Start Savings Account Paperwork

Introduction to Savings Accounts

Opening a savings account is a fundamental step in managing one’s finances effectively. It provides a safe and often insured place to store excess funds, allowing for easy access when needed. Savings accounts are offered by various financial institutions, including banks and credit unions, and they come with different features and benefits. Understanding the basics of savings accounts and the process of opening one is crucial for making informed decisions about personal finance.

Benefits of Savings Accounts

There are several benefits to having a savings account: - Liquidity: Savings accounts provide easy access to your money when you need it. - Interest: Most savings accounts earn interest, allowing your money to grow over time. - Security: Savings accounts are typically insured, protecting your deposits up to a certain amount. - Discipline: Having a separate account for savings can help you avoid spending money impulsively. - Goal Achievement: Savings accounts can be used to save for specific goals, such as a down payment on a house, a car, or a vacation.

Types of Savings Accounts

There are various types of savings accounts designed to meet different needs: - Basic Savings Account: A standard account with basic features. - High-Yield Savings Account: Offers a higher interest rate compared to a basic savings account. - Money Market Savings Account: Combines features of savings and checking accounts, often with debit cards, checks, or online payment capabilities. - Youth Savings Account: Designed for minors, often with features that encourage saving and may have parental controls. - Senior Savings Account: May offer special benefits or higher interest rates for seniors.

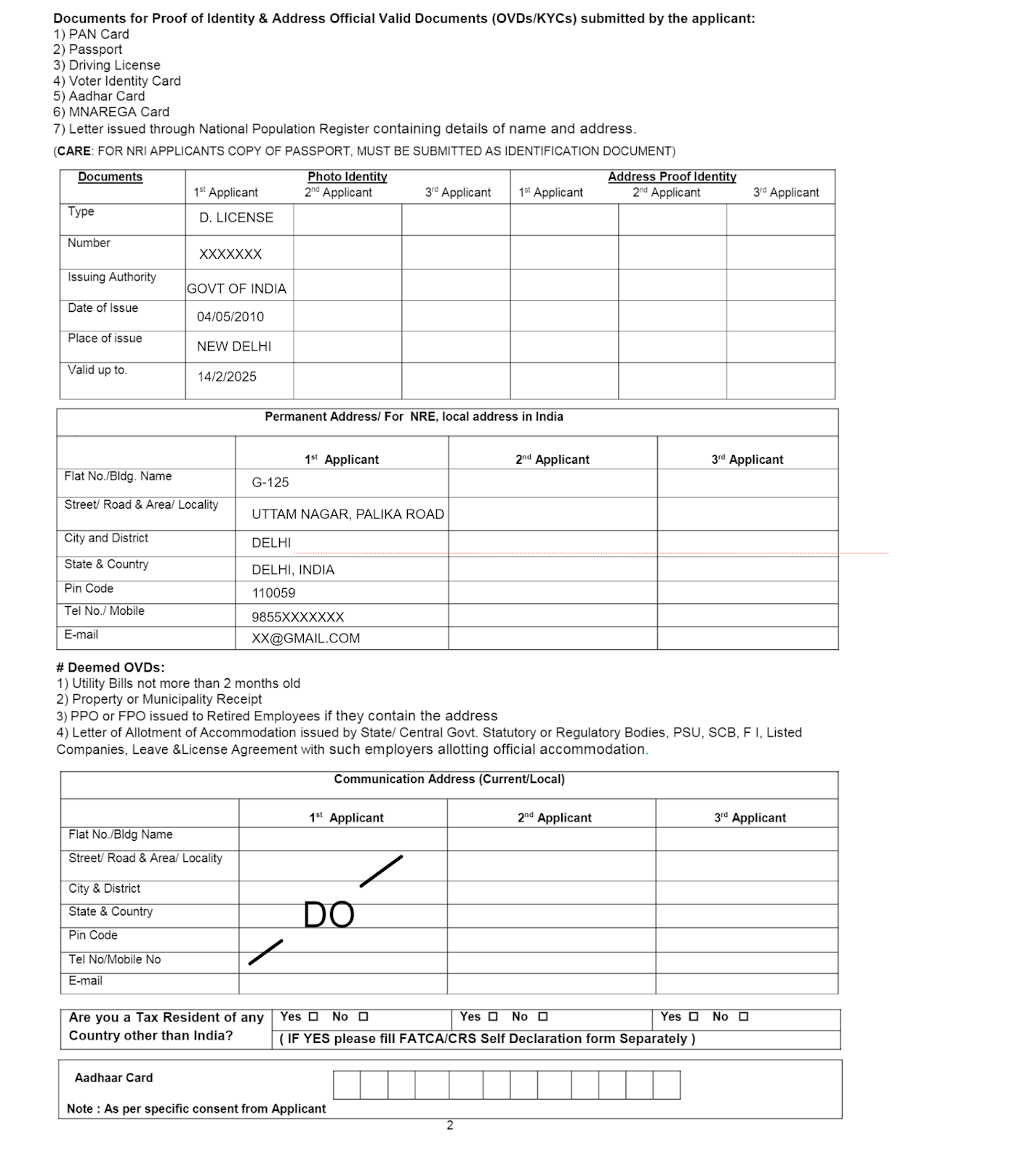

Requirements for Opening a Savings Account

The requirements for opening a savings account can vary depending on the financial institution and the type of account. Generally, you will need: - Identification: A valid government-issued ID, such as a driver’s license or passport. - Proof of Address: A utility bill, lease agreement, or other document showing your current address. - Social Security Number or Tax ID Number: For tax reporting purposes. - Minimum Deposit: Some accounts require an initial deposit to open the account. - Age Requirement: You must be at least 18 years old to open an account in your name, though some accounts are designed for minors with parental or guardian involvement.

Steps to Open a Savings Account

The process of opening a savings account is relatively straightforward and can often be completed online, by phone, or in person at a bank branch: 1. Choose a Financial Institution: Research and select a bank or credit union that meets your needs. 2. Select the Type of Account: Decide which type of savings account is best for you based on your financial goals and needs. 3. Gather Required Documents: Ensure you have all necessary identification and proof of address. 4. Apply Online, by Phone, or in Person: Follow the application process as directed by the institution. 5. Fund Your Account: Make the initial deposit, if required, to open and activate your account. 6. Set Up Online Access: Create a username and password to manage your account online or through a mobile app.

Managing Your Savings Account

After opening your savings account, it’s essential to manage it effectively: - Regular Deposits: Set up automatic transfers from your checking account to your savings. - Monitor Your Account: Keep track of your balance and transactions through online banking or the mobile app. - Avoid Fees: Understand the fees associated with your account, such as maintenance fees or overdraft fees, and manage your account to avoid them. - Consider Savings Goals: Use your savings account to work towards specific financial goals, such as building an emergency fund or saving for a large purchase.

📝 Note: Always review the terms and conditions of your savings account to understand the features, benefits, and any potential fees or requirements.

Conclusion and Future Planning

In summary, opening a savings account is a significant step towards securing your financial future. By understanding the benefits, types, and requirements of savings accounts, you can make informed decisions that align with your financial goals. Whether you’re saving for a short-term goal or long-term security, a well-managed savings account can provide peace of mind and a foundation for financial stability. As you move forward, consider how your savings account fits into your overall financial strategy and adjust your approach as your financial situation and goals evolve.

What is the minimum age to open a savings account?

+

The minimum age to open a savings account in your name is typically 18 years old. However, some accounts are designed for minors and can be opened with the involvement of a parent or guardian.

Do all savings accounts earn interest?

+

Most savings accounts earn interest, but the rate can vary significantly between accounts and institutions. Some accounts, especially those with very low balances or specific restrictions, might not earn interest.

Can I open a savings account online?

+

Yes, many banks and credit unions allow you to open a savings account online. The process typically involves filling out an application, providing required documents, and funding your account, all from the comfort of your own home.