Taxable Value on Auto Tag Renewal

Understanding Taxable Value on Auto Tag Renewal

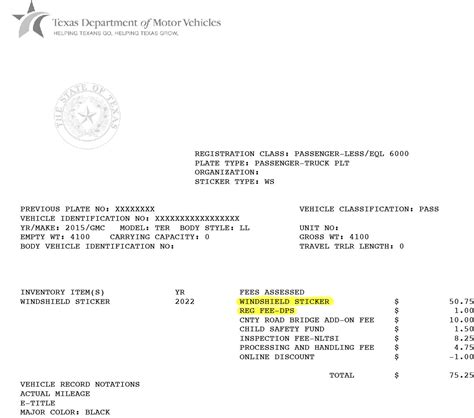

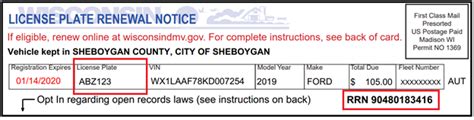

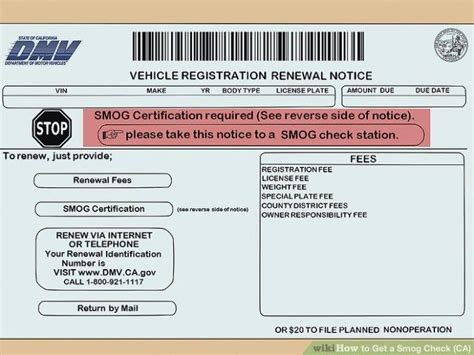

The process of renewing auto tags, also known as vehicle registration, involves several steps and requirements. One crucial aspect of this process is determining the taxable value of the vehicle. The taxable value is used to calculate the amount of taxes owed on the vehicle, which is a significant component of the overall renewal cost. In this blog post, we will delve into the concept of taxable value on auto tag renewal, exploring what it entails, how it is calculated, and its implications for vehicle owners.

What is Taxable Value?

The taxable value of a vehicle refers to the value of the vehicle that is subject to taxation. This value is typically determined by the state or local government and is used as the basis for calculating the amount of taxes owed on the vehicle. The taxable value takes into account various factors, including the vehicle’s make, model, year, and condition. In some jurisdictions, the taxable value may also consider the vehicle’s market value, which can fluctuate over time.

How is Taxable Value Calculated?

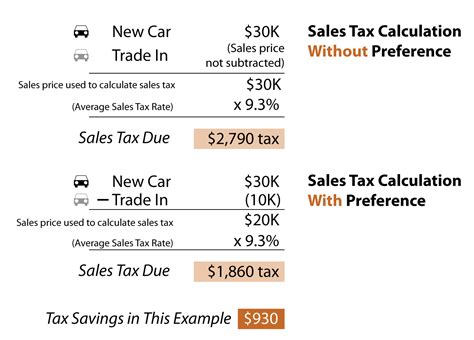

The calculation of taxable value varies from state to state, but it typically involves a combination of the following factors: * Vehicle make and model: The type of vehicle, including its make and model, can impact its taxable value. Luxury vehicles, for example, may have a higher taxable value than more affordable models. * Vehicle year: The age of the vehicle can also influence its taxable value. Newer vehicles typically have a higher taxable value than older ones. * Vehicle condition: The condition of the vehicle, including any damage or customizations, can also be a factor in determining its taxable value. * Market value: In some jurisdictions, the taxable value may be based on the vehicle’s market value, which can be determined by consulting pricing guides or conducting an appraisal.

Factors Affecting Taxable Value

Several factors can affect the taxable value of a vehicle, including: * Depreciation: As a vehicle ages, its value typically decreases. This depreciation can result in a lower taxable value over time. * Customizations: Any customizations or upgrades made to the vehicle can increase its taxable value. * Damage: If the vehicle has sustained damage, its taxable value may be reduced. * Market fluctuations: Changes in the market value of the vehicle can also impact its taxable value.

Implications for Vehicle Owners

Understanding the taxable value of a vehicle is essential for vehicle owners, as it can significantly impact the cost of renewing their auto tag. A higher taxable value can result in higher taxes owed, which can be a substantial burden for owners. On the other hand, a lower taxable value can lead to lower taxes owed, making it more affordable for owners to renew their auto tag.

📝 Note: Vehicle owners should review their vehicle's taxable value carefully to ensure accuracy and avoid any potential errors or discrepancies.

Steps to Determine Taxable Value

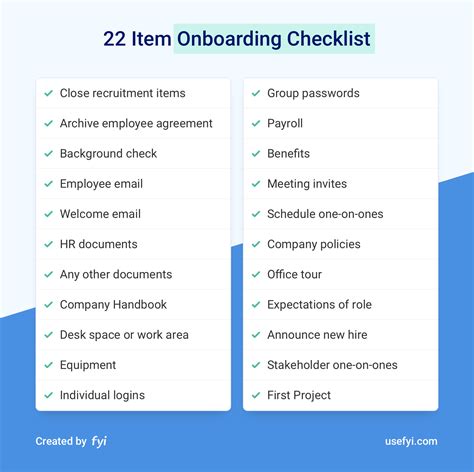

To determine the taxable value of a vehicle, owners can follow these steps: * Consult the state or local government’s website for information on taxable value calculations * Review the vehicle’s registration documents to ensure accuracy * Research the market value of the vehicle using pricing guides or appraisal services * Contact the state or local government’s department of motor vehicles for guidance and support

| Factor | Impact on Taxable Value |

|---|---|

| Depreciation | Decreases taxable value |

| Customizations | Increases taxable value |

| Damage | Decreases taxable value |

| Market fluctuations | Impacts taxable value |

Benefits of Accurate Taxable Value

Accurate determination of taxable value is crucial for vehicle owners, as it can result in: * Lower taxes owed: An accurate taxable value can lead to lower taxes owed, making it more affordable for owners to renew their auto tag. * Avoidance of penalties: Inaccurate taxable values can result in penalties and fines. Accurate determination can help owners avoid these penalties. * Compliance with regulations: Accurate taxable values ensure compliance with state and local regulations, reducing the risk of non-compliance and associated consequences.

In summary, the taxable value of a vehicle plays a critical role in the auto tag renewal process. Understanding the factors that affect taxable value and following the steps to determine it accurately can help vehicle owners avoid errors, reduce taxes owed, and ensure compliance with regulations.

The key points to take away from this discussion are the importance of accurate taxable value determination, the factors that influence taxable value, and the steps to follow to ensure accuracy. By being informed and proactive, vehicle owners can navigate the auto tag renewal process with confidence and avoid any potential pitfalls. Ultimately, a thorough understanding of taxable value can lead to a smoother and more cost-effective renewal experience.

What is the taxable value of a vehicle?

+

The taxable value of a vehicle refers to the value of the vehicle that is subject to taxation, typically determined by the state or local government.

How is taxable value calculated?

+

The calculation of taxable value varies from state to state but typically involves a combination of factors, including vehicle make and model, year, condition, and market value.

What factors affect taxable value?

+

Several factors can affect the taxable value of a vehicle, including depreciation, customizations, damage, and market fluctuations.