Paperwork

Personal Tax Filing Paperwork Needed

Introduction to Personal Tax Filing

When it comes to personal tax filing, gathering the necessary paperwork is a crucial step in ensuring a smooth and accurate filing process. The paperwork needed for personal tax filing can vary depending on individual circumstances, such as income sources, deductions, and credits. In this article, we will guide you through the essential paperwork required for personal tax filing, helping you navigate the process with confidence.

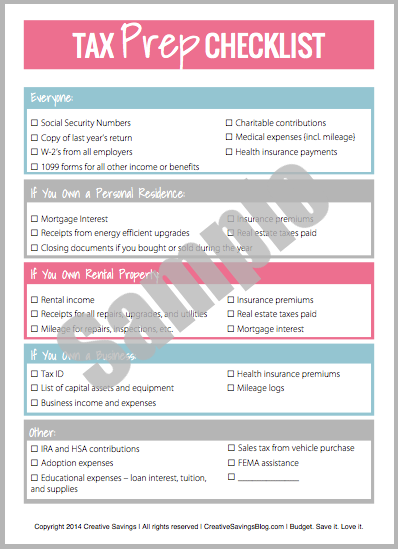

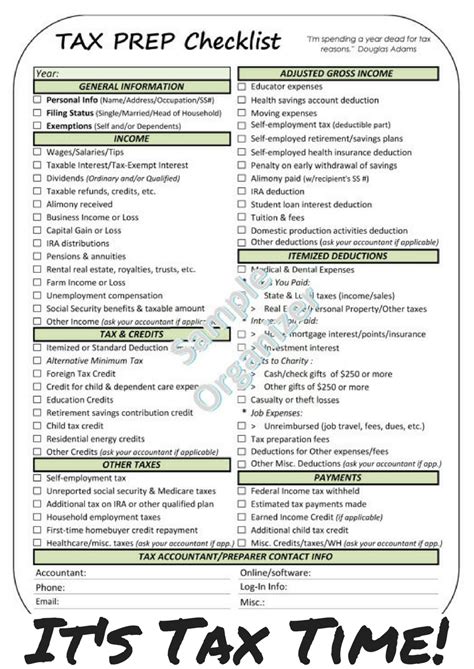

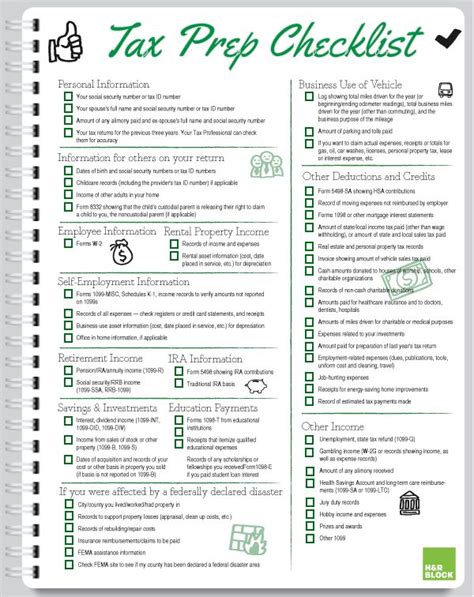

Income-Related Paperwork

To file your personal taxes, you will need to gather paperwork related to your income. This includes:

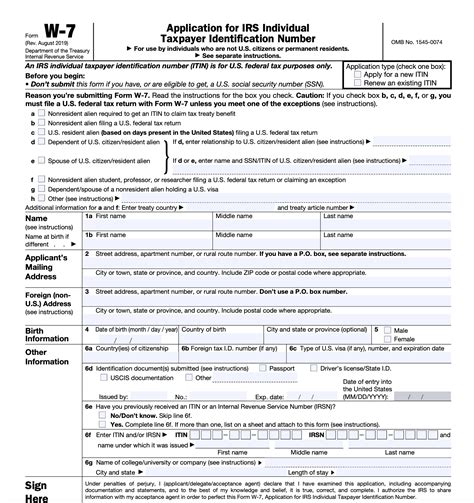

- W-2 forms: These forms are provided by your employer and show your income and taxes withheld.

- 1099 forms: If you are self-employed or have income from freelance work, interest, dividends, or capital gains, you will receive 1099 forms from the payer.

- K-1 forms: If you have income from partnerships, S corporations, or trusts, you will receive K-1 forms.

- Interest statements: You will need statements from your bank or financial institution showing the interest earned on your accounts.

Deduction-Related Paperwork

Deductions can help reduce your taxable income, and having the necessary paperwork is crucial to claiming these deductions. Some common deduction-related paperwork includes:

- Medical expense receipts: Keep receipts for medical expenses, such as doctor visits, prescriptions, and hospital stays.

- Charitable donation receipts: If you made charitable donations, keep receipts or acknowledgment letters from the charity.

- Mortgage interest statements: If you own a home, keep statements showing the mortgage interest paid.

- Property tax statements: Keep statements showing the property taxes paid on your primary residence or other properties.

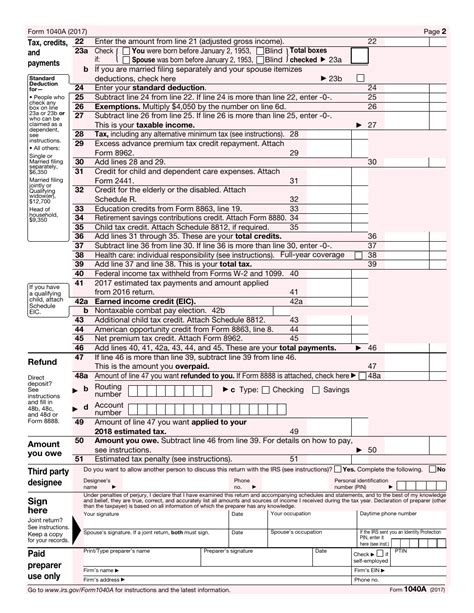

Credit-Related Paperwork

Tax credits can provide a significant reduction in your tax liability, and having the necessary paperwork is crucial to claiming these credits. Some common credit-related paperwork includes:

- Earned Income Tax Credit (EITC) paperwork: If you are eligible for the EITC, keep paperwork showing your income and family size.

- Child Tax Credit paperwork: If you are eligible for the Child Tax Credit, keep paperwork showing the number of qualifying children and their ages.

- Education credit paperwork: If you are eligible for education credits, keep paperwork showing your education expenses and eligibility.

Dependent-Related Paperwork

If you have dependents, you will need to gather paperwork related to their eligibility as dependents. This includes:

- Birth certificates: Keep birth certificates for your dependents to prove their relationship to you.

- Social Security numbers: Keep Social Security numbers for your dependents to claim them as dependents.

- Child care expense receipts: If you paid for child care, keep receipts to claim the Child and Dependent Care Credit.

📝 Note: Keep all tax-related paperwork organized and easily accessible to ensure a smooth tax filing process.

Conclusion and Final Thoughts

In conclusion, gathering the necessary paperwork is a critical step in the personal tax filing process. By having all the required paperwork, you can ensure an accurate and smooth filing process, minimizing the risk of errors or audits. Remember to keep all tax-related paperwork organized and easily accessible to ensure a stress-free tax filing experience.

What is the deadline for filing personal taxes?

+

The deadline for filing personal taxes is typically April 15th of each year, but it may vary depending on your location and individual circumstances.

What paperwork do I need to file for deductions?

+

You will need to gather paperwork related to your expenses, such as receipts, statements, and acknowledgment letters, to claim deductions on your tax return.

Can I file my personal taxes online?

+

Yes, you can file your personal taxes online through the IRS website or through tax preparation software, such as TurboTax or H&R Block.