Closing Store Paperwork Requirements

Introduction to Closing Store Paperwork Requirements

When a store closes, whether due to bankruptcy, retirement, or simply a decision to cease operations, there are numerous legal and administrative tasks that must be addressed. One of the most critical aspects of this process is the handling of paperwork requirements. These requirements can vary significantly depending on the jurisdiction, the type of business, and the specific circumstances surrounding the closure. In this article, we will delve into the intricacies of closing store paperwork, highlighting key documents, steps, and considerations that business owners must be aware of.

Key Documents and Steps Involved

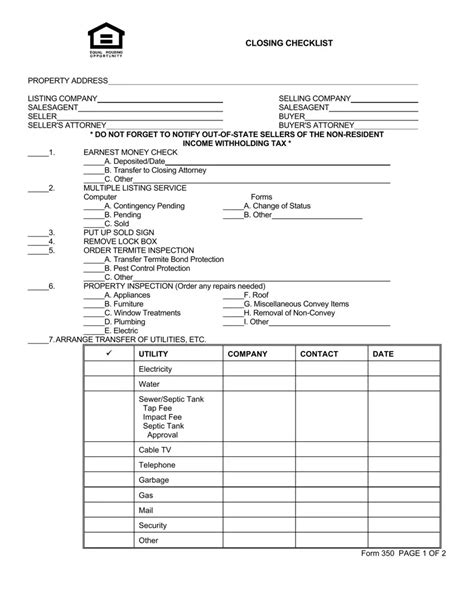

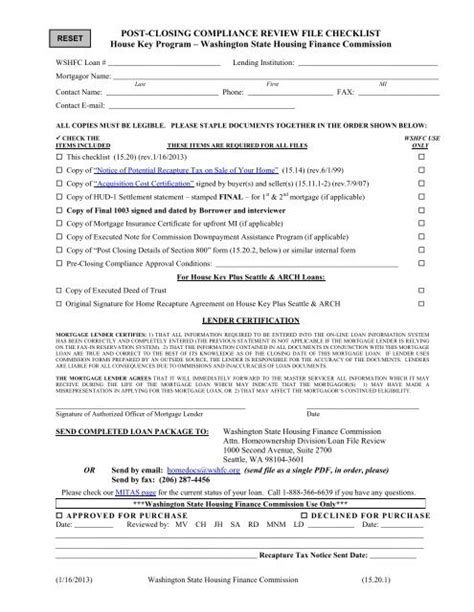

The process of closing a store involves a multitude of documents and steps. Business registration documents, such as articles of incorporation or partnership agreements, are crucial as they outline the legal structure of the business and the responsibilities of its owners. Additionally, tax clearance certificates are necessary to ensure that all tax obligations have been met. This includes filing final tax returns and obtaining a certificate from the relevant tax authority indicating that the business has no outstanding tax liabilities.

Other important documents include: - Employee termination documents: If the closure involves layoffs, proper documentation, including severance packages and termination notices, must be prepared. - Lease termination agreements: For businesses operating from leased premises, a formal agreement to terminate the lease must be negotiated with the landlord. - Asset disposal records: If the business is selling or disposing of assets, records of these transactions must be kept for tax and accounting purposes.

Notifying Relevant Parties

Notifying relevant parties about the store’s closure is a critical step in the process. This includes: - Employees: They must be informed in advance, as per the labor laws of the jurisdiction, and provided with necessary support, such as severance pay and career counseling. - Customers: Informing customers about the closure can help in maintaining goodwill and allowing them to make alternative arrangements. - Suppliers and creditors: These parties must be notified to stop any ongoing shipments or services and to discuss payment arrangements for any outstanding debts. - Government agencies: Relevant government agencies, such as the business registration office and tax authorities, must be informed to update business records and to comply with any necessary procedures.

Financial Considerations

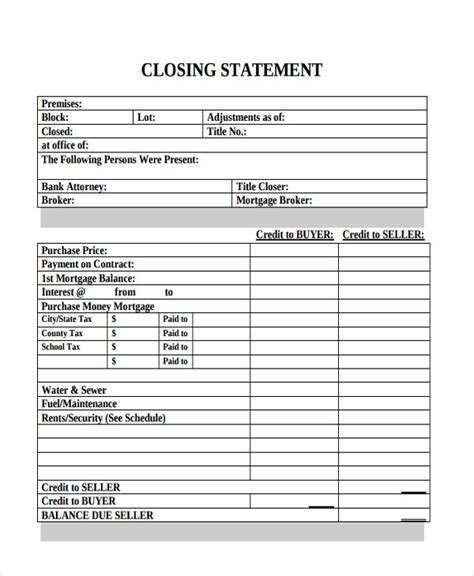

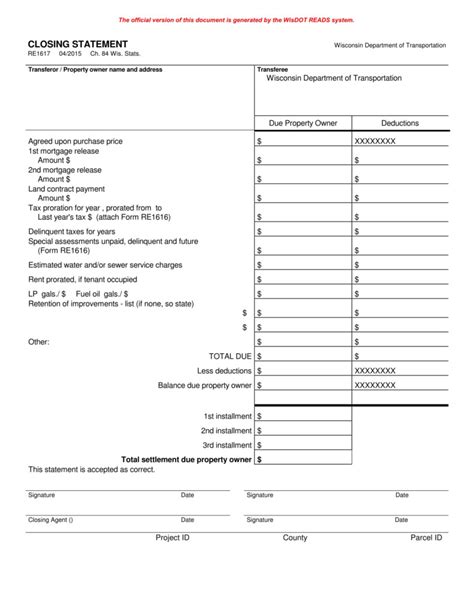

The financial aspects of closing a store are complex and require careful planning. Liquidating assets to pay off debts, settling accounts with suppliers and customers, and filing for tax refunds if applicable are all part of this process. Moreover, business owners must consider bankruptcy laws if the business is insolvent, as these laws provide a framework for dealing with debts that cannot be paid.

Environmental and Health Considerations

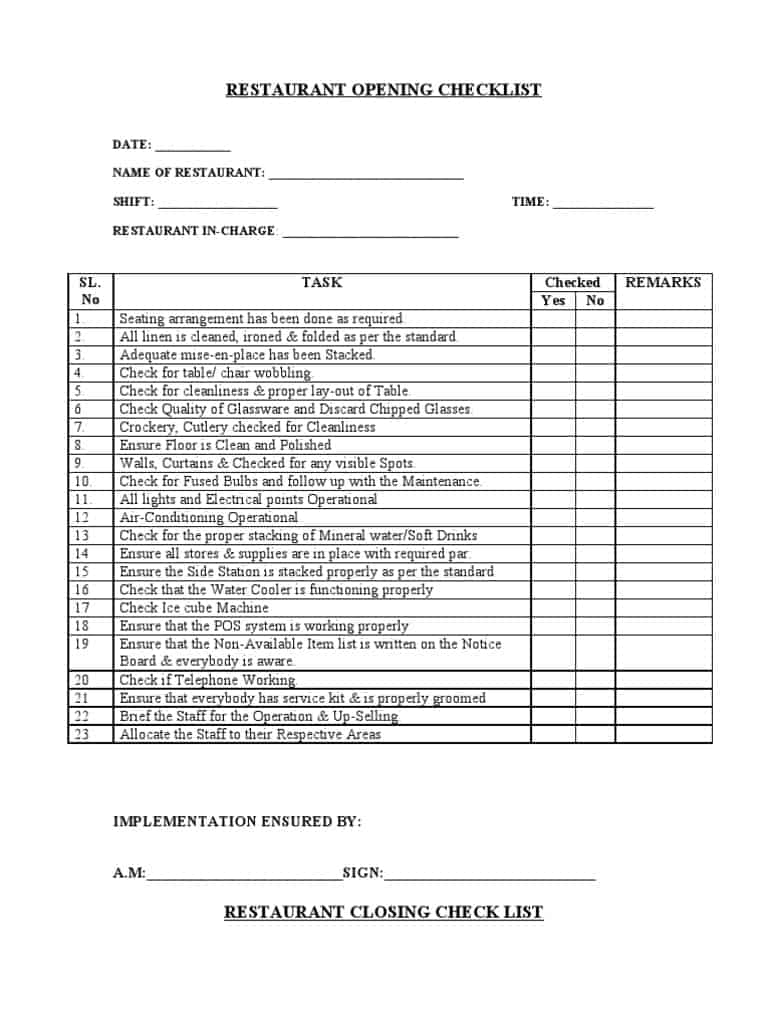

For businesses that handle hazardous materials or have specific health and safety requirements, such as restaurants or chemical stores, there are additional considerations. Environmental regulations must be complied with to ensure that the closure does not pose a risk to the environment. This may involve disposing of hazardous waste properly and decontaminating premises. Similarly, health and safety regulations must be followed, particularly if the business involves food handling or other activities that could impact public health.

Final Steps and Considerations

After addressing the legal, financial, and administrative aspects of closing a store, business owners must take final steps to formally dissolve the business. This involves dissolving the business entity through the relevant state or national business registry, canceling licenses and permits, and ensuring that all outstanding legal issues are resolved. Furthermore, securing the premises to prevent unauthorized access and preserving business records for future reference or legal requirements are essential.

📝 Note: The specific steps and requirements for closing a store can vary widely, so it's crucial for business owners to consult with legal, financial, and environmental experts to ensure compliance with all relevant laws and regulations.

In summary, closing a store involves a comprehensive array of legal, financial, and administrative tasks. Business owners must be meticulous in their approach, ensuring that all necessary documents are prepared, relevant parties are notified, and financial and environmental considerations are addressed. By understanding and adhering to these requirements, business owners can navigate the complex process of store closure efficiently and responsibly.

What are the first steps in closing a store?

+

The first steps involve notifying relevant parties such as employees, customers, suppliers, and government agencies, and beginning the process of dissolving the business entity.

How do I handle the financial aspects of closing a store?

+

This includes liquidating assets, settling accounts with suppliers and customers, filing for tax refunds if applicable, and considering bankruptcy laws if the business is insolvent.

What environmental considerations must be taken into account when closing a store?

+

Businesses must comply with environmental regulations, particularly if they handle hazardous materials, to ensure proper disposal of waste and decontamination of premises.