5 UVI Paperwork Tips

Understanding the Importance of UVI Paperwork

When dealing with Used Vehicle Imports (UVI), paperwork is a critical component that cannot be overlooked. The process of importing a used vehicle into a country involves a plethora of documents and regulations that must be strictly adhered to. Failure to comply with these requirements can lead to significant delays, fines, or even the vehicle being turned back at the border. In this context, having a thorough understanding of the necessary paperwork and how to manage it efficiently is essential for a smooth and successful import process.

Tip 1: Ensure Compliance with Regulatory Requirements

The first and foremost tip is to ensure that all paperwork complies with the regulatory requirements of the importing country. This includes obtaining the necessary permits, certifications, and meeting environmental and safety standards. Researching the specific regulations applicable to the vehicle being imported is crucial. This involves understanding the rules regarding vehicle age, emissions, safety features, and any other stipulations that may apply. By ensuring compliance from the outset, importers can avoid potential issues down the line.

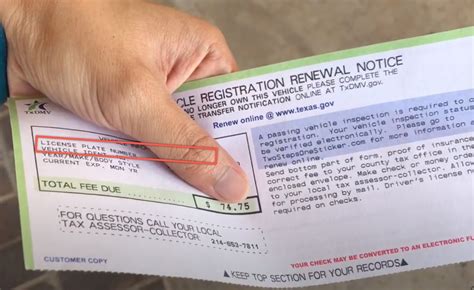

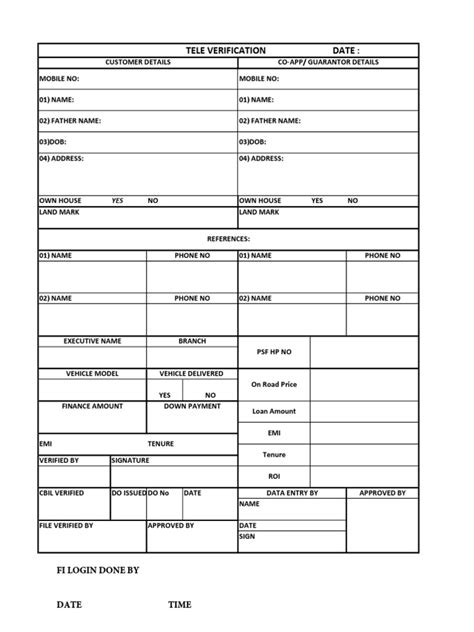

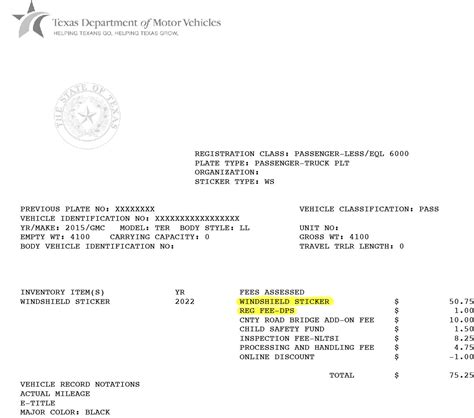

Tip 2: Gather All Necessary Documents

Gathering all the necessary documents is a vital step in the UVI paperwork process. This typically includes: - Commercial Invoice: A detailed invoice from the seller that includes the vehicle’s description, purchase price, and other relevant details. - Bill of Lading: A document issued by the shipping company that details the shipment, including the vehicle’s make, model, and VIN (Vehicle Identification Number). - Certificate of Title: Proof of ownership of the vehicle. - Export Certificate: If required, this certifies that the vehicle has been legally exported from the country of origin. - Customs Declaration: A declaration to customs authorities in the importing country, detailing the vehicle and its value.

Tip 3: Understand and Meet Customs Requirements

Customs requirements can be complex and vary significantly from one country to another. It is essential to understand these requirements to avoid any complications during the import process. This includes: - Determining the correct tariff classification for the vehicle, which affects the duties payable. - Calculating duties and taxes accurately to ensure no unexpected costs arise. - Complying with any specific customs regulations, such as the need for an import license or compliance with certain standards.

Tip 4: Keep Records Organized and Accessible

Keeping all paperwork and records organized and easily accessible is crucial for several reasons. Firstly, it facilitates the tracking of the import process, ensuring that all steps are completed in a timely manner. Secondly, it provides a clear audit trail, which can be essential in case of any disputes or issues with regulatory bodies. Finally, organized records can help in making future imports more efficient, as they provide a valuable reference point.

Tip 5: Seek Professional Advice When Necessary

Given the complexity of UVI paperwork, it is often beneficial to seek professional advice. This could be from a customs broker, a legal advisor specializing in import/export law, or a consultant with experience in vehicle imports. Professional advice can help navigate the intricacies of the process, ensure compliance with all regulations, and avoid costly mistakes.

📝 Note: Always verify the credentials and experience of any professional advisor before engaging their services, to ensure they are competent in handling UVI paperwork.

In summary, managing UVI paperwork effectively requires a combination of thorough research, meticulous attention to detail, and sometimes, the expertise of professionals. By following these tips, individuals and businesses can streamline their import processes, reduce the risk of errors, and ensure that their used vehicle imports are successful and compliant with all relevant regulations.

What is the most critical document in UVI paperwork?

+

The commercial invoice is often considered the most critical document, as it provides detailed information about the vehicle and its value, which is essential for customs clearance and duty calculation.

How long does the UVI paperwork process typically take?

+

The duration of the UVI paperwork process can vary significantly depending on several factors, including the complexity of the import, the efficiency of the importer, and the speed of regulatory approvals. It can range from a few weeks to several months.

Can UVI paperwork be handled without professional assistance?

+

While it is possible to handle UVI paperwork without professional assistance, it is generally recommended to seek help from experienced professionals, especially for complex or high-value imports, to minimize the risk of errors and ensure compliance with all regulations.