Estate Paperwork Retention Guidelines

Introduction to Estate Paperwork Retention

When it comes to managing an estate, whether it’s your own or that of a loved one, the amount of paperwork involved can be overwhelming. From wills and trusts to deeds and tax documents, it’s essential to understand what papers to keep, for how long, and why. Proper estate paperwork retention is crucial for ensuring that all aspects of the estate are handled correctly, reducing the risk of disputes, and complying with legal requirements. In this article, we will delve into the world of estate paperwork, exploring the types of documents that require retention, the duration for which they should be kept, and the best practices for storing them securely.

Types of Estate Documents

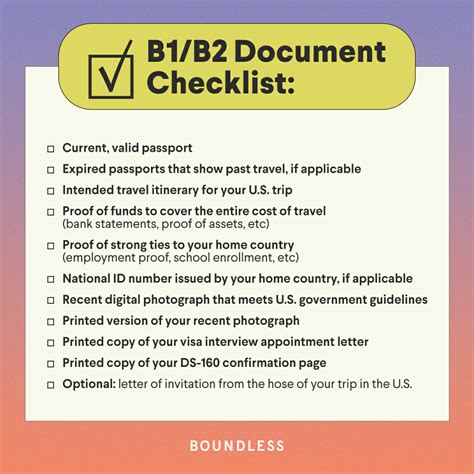

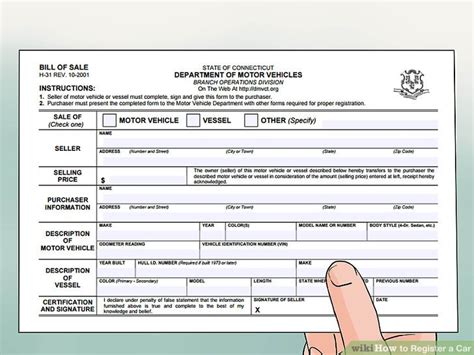

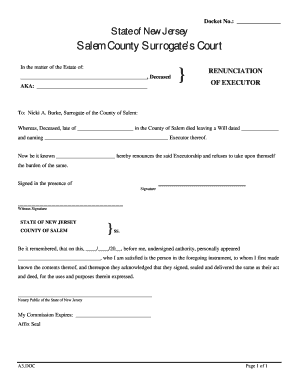

Estate documents can be broadly categorized into several types, each serving a unique purpose. Understanding these categories is the first step in developing an effective retention strategy. Some of the key documents include: - Wills and Codicils: The will is the cornerstone of estate planning, outlining how assets are to be distributed. Codicils are amendments to the will. - Trusts: These are legal arrangements where one party (the trustee) holds assets for the benefit of another (the beneficiary). - Deeds: Documents that prove ownership of real estate. - Power of Attorney (POA): Grants one person the authority to act on another’s behalf in legal or financial matters. - Tax Returns and Documents: Essential for understanding the tax obligations of the estate. - Insurance Policies: Life insurance, health insurance, and other policies that may be relevant to the estate. - Bank and Investment Statements: Records of the estate’s financial assets.

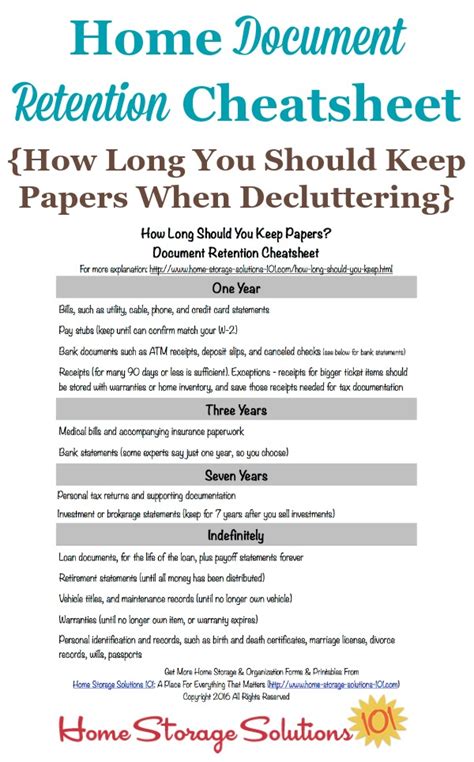

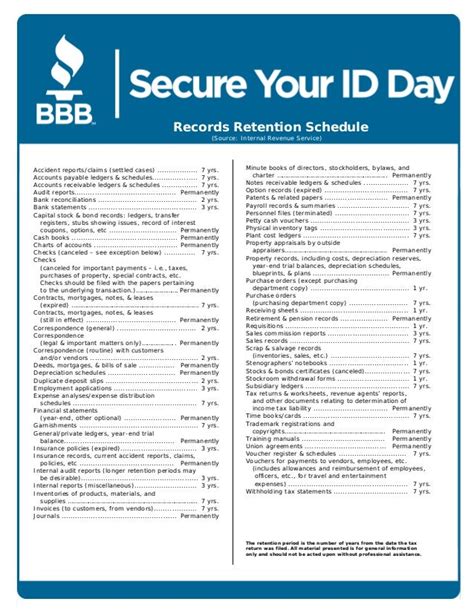

Retention Guidelines

The retention period for estate documents varies, depending on their type and purpose. Here are some general guidelines: - Permanent Retention: Documents like wills, trusts, deeds, and powers of attorney should be kept permanently, as they are foundational to the estate’s legal and financial structure. - Tax Documents: The IRS recommends keeping tax returns and supporting documents for at least three years in case of an audit. However, it’s advisable to keep them for seven years or more, considering the statute of limitations for tax audits and the potential need for historical tax information. - Financial Records: Bank statements, investment records, and other financial documents should be kept for at least a year, but keeping them for longer can provide a clearer picture of the estate’s financial history, which can be useful for tax purposes or in case of disputes. - Insurance Policies: Keep these as long as the policies are in effect, plus an additional few years after they lapse or are terminated, in case claims are made during this period.

Best Practices for Document Storage

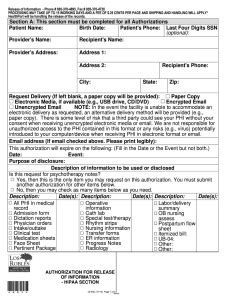

Given the importance and sensitivity of estate documents, how they are stored is just as crucial as what is stored. Best practices include: - Physical Storage: Use fireproof safes or safe deposit boxes at banks. Ensure that at least two trusted individuals know the combination or have access. - Digital Storage: Consider scanning physical documents and storing them digitally. Use secure, encrypted cloud storage services that offer redundancy and are less susceptible to data loss. - Organization: Keep documents organized and easily accessible. This can be achieved through categorization and the use of clear, descriptive file names. - Security: Implement strong security measures, including two-factor authentication for digital storage and limiting physical access to authorized individuals.

Benefits of Proper Estate Paperwork Retention

Proper retention of estate paperwork offers several benefits, including: - Reduced Risk of Disputes: Clear documentation can resolve conflicts over asset distribution or the intentions of the deceased. - Compliance with Legal Requirements: Avoids legal issues stemming from non-compliance with tax laws or estate regulations. - Efficient Administration: Facilitates the smooth administration of the estate, reducing the time and cost associated with managing and distributing assets. - Peace of Mind: Knowing that all necessary documents are secure and accessible provides peace of mind for both the estate holder and the beneficiaries.

📝 Note: It's essential to review and update estate documents periodically to reflect changes in personal circumstances, asset holdings, or legal requirements.

Conclusion and Next Steps

In conclusion, managing estate paperwork effectively is a critical aspect of estate planning. By understanding what documents to retain, for how long, and how to store them securely, individuals can ensure that their estate is managed efficiently and in accordance with their wishes. The next steps involve implementing these guidelines, reviewing existing documents, and consulting with legal and financial professionals to tailor a retention strategy that meets the unique needs of the estate. Whether you’re planning your own estate or managing that of a loved one, taking these steps will provide clarity and security for the future.

What are the most critical documents to retain in estate planning?

+

The most critical documents include wills, trusts, deeds, powers of attorney, and tax returns. These documents form the foundation of an estate plan and are essential for the distribution of assets and the administration of the estate.

How long should tax documents be kept?

+

Tax documents should be kept for at least three years in case of an audit, but it’s recommended to keep them for seven years or more. This extended period covers the statute of limitations for tax audits and provides historical financial information that may be necessary for future reference.

What are the best practices for storing estate documents?

+

Best practices include using fireproof safes or safe deposit boxes for physical documents and secure, encrypted cloud storage for digital documents. It’s also important to keep documents organized and to ensure that at least two trusted individuals have access to them.