5 Tips Save Bill

Introduction to Saving Bills

Saving bills is an essential aspect of personal finance that can help individuals manage their expenses, reduce debt, and achieve long-term financial goals. With the rise of digital payments and online transactions, it’s easier than ever to track and manage your bills. In this article, we’ll explore five tips to help you save on your bills and improve your overall financial health.

Understanding Your Bills

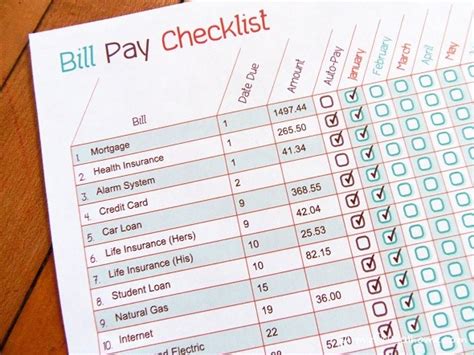

Before you can start saving on your bills, it’s essential to understand what you’re paying for. Take some time to review your monthly bills, including your rent/mortgage, utilities, credit card statements, and loan payments. Make a list of all your bills and categorize them by type and priority. This will help you identify areas where you can cut back and save.

5 Tips to Save on Your Bills

Here are five tips to help you save on your bills: * Tip 1: Negotiate with Service Providers: Many service providers, such as cable and internet companies, offer discounts and promotions to new customers. If you’ve been with the same provider for a while, it’s worth calling them to see if they can offer you a better deal. You can also try negotiating with your credit card company to lower your interest rate or waive fees. * Tip 2: Use Energy-Efficient Appliances: Energy-efficient appliances can help you save on your utility bills by reducing your energy consumption. Look for appliances with the ENERGY STAR label, which indicates that they meet energy efficiency standards set by the U.S. Environmental Protection Agency. * Tip 3: Use Cashback and Rewards Programs: Cashback and rewards programs can help you save on your bills by offering you money back or rewards on your purchases. Look for credit cards and apps that offer cashback or rewards on your utility bills, groceries, and other everyday expenses. * Tip 4: Use Budgeting Apps: Budgeting apps can help you track and manage your bills, as well as identify areas where you can cut back and save. Look for apps that offer bill tracking, budgeting, and savings features, such as Mint, You Need a Budget (YNAB), and Personal Capital. * Tip 5: Consider Bundling Services: Bundling services, such as cable, internet, and phone, can help you save on your bills by reducing the number of separate bills you need to pay. Look for providers that offer bundle discounts and promotions, and be sure to read the fine print to ensure you’re getting the best deal.

Additional Tips and Tricks

In addition to the five tips above, here are some additional tips and tricks to help you save on your bills: * Use the 50/30/20 rule: Allocate 50% of your income towards necessary expenses, such as rent/mortgage, utilities, and groceries. Use 30% for discretionary spending, and 20% for saving and debt repayment. * Use automatic payments: Set up automatic payments for your bills to ensure you never miss a payment. This can also help you avoid late fees and penalties. * Use price comparison tools: Use price comparison tools, such as Google Shopping or Nextdoor, to compare prices and find the best deals on your bills.

| Bill Type | Average Cost | Ways to Save |

|---|---|---|

| Utilities (electricity, gas, water) | $150-300 per month | Use energy-efficient appliances, turn off lights and electronics when not in use |

| Cable and internet | $100-200 per month | Negotiate with service providers, consider streaming services instead of cable |

| Phone bill | $50-100 per month | Consider prepaid plans or low-cost carriers, use Wi-Fi calling and messaging apps |

💡 Note: Be sure to review your bills regularly to ensure you're getting the best deals and rates. Consider using budgeting apps and price comparison tools to help you save even more.

In summary, saving on your bills requires a combination of understanding your expenses, negotiating with service providers, using energy-efficient appliances, and taking advantage of cashback and rewards programs. By following these tips and tricks, you can reduce your bills and achieve your long-term financial goals. Remember to stay vigilant and regularly review your bills to ensure you’re getting the best deals and rates. With a little effort and planning, you can save hundreds or even thousands of dollars per year on your bills.

What are some common mistakes people make when trying to save on their bills?

+

Some common mistakes people make when trying to save on their bills include not reviewing their bills regularly, not negotiating with service providers, and not taking advantage of cashback and rewards programs.

How can I use budgeting apps to save on my bills?

+

Budgeting apps can help you track and manage your bills, as well as identify areas where you can cut back and save. Look for apps that offer bill tracking, budgeting, and savings features, such as Mint, You Need a Budget (YNAB), and Personal Capital.

What are some additional tips for saving on my bills?

+

Some additional tips for saving on your bills include using the 50/30/20 rule, using automatic payments, and using price comparison tools. You can also consider bundling services, using energy-efficient appliances, and taking advantage of cashback and rewards programs.