7 Tax Record Tips

Introduction to Tax Record Keeping

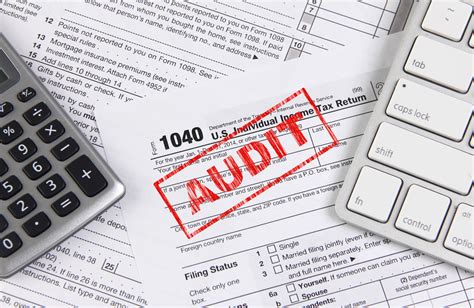

Proper tax record keeping is essential for individuals and businesses to ensure they are in compliance with tax laws and regulations. It helps in accurate tax filing, reduces the risk of audits, and enables the retrieval of necessary documents when needed. In this article, we will explore seven tax record tips to help you manage your tax documents efficiently.

Understanding the Importance of Tax Records

Tax records are vital for both personal and business financial management. They provide a clear picture of your income, expenses, and tax obligations. Accurate and detailed records can help you claim legitimate deductions, credits, and exemptions, thereby reducing your tax liability. Moreover, well-organized tax records can save you time and stress during tax season.

Tax Record Tip 1: Identify Necessary Documents

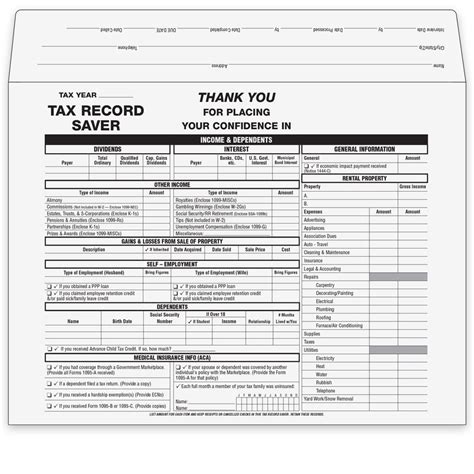

To start managing your tax records, you need to identify the necessary documents. These may include:

- W-2 forms from your employer

- 1099 forms for freelance or contract work

- Interest statements from banks and investments

- Charitable donation receipts

- Medical expense records

- Business expense receipts (for business owners)

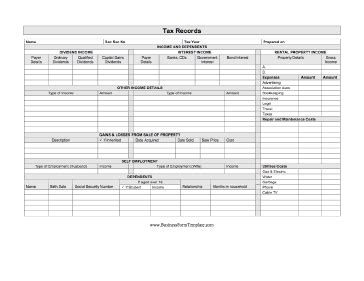

Tax Record Tip 2: Implement a Filing System

A well-organized filing system is crucial for efficient tax record keeping. You can use physical files or digital storage solutions like cloud-based services. Label each file clearly and consider categorizing them by type (e.g., income, expenses, deductions) or by year. This will make it easier to locate specific documents when needed.

Tax Record Tip 3: Keep Digital Copies

In addition to physical files, it’s a good idea to keep digital copies of your tax records. This can be done by scanning paper documents or saving electronic versions. Digital storage solutions like external hard drives or cloud services can provide secure and accessible storage for your tax records.

Tax Record Tip 4: Track Expenses Throughout the Year

To ensure accurate tax filing, it’s essential to track your expenses throughout the year. This can be done using:

- Spreadsheet software

- Accounting apps

- Expense tracking apps

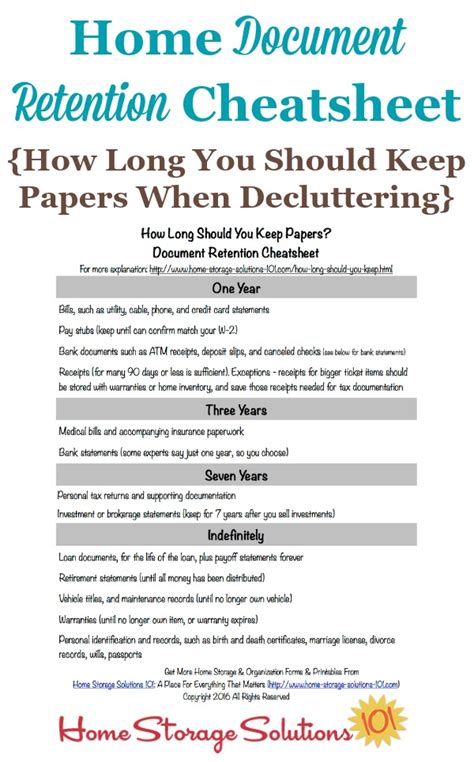

Tax Record Tip 5: Understand Retention Requirements

The IRS recommends keeping tax records for at least three years in case of an audit. However, some records, such as those related to property ownership or business assets, should be kept for longer periods. It’s essential to understand the retention requirements for different types of tax records to ensure you’re in compliance with tax laws.

Tax Record Tip 6: Review and Update Records Annually

At the end of each year, take the time to review your tax records and update them as necessary. This includes:

- Verifying the accuracy of your records

- Updating your filing system

- Shredding or securely disposing of unnecessary documents

Tax Record Tip 7: Seek Professional Help When Needed

If you’re unsure about any aspect of tax record keeping or tax filing, consider seeking help from a tax professional. They can provide guidance on:

- Tax law changes and updates

- Record keeping best practices

- Tax planning and strategy

📝 Note: Always keep your tax records secure and confidential to protect your personal and financial information.

In summary, proper tax record keeping is essential for individuals and businesses to ensure compliance with tax laws and regulations. By following these seven tax record tips, you can efficiently manage your tax documents, reduce the risk of audits, and claim legitimate deductions and credits. Remember to stay organized, keep accurate records, and seek professional help when needed to ensure a smooth tax filing experience.

What documents do I need to keep for tax purposes?

+

You should keep documents such as W-2 forms, 1099 forms, interest statements, charitable donation receipts, and medical expense records.

How long should I keep my tax records?

+

The IRS recommends keeping tax records for at least three years in case of an audit. However, some records should be kept for longer periods.

Can I keep digital copies of my tax records?

+

Yes, you can keep digital copies of your tax records. In fact, it’s a good idea to keep both physical and digital copies to ensure you have access to your records when needed.