrowers can submit their application to the lender. The lender will review the application and paperwork to determine eligibility for the VA loan. If approved, the borrower will receive a pre-approval letter, which indicates the loan amount and terms.

VA Loan Paperwork Tips

To ensure a smooth and efficient VA loan process, borrowers should follow these tips: * Gather all necessary paperwork: Borrowers should gather all necessary paperwork before submitting their application. * Verify information: Borrowers should carefully verify all information to ensure accuracy and completeness. * Work with a reputable lender: Borrowers should work with a reputable lender who is experienced in VA loans. * Stay organized: Borrowers should stay organized and keep track of all paperwork and correspondence.

| Document | Description |

|---|---|

| Certificate of Eligibility (COE) | Confirms eligibility for a VA loan |

| DD Form 214 | Verifies military service |

| VA Form 26-1880 | Applies for a COE |

| Loan Application | Applies for the VA loan |

| Appraisal Report | Provides an independent assessment of the property's value |

In summary, the VA loan process involves submitting various papers and documents to secure a loan. The five essential papers, including the Certificate of Eligibility, DD Form 214, VA Form 26-1880, Loan Application, and Appraisal Report, play a crucial role in this process. By understanding the importance of accurate paperwork and following the tips outlined above, borrowers can ensure a smooth and efficient VA loan process.

What is a Certificate of Eligibility (COE)?

+

A Certificate of Eligibility (COE) is a document that confirms a borrower’s eligibility for a VA loan.

What is the purpose of the DD Form 214?

+

The DD Form 214 is used to verify a borrower’s military service.

How do I apply for a VA loan?

+

To apply for a VA loan, borrowers must submit a Loan Application and provide all necessary paperwork, including the Certificate of Eligibility, DD Form 214, and income documents.