5 Ways Get EIN Paperwork

Understanding the Importance of EIN Paperwork

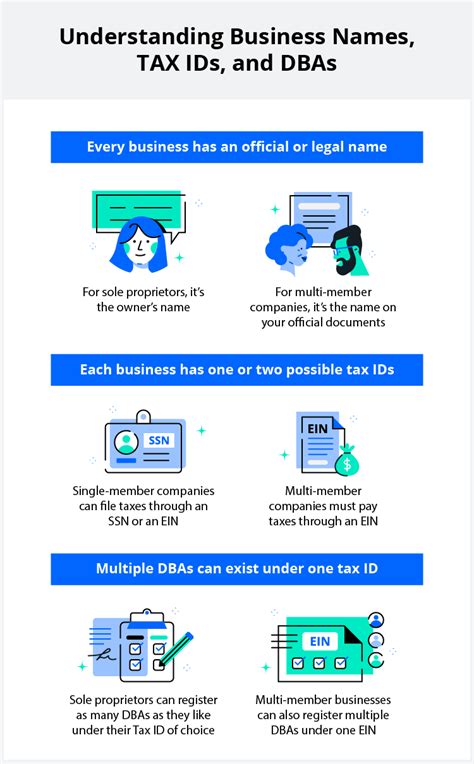

When starting a business, one of the crucial steps is obtaining an Employer Identification Number (EIN). The EIN is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify a business for tax purposes. It is essential for various business operations, including opening a business bank account, filing tax returns, and hiring employees. The process of getting EIN paperwork can seem daunting, but it is relatively straightforward. In this article, we will explore the different ways to obtain EIN paperwork and highlight the key aspects of each method.

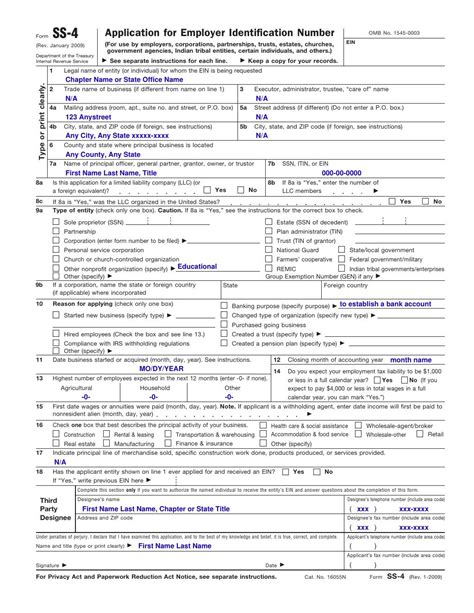

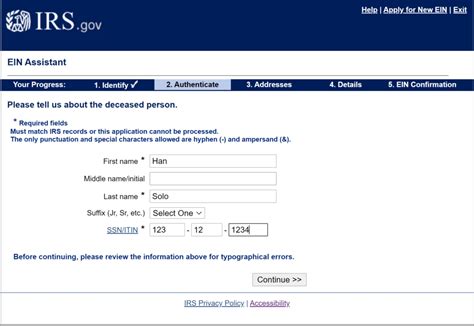

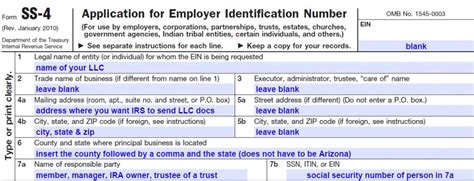

Method 1: Applying Online

The IRS provides an online application process for obtaining an EIN, which is the fastest and most convenient method. To apply online, you will need to visit the IRS website and fill out Form SS-4, Application for Employer Identification Number. The online application is available from 7:00 a.m. to 10:00 p.m. local time, Monday through Friday. You will need to provide basic business information, such as the business name, address, and type of business. Once you submit the application, you will receive your EIN immediately.

Method 2: Applying by Phone

If you prefer to apply by phone, you can call the IRS Business and Specialty Tax Line at (800) 829-4933. The phone application process is available from 7:00 a.m. to 7:00 p.m. local time, Monday through Friday. You will need to provide the same information as the online application, and the IRS representative will guide you through the process. You will receive your EIN at the end of the call.

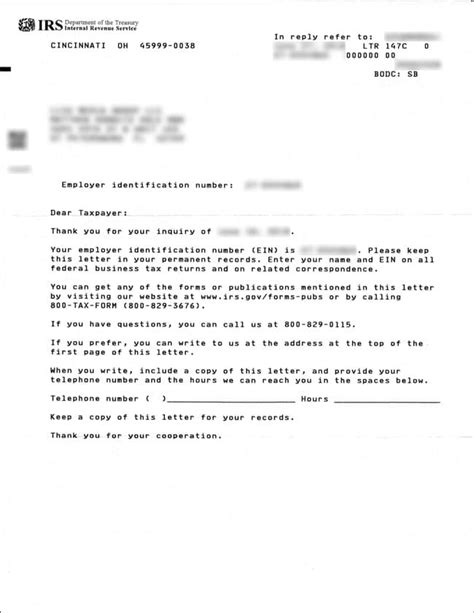

Method 3: Applying by Mail

You can also apply for an EIN by mail by sending a completed Form SS-4 to the IRS. The address is:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

You can download Form SS-4 from the IRS website or call the IRS to request a form. The mail application process takes longer than the online or phone application, as you will need to wait for the IRS to process your application and mail your EIN.

Method 4: Applying by Fax

Another option is to apply for an EIN by fax. You can fax a completed Form SS-4 to (855) 214-2228. The fax application process is available 24 hours a day, 7 days a week. You will need to provide the same information as the online application, and the IRS will fax your EIN back to you.

Method 5: Using a Third-Party Service

Finally, you can use a third-party service to obtain an EIN. These services, such as business formation companies, can help you with the application process and provide additional services, such as business registration and tax consulting. However, be aware that these services may charge a fee, and you should carefully review their terms and conditions before using their services.

📝 Note: Make sure to double-check your application for accuracy and completeness to avoid delays in processing.

To summarize, obtaining EIN paperwork is a crucial step in starting a business, and there are several ways to do so. The online application is the fastest and most convenient method, while the phone and mail applications provide alternative options. The fax application and third-party services offer additional choices. Regardless of the method you choose, it is essential to ensure the accuracy and completeness of your application to avoid delays.

In terms of the benefits and drawbacks of each method, the following table provides a summary:

| Method | Benefits | Drawbacks |

|---|---|---|

| Online Application | Fast, convenient, and available 24⁄7 | Technical issues may occur |

| Phone Application | Personalized assistance and immediate EIN | Limited hours of operation and potential wait times |

| Mail Application | No technical requirements and paper trail | Slow processing time and potential lost documents |

| Fax Application | Quick processing time and paper trail | Technical issues may occur and potential fax transmission errors |

| Third-Party Service | Convenient and additional services provided | Potential fees and dependence on the service provider |

To ensure a smooth application process, it is essential to have the necessary information and documents ready. The following bullet points highlight the key requirements: * Business name and address * Business type (sole proprietorship, partnership, corporation, etc.) * Business purpose and structure * Owner or authorized representative information * Social Security number or Individual Taxpayer Identification Number (ITIN)

By understanding the different methods and requirements for obtaining EIN paperwork, you can choose the best option for your business needs and ensure a successful application process.

In final thoughts, obtaining an EIN is a critical step in establishing a business, and the method you choose can impact the speed and efficiency of the process. By considering the benefits and drawbacks of each method and preparing the necessary information and documents, you can ensure a smooth and successful application process.

What is an EIN, and why do I need it?

+

An EIN is a unique nine-digit number assigned by the IRS to identify a business for tax purposes. You need an EIN to open a business bank account, file tax returns, and hire employees.

How long does it take to get an EIN?

+

The processing time for an EIN varies depending on the application method. Online applications are processed immediately, while phone and fax applications take a few minutes. Mail applications can take several weeks.

Can I apply for an EIN without a Social Security number?

+

Yes, you can apply for an EIN without a Social Security number. You can use an Individual Taxpayer Identification Number (ITIN) or apply for an EIN as a foreign entity.