5 LLC Forms

Understanding the Basics of LLC Forms

When it comes to forming a Limited Liability Company (LLC), one of the most crucial steps is filing the necessary paperwork. This process involves submitting various LLC forms to the relevant state authorities. The specific forms required can vary depending on the state in which you’re forming your LLC. However, there are some common forms that are typically needed across most states. In this article, we’ll delve into the details of five key LLC forms that you might encounter during the formation process.

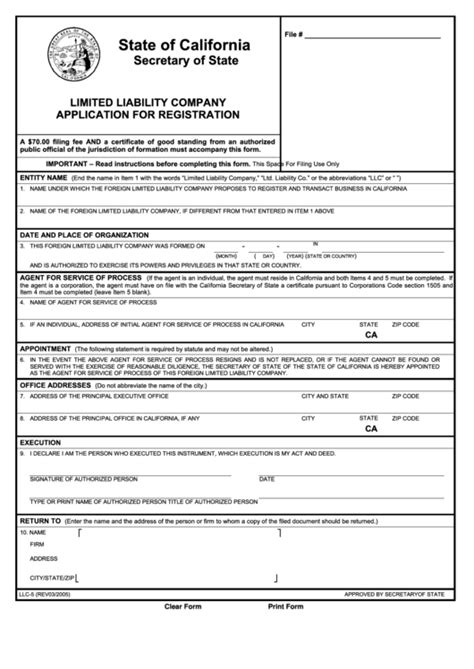

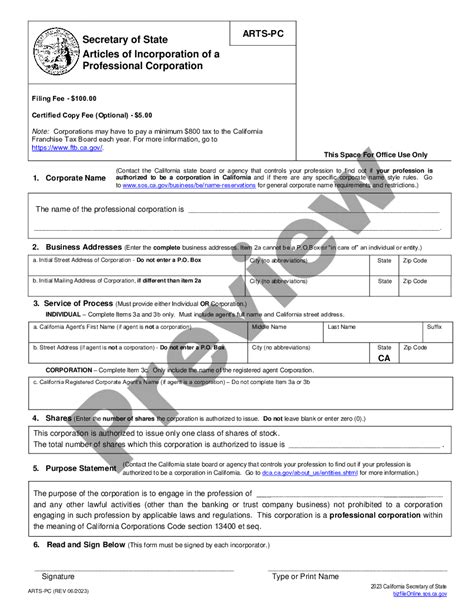

1. Articles of Organization

The Articles of Organization is arguably the most important LLC form. It’s the document that officially establishes your LLC with the state. This form typically includes basic information about your business, such as its name, address, purpose, and the names and addresses of its members (owners) or managers. The specific requirements for the Articles of Organization can vary by state, but it generally needs to include: - The LLC’s name and address - The purpose of the LLC - The names and addresses of the LLC’s members or managers - The name and address of the LLC’s registered agent - The duration of the LLC, if not perpetual

📝 Note: The filing fee for the Articles of Organization also varies by state, ranging from a few hundred to over a thousand dollars.

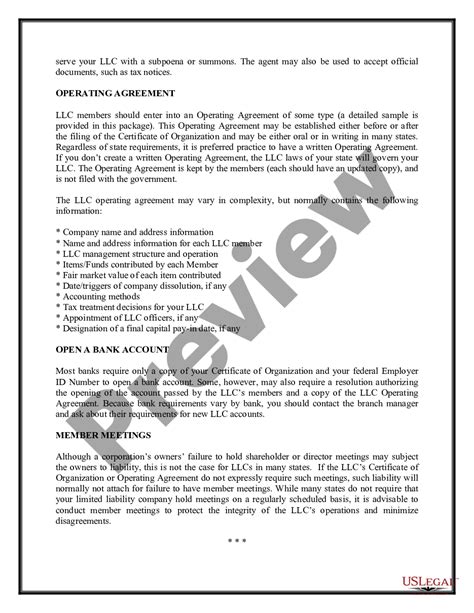

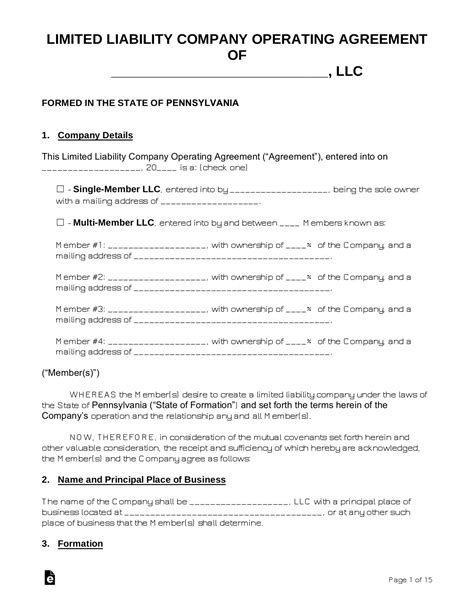

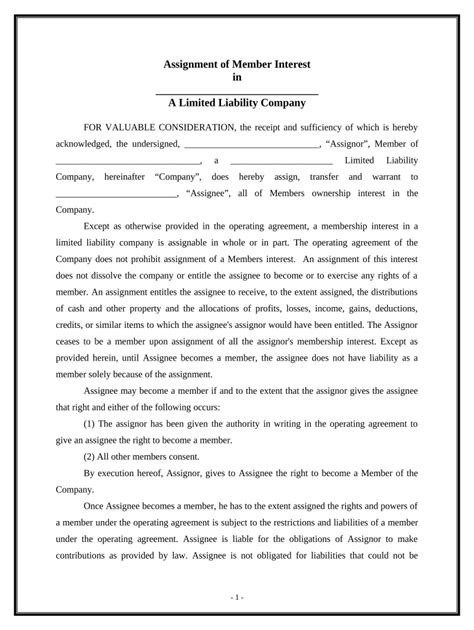

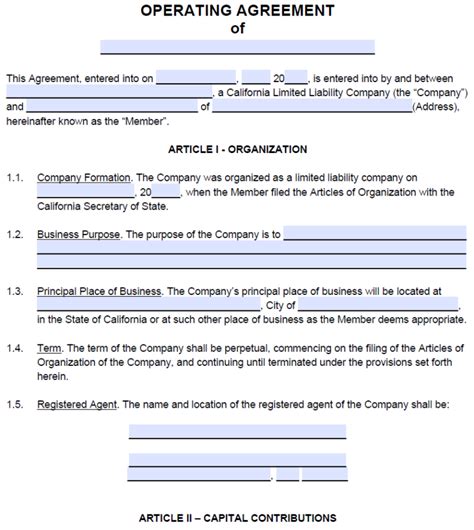

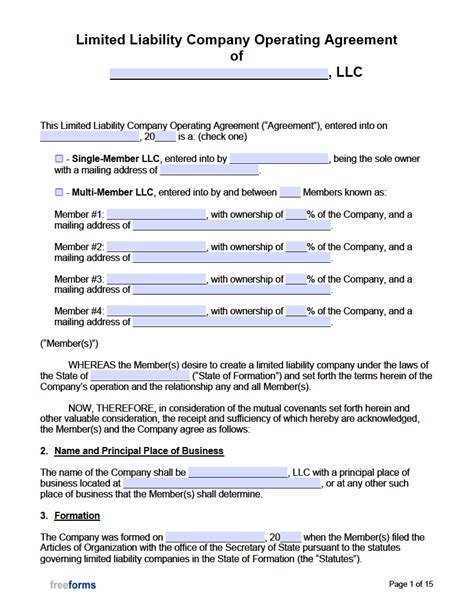

2. Operating Agreement

While not always required to be filed with the state, an Operating Agreement is a crucial internal document for any LLC. It outlines the ownership, management structure, and operational procedures of the company. This agreement is essential for establishing the roles and responsibilities of members or managers, how profits and losses are distributed, and the process for making significant business decisions. Key elements of an Operating Agreement include: - Ownership percentages - Voting rights - Management structure (member-managed vs. manager-managed) - Distribution of profits and losses - Buy-sell provisions

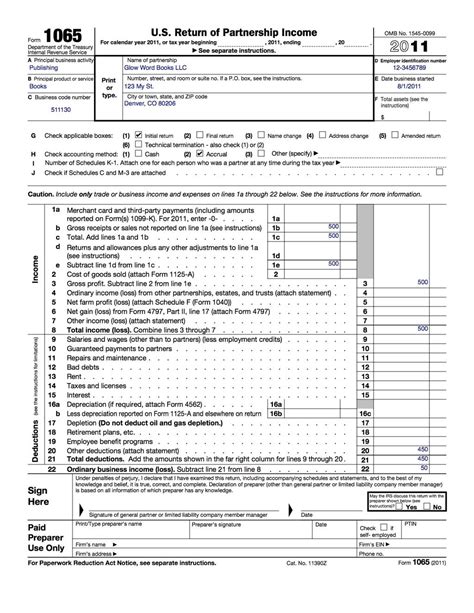

3. EIN Application (Form SS-4)

To obtain an Employer Identification Number (EIN), you’ll need to submit Form SS-4 to the IRS. An EIN is necessary for tax purposes, opening a business bank account, and hiring employees. While not a state-level LLC form, it’s a critical step in setting up your LLC. The application can be submitted online, by phone, or by mail/fax. You’ll need to provide your business name, address, type of business, and the reason for applying, among other details.

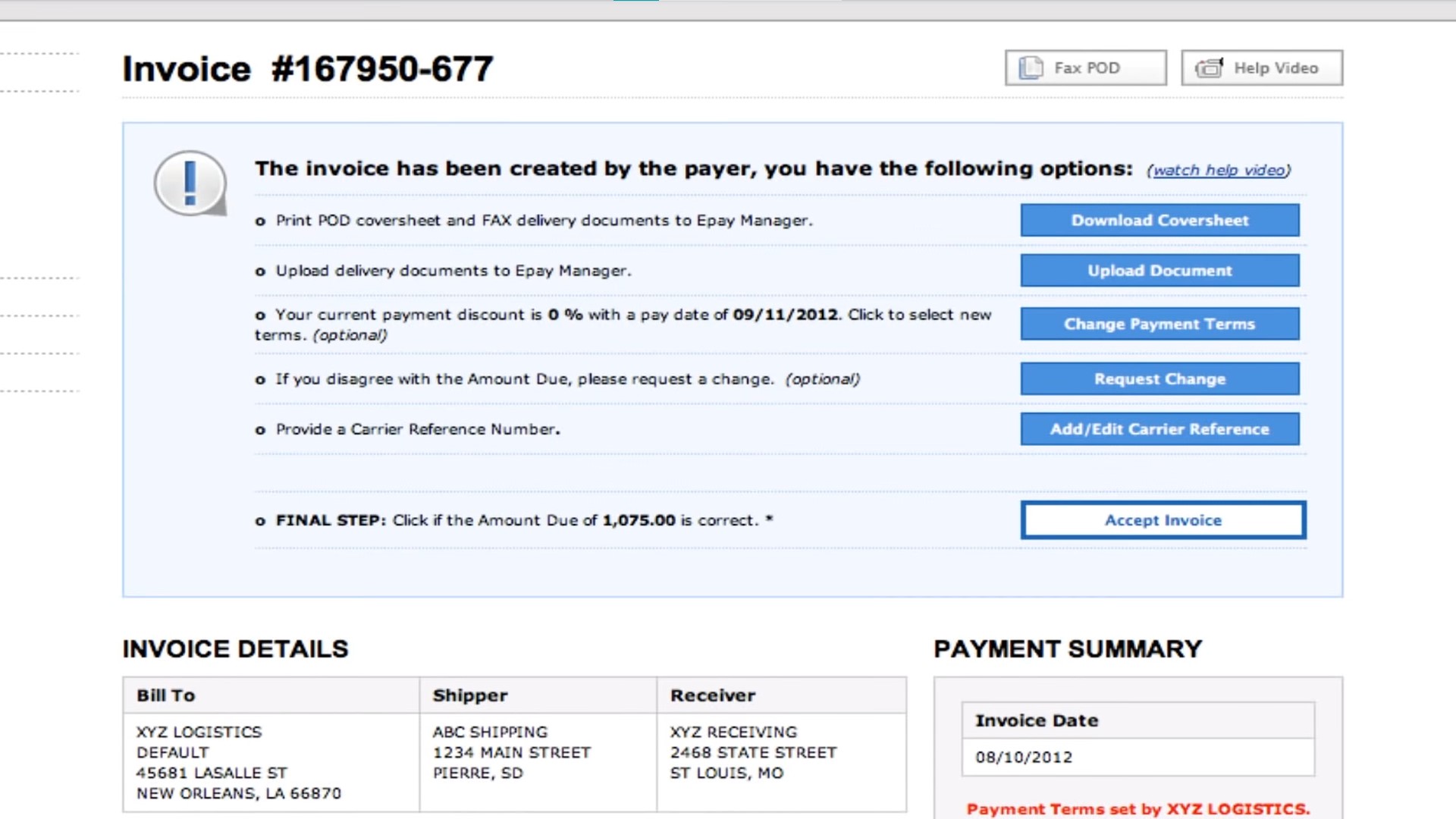

4. Annual Report

Most states require LLCs to file an Annual Report (or a similar document, such as a Statement of Information) with the state’s business registration office. This report is used to update the state’s records regarding your business’s current information, such as its address, members/managers, and business activities. The due date for the Annual Report varies by state, and there’s usually a filing fee involved. Failure to file the Annual Report on time can result in penalties, fines, or even the dissolution of your LLC.

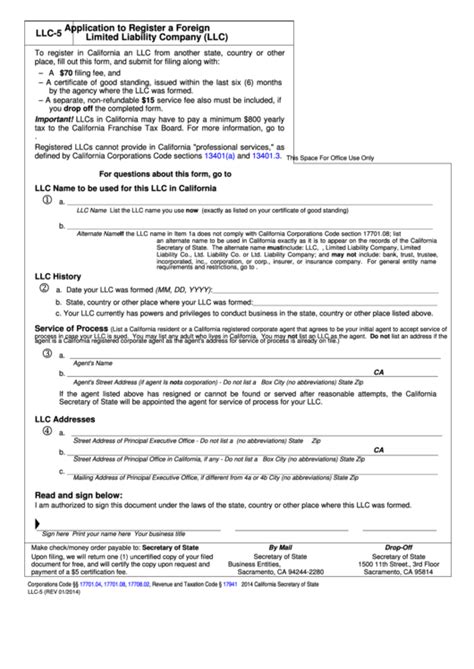

5. Certificate of Good Standing

A Certificate of Good Standing (also known as a Certificate of Existence or Certificate of Authorization) is a document issued by the state that confirms your LLC is in compliance with all state requirements, has paid all necessary fees, and is authorized to conduct business in the state. This certificate is often required when: - Applying for a business loan - Expanding your business into another state (through foreign qualification) - Selling your business - Entering into significant business contracts

| Form | Purpose | Filing Requirement |

|---|---|---|

| Articles of Organization | Establishes the LLC with the state | Required for all LLCs |

| Operating Agreement | Outlines the ownership and operation of the LLC | Not required to be filed with the state |

| EIN Application (Form SS-4) | Obtains an Employer Identification Number from the IRS | Required for all businesses |

| Annual Report | Updates the state's records regarding the LLC's information | Required annually by most states |

| Certificate of Good Standing | Confirms the LLC's compliance with state requirements | Issued by the state upon request |

In summary, forming and maintaining an LLC involves several key documents and filings. Understanding the purpose and requirements of each LLC form is essential for compliance with state and federal regulations. By ensuring you have the necessary forms in place, you can protect your personal assets, establish a clear business structure, and maintain good standing with the state.

What is the primary purpose of the Articles of Organization?

+

The primary purpose of the Articles of Organization is to officially establish your LLC with the state, providing basic information about your business.

Is an Operating Agreement required to be filed with the state?

+

No, an Operating Agreement is not required to be filed with the state. However, it is a crucial internal document for outlining the ownership, management, and operational procedures of your LLC.

Why is obtaining an EIN important for my LLC?

+

Obtaining an EIN is important because it’s necessary for tax purposes, opening a business bank account, and hiring employees. It serves as a unique identifier for your business with the IRS.