PPP Loan Paperwork Requirements

Introduction to PPP Loan Paperwork Requirements

The Paycheck Protection Program (PPP) is a loan program established by the US government to help small businesses and other eligible entities keep their workers employed during the COVID-19 pandemic. The program is administered by the Small Business Administration (SBA) and provides loans with favorable terms, including a low interest rate and the possibility of loan forgiveness. To apply for a PPP loan, businesses must meet certain eligibility criteria and provide required paperwork. In this article, we will explore the PPP loan paperwork requirements and provide guidance on how to navigate the application process.

Eligibility Criteria for PPP Loans

To be eligible for a PPP loan, a business must meet certain criteria, including: * Being a small business, nonprofit organization, veteran organization, or tribal business with 500 or fewer employees * Being in operation on February 15, 2020 * Having paid employees or independent contractors * Being able to demonstrate a need for the loan due to the economic uncertainty caused by the COVID-19 pandemic * Not being engaged in any activity that is illegal under federal, state, or local law

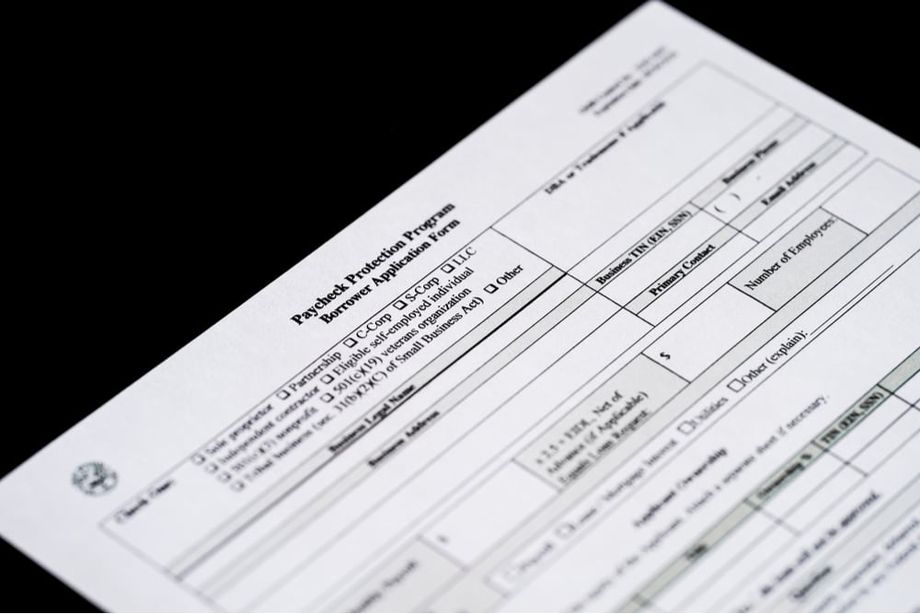

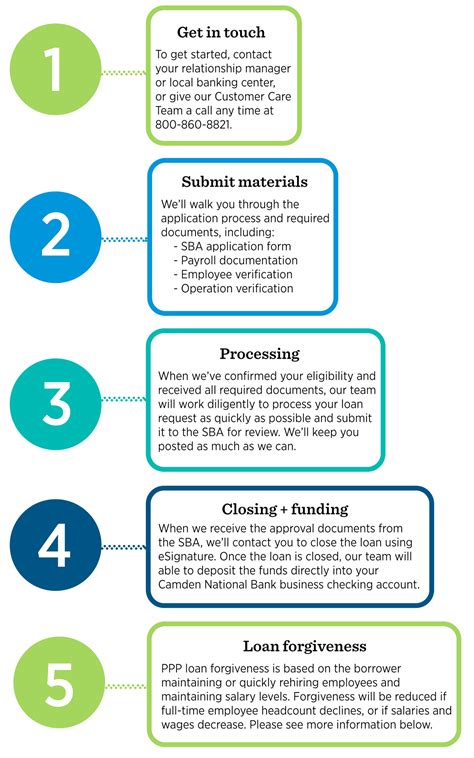

Required Paperwork for PPP Loan Application

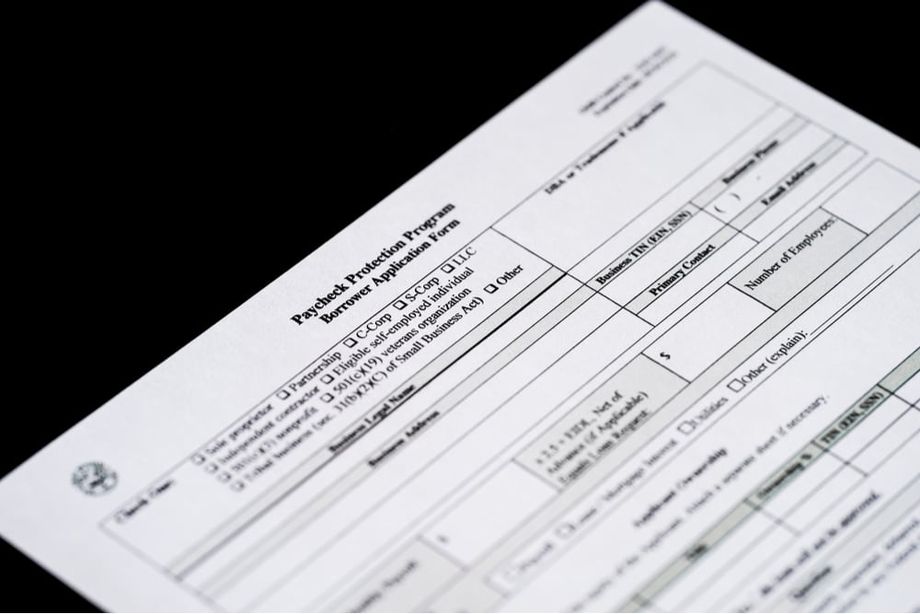

To apply for a PPP loan, businesses will need to provide the following paperwork: * Business tax returns: The business’s most recent tax return (2019 or 2020) will be required to verify the business’s income and expenses. * Payroll records: The business will need to provide payroll records, including payroll tax filings, to demonstrate the number of employees and the payroll costs. * Identification documents: The business owner’s or authorized representative’s identification documents, such as a driver’s license or passport, will be required. * Business license: A copy of the business license or other documentation showing the business is authorized to operate in the state. * Loan application form: The business will need to complete a loan application form, which will include information about the business, the loan amount, and the use of funds.

Additional Documentation Requirements

In addition to the above paperwork, businesses may need to provide additional documentation, such as: * Proof of payroll costs: The business may need to provide documentation, such as bank statements or canceled checks, to verify payroll costs. * Proof of business existence: The business may need to provide documentation, such as articles of incorporation or a business registration certificate, to verify the business’s existence. * Proof of economic uncertainty: The business may need to provide documentation, such as financial statements or a narrative explaining the impact of the COVID-19 pandemic on the business, to demonstrate the need for the loan.

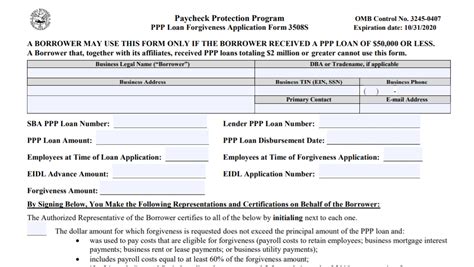

Loan Forgiveness Paperwork Requirements

If a business receives a PPP loan, it may be eligible for loan forgiveness if it meets certain criteria, including: * Using the loan proceeds for eligible expenses, such as payroll costs, rent, and utilities * Maintaining employee headcount and compensation levels * Spending at least 60% of the loan proceeds on payroll costs To apply for loan forgiveness, businesses will need to provide paperwork, including: * Loan forgiveness application form: The business will need to complete a loan forgiveness application form, which will include information about the loan, the use of funds, and the eligibility for loan forgiveness. * Documentation of eligible expenses: The business will need to provide documentation, such as receipts, invoices, and bank statements, to verify eligible expenses. * Documentation of employee headcount and compensation levels: The business will need to provide documentation, such as payroll records and employee roster, to verify employee headcount and compensation levels.

📝 Note: Businesses should consult with their lender and a financial advisor to ensure they have all the required paperwork and meet the eligibility criteria for loan forgiveness.

Conclusion and Final Thoughts

In summary, the PPP loan program provides an opportunity for small businesses and other eligible entities to receive a loan with favorable terms to help keep their workers employed during the COVID-19 pandemic. To apply for a PPP loan, businesses must meet certain eligibility criteria and provide required paperwork, including business tax returns, payroll records, and identification documents. Additionally, businesses may need to provide additional documentation, such as proof of payroll costs and proof of business existence. If a business receives a PPP loan, it may be eligible for loan forgiveness if it meets certain criteria and provides required paperwork, including a loan forgiveness application form and documentation of eligible expenses.

What is the Paycheck Protection Program (PPP)?

+

The Paycheck Protection Program (PPP) is a loan program established by the US government to help small businesses and other eligible entities keep their workers employed during the COVID-19 pandemic.

What are the eligibility criteria for a PPP loan?

+

To be eligible for a PPP loan, a business must meet certain criteria, including being a small business, nonprofit organization, veteran organization, or tribal business with 500 or fewer employees, being in operation on February 15, 2020, and having paid employees or independent contractors.

What paperwork is required for a PPP loan application?

+

To apply for a PPP loan, businesses will need to provide paperwork, including business tax returns, payroll records, identification documents, business license, and a loan application form.