Paperwork

Washington State New Hire Paperwork Requirements

Introduction to Washington State New Hire Paperwork Requirements

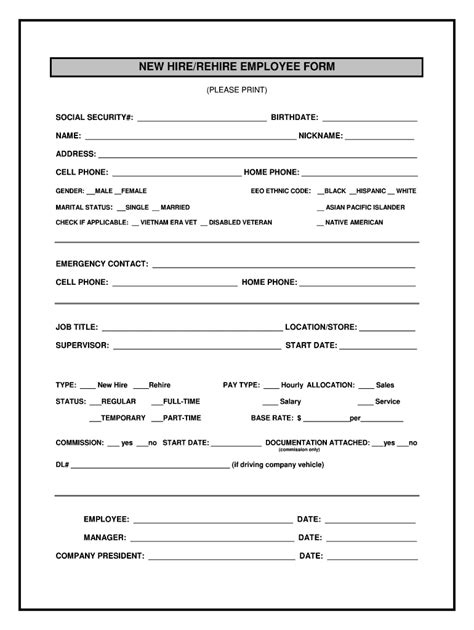

When hiring new employees in Washington State, it’s essential to understand the necessary paperwork requirements to ensure compliance with state and federal regulations. This process involves several steps, including verifying the employee’s identity, completing tax forms, and providing information about the company’s policies and benefits. In this article, we’ll guide you through the essential new hire paperwork requirements in Washington State, highlighting key documents, and providing tips for a smooth onboarding process.

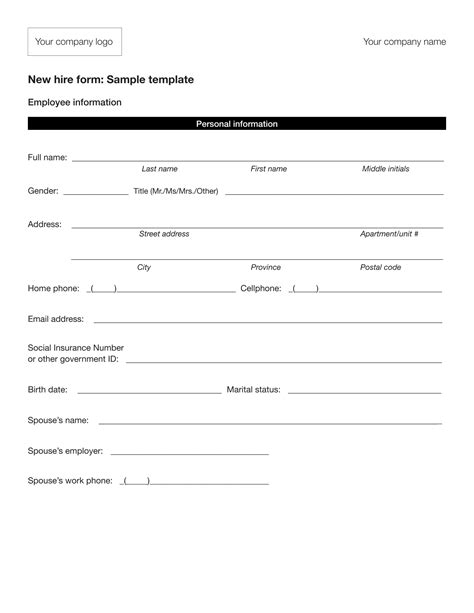

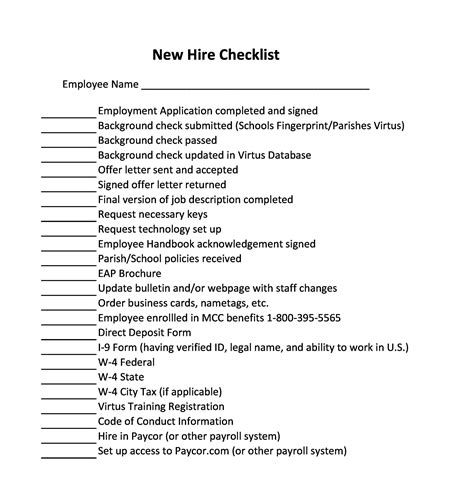

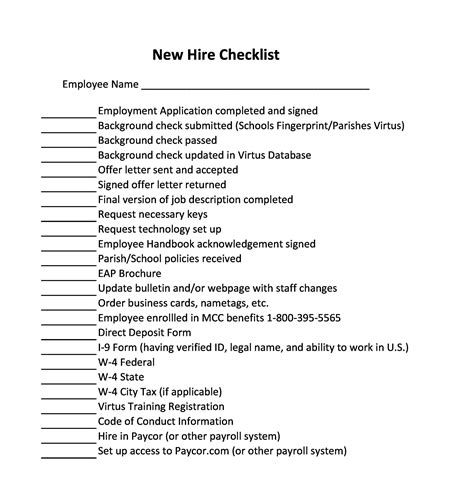

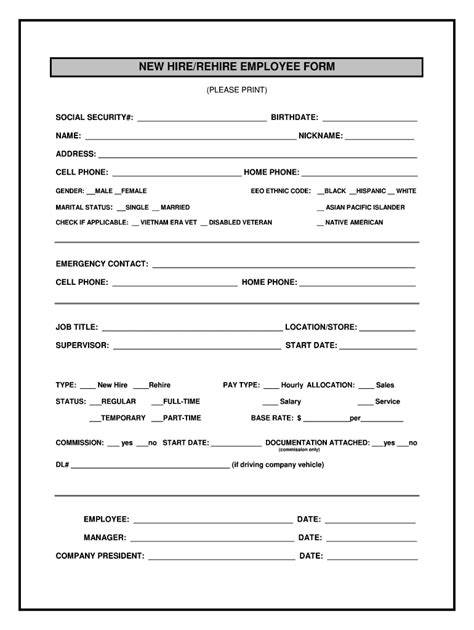

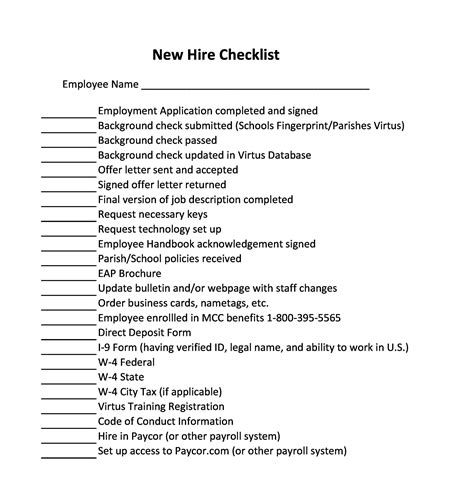

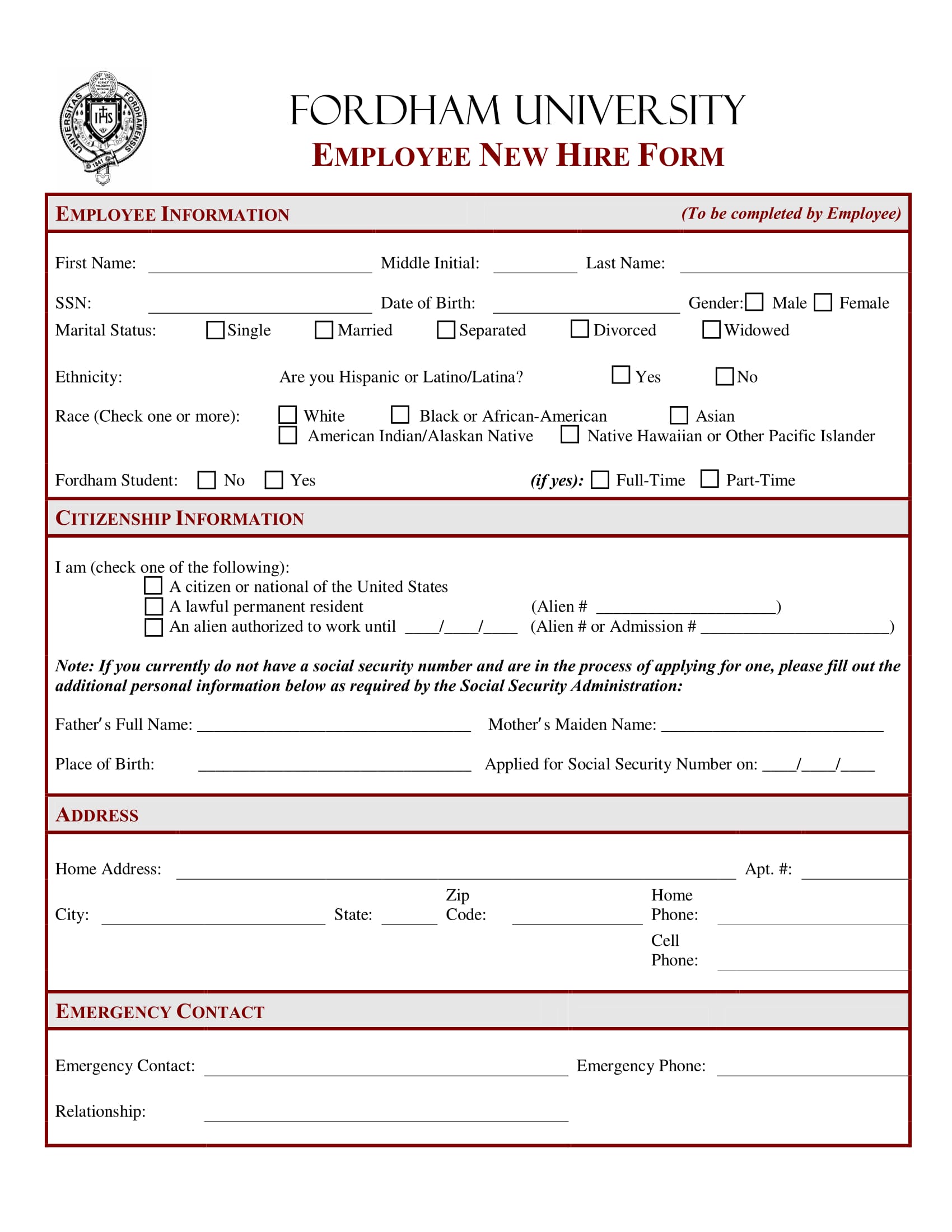

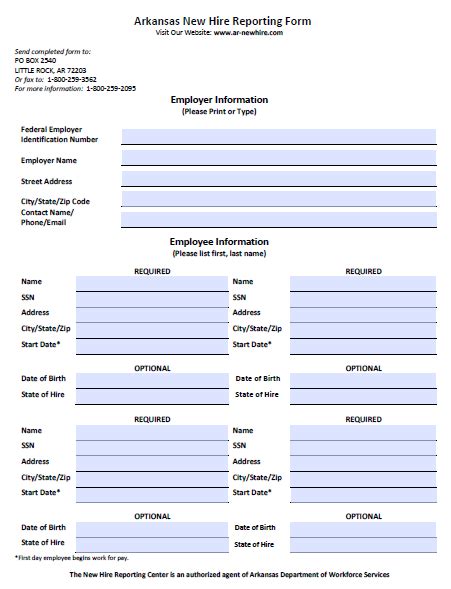

Required New Hire Paperwork in Washington State

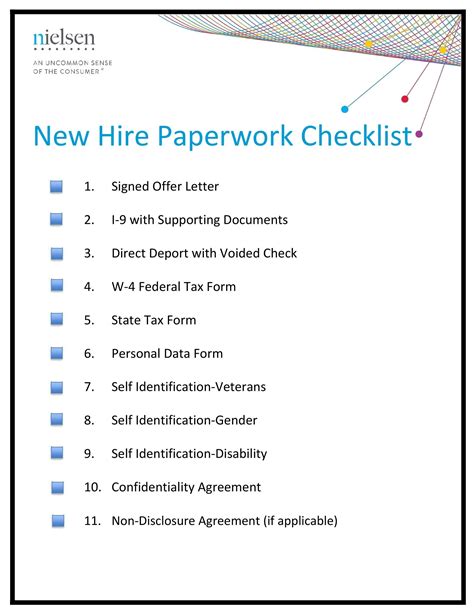

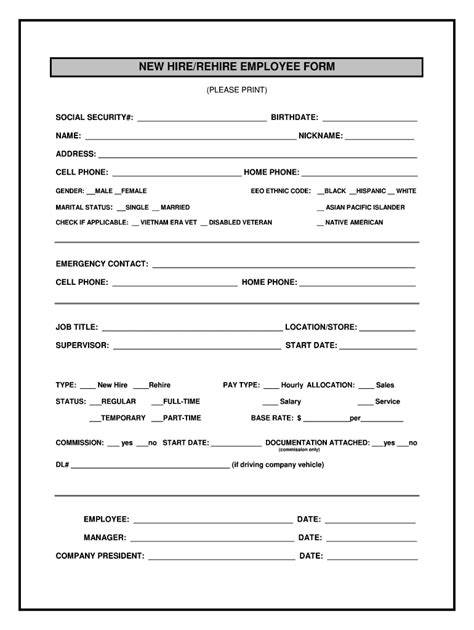

The following documents are typically required when hiring new employees in Washington State:

- W-4 Form: The Employee’s Withholding Certificate is used to determine the amount of federal income tax to withhold from the employee’s wages.

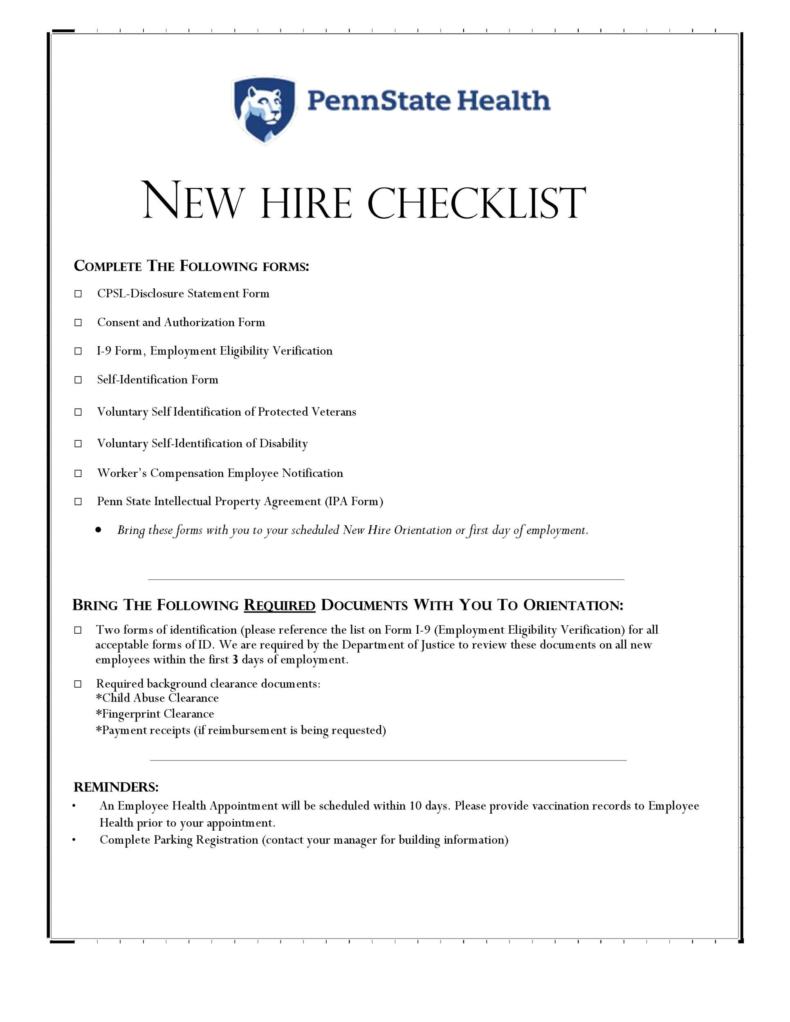

- I-9 Form: The Employment Eligibility Verification form is used to verify the employee’s identity and eligibility to work in the United States.

- Washington State W-4 Form: This form is used to determine the amount of state income tax to withhold from the employee’s wages.

- Direct Deposit Authorization Form: This form authorizes the employer to deposit the employee’s paycheck directly into their bank account.

- Benefits Enrollment Forms: Depending on the company’s benefits package, employees may need to complete forms to enroll in health insurance, retirement plans, or other benefits.

Verification of Identity and Work Eligibility

Verifying an employee’s identity and work eligibility is a critical step in the hiring process. Employers must complete the I-9 form and review the employee’s documentation to ensure they are eligible to work in the United States. Acceptable documents include:

- U.S. Passport

- Driver’s License or State ID

- Birth Certificate

- Social Security Card

- Permanent Resident Card

Tax Forms and Withholding

Employers must complete tax forms and withhold the correct amount of taxes from the employee’s wages. The W-4 form is used to determine the amount of federal income tax to withhold, while the Washington State W-4 form is used to determine the amount of state income tax to withhold. Employers must also provide employees with a W-2 form at the end of each tax year, showing the employee’s income and taxes withheld.

Company Policies and Benefits

Employers must provide employees with information about company policies and benefits, including:

- Employee Handbook: A comprehensive guide to company policies, procedures, and benefits.

- Benefits Package: Information about health insurance, retirement plans, and other benefits offered by the company.

- Payroll Schedule: The schedule for paying employees, including pay dates and pay periods.

Best Practices for New Hire Paperwork

To ensure a smooth onboarding process, employers should follow these best practices:

- Use Electronic Onboarding Systems: Electronic onboarding systems can streamline the paperwork process and reduce errors.

- Provide Clear Instructions: Employers should provide clear instructions and guidance to employees on completing paperwork.

- Verify Documentation: Employers must verify the employee’s documentation to ensure they are eligible to work in the United States.

- Keep Records Up-to-Date: Employers must keep accurate and up-to-date records of employee paperwork and documentation.

📝 Note: Employers should ensure that they are complying with all applicable laws and regulations, including the Immigration Reform and Control Act (IRCA) and the Fair Labor Standards Act (FLSA).

Conclusion and Next Steps

In conclusion, new hire paperwork requirements in Washington State involve several essential documents, including tax forms, verification of identity and work eligibility, and company policies and benefits. Employers must ensure they are complying with all applicable laws and regulations and provide clear instructions and guidance to employees. By following best practices and using electronic onboarding systems, employers can streamline the paperwork process and reduce errors.

What is the purpose of the I-9 form?

+

The I-9 form is used to verify the employee’s identity and eligibility to work in the United States.

What documents are acceptable for verifying identity and work eligibility?

+

Acceptable documents include a U.S. passport, driver’s license or state ID, birth certificate, social security card, and permanent resident card.

What is the purpose of the W-4 form?

+

The W-4 form is used to determine the amount of federal income tax to withhold from the employee’s wages.