5 VA Loan Papers

Understanding the 5 VA Loan Papers You Need to Know

When navigating the process of obtaining a VA loan, it’s essential to understand the various documents and papers involved. The Department of Veterans Affairs (VA) guarantees a portion of these loans, which are provided by private lenders, such as banks and mortgage companies. To ensure a smooth application process, being familiar with the key papers is crucial. Here are the 5 VA loan papers you need to know:

The VA loan process can be complex, but knowing what to expect can make it more manageable. Preparation is key when it comes to gathering the necessary documents. Let's break down the essential papers you'll encounter during your VA loan journey.

The 5 Essential VA Loan Papers

The following documents are vital to the VA loan application process. It’s essential to understand their purpose and what information they contain.

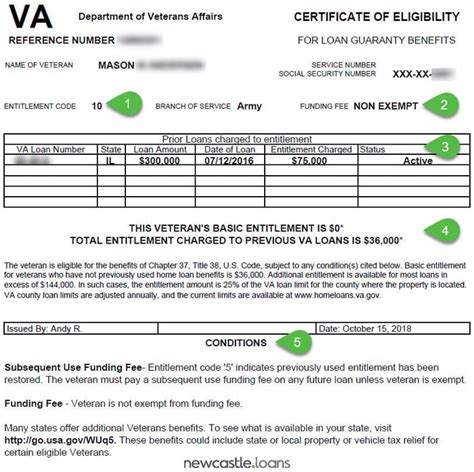

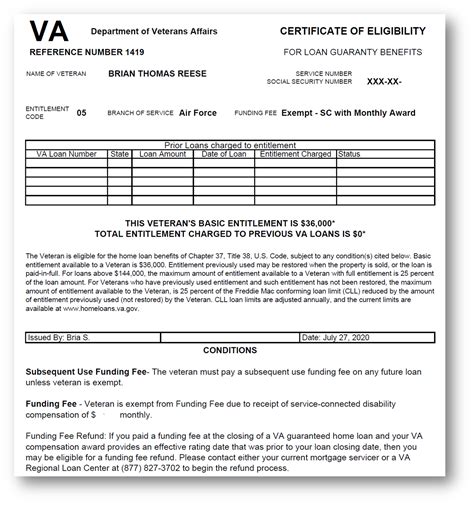

- Certificate of Eligibility (COE): This document confirms your eligibility for a VA-backed loan. You can obtain a COE through the VA’s eBenefits portal, by mail, or through your lender.

- DD Form 214: This is your Certificate of Release or Discharge from Active Duty. It’s required to verify your military service and eligibility for a VA loan.

- VA Loan Application (VA Form 26-1880): This form is used to apply for a VA loan. You’ll need to provide personal and financial information, as well as details about the property you’re purchasing.

- Appraisal Report: This report provides an independent assessment of the property’s value. It’s required to ensure the property’s value is sufficient to secure the loan.

- Loan Guarantee Certificate: This document guarantees a portion of the loan, reducing the risk for the lender. It’s typically issued by the VA after the loan is approved.

These documents play a critical role in the VA loan application process. Understanding their purpose and what information they contain can help you navigate the process with confidence.

Additional Documents You May Need

While the 5 essential VA loan papers are the foundation of your application, you may need to provide additional documents to support your loan request. These can include:

- Income verification: Pay stubs, W-2 forms, and tax returns to verify your income

- Bank statements: To verify your assets and creditworthiness

- Credit report: To evaluate your credit history and score

- Identification documents: Driver’s license, passport, or state ID to verify your identity

📝 Note: The specific documents required may vary depending on your lender and individual circumstances. It's essential to work closely with your lender to ensure you provide all necessary documents.

Understanding the VA Loan Process

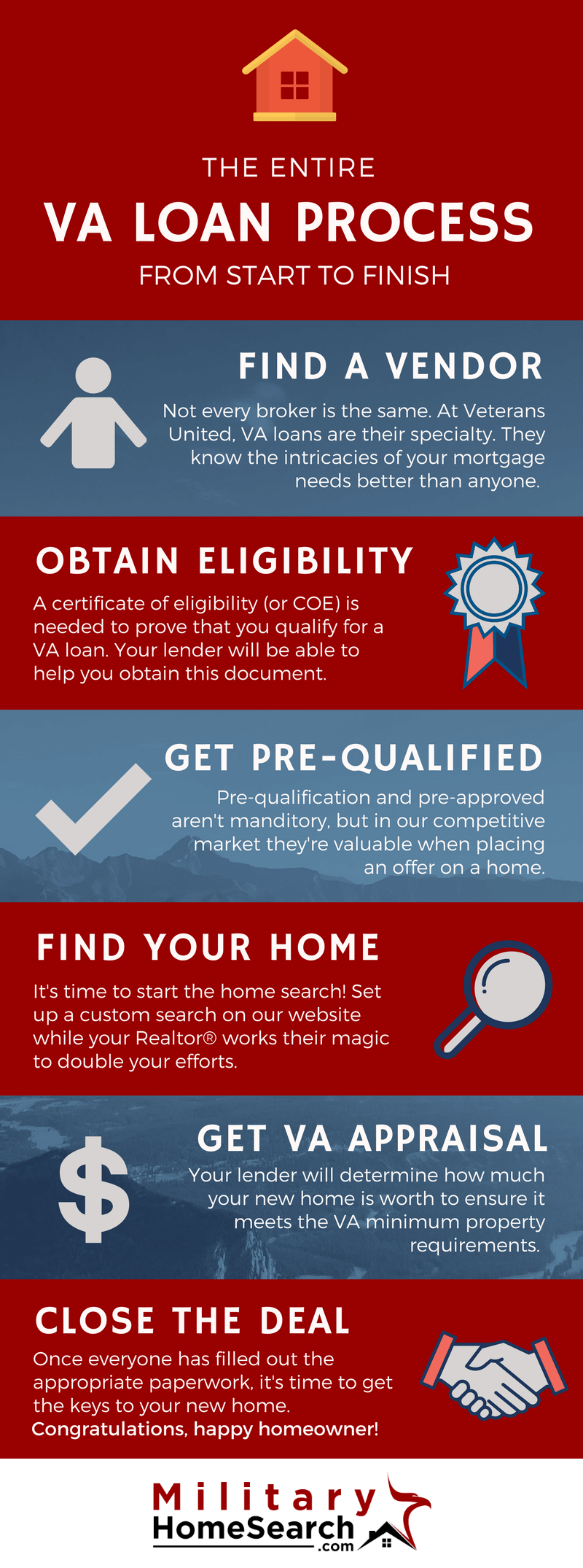

The VA loan process involves several steps, from pre-approval to closing. Here’s an overview of what you can expect:

- Pre-approval: You’ll provide financial information to your lender, who will issue a pre-approval letter stating the amount you’re eligible to borrow.

- Home search: You’ll work with a real estate agent to find a home that meets your needs and budget.

- Loan application: You’ll submit your loan application, including the 5 essential VA loan papers and any additional required documents.

- Appraisal and inspection: The property will be appraised and inspected to ensure it meets VA requirements.

- Loan approval and closing: Your loan will be approved, and you’ll close on the property, finalizing the purchase.

By understanding the VA loan process and the 5 essential papers involved, you'll be better equipped to navigate the application process and secure the financing you need to purchase your dream home.

VA Loan Benefits and Advantages

VA loans offer several benefits and advantages, including:

- No down payment requirement: VA loans often require no down payment, making it easier to purchase a home.

- Lower interest rates: VA loans typically offer competitive interest rates, reducing your monthly mortgage payment.

- No mortgage insurance: VA loans don’t require mortgage insurance, saving you money on your monthly payment.

- Lenient credit requirements: VA loans have more lenient credit requirements, making it easier to qualify for a loan.

These benefits and advantages make VA loans an attractive option for eligible veterans, active-duty military personnel, and surviving spouses.

Conclusion and Next Steps

In conclusion, understanding the 5 VA loan papers and the overall loan process is crucial to securing the financing you need to purchase a home. By working closely with your lender and providing the necessary documents, you can navigate the application process with confidence. Remember to take advantage of the benefits and advantages offered by VA loans, and don’t hesitate to reach out to your lender or a VA representative if you have any questions or concerns.

What is the Certificate of Eligibility, and how do I obtain it?

+

The Certificate of Eligibility is a document that confirms your eligibility for a VA-backed loan. You can obtain a COE through the VA’s eBenefits portal, by mail, or through your lender.

What is the difference between a VA loan and a conventional loan?

+

VA loans are guaranteed by the Department of Veterans Affairs and offer several benefits, including no down payment requirement and lower interest rates. Conventional loans, on the other hand, are not guaranteed by the government and often require a down payment and mortgage insurance.

Can I use a VA loan to purchase a second home or investment property?

+

VA loans are typically used to purchase a primary residence. However, you may be able to use a VA loan to purchase a second home or investment property, but you’ll need to meet specific requirements and guidelines set by the VA.