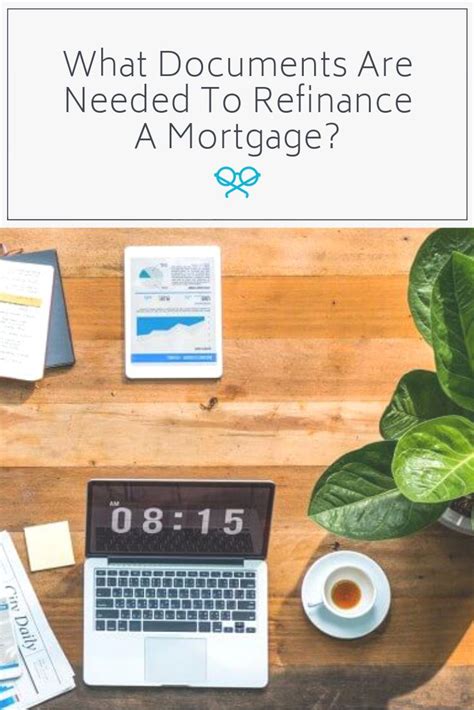

Refinance Mortgage Paperwork Needed

Introduction to Refinancing a Mortgage

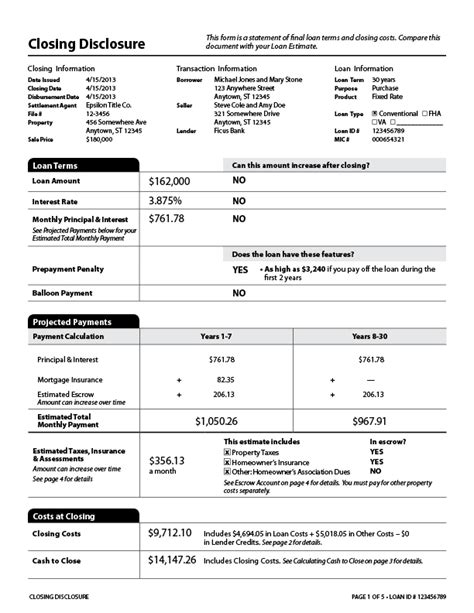

Refinancing a mortgage can be a complex and overwhelming process, especially when it comes to gathering all the necessary paperwork. Refinancing involves replacing an existing mortgage with a new one, usually to take advantage of lower interest rates, switch from an adjustable-rate to a fixed-rate loan, or tap into home equity. To navigate this process smoothly, it’s essential to understand what documents you’ll need to provide to your lender.

Why Refinance a Mortgage?

Before diving into the paperwork, let’s briefly explore the reasons why homeowners might choose to refinance their mortgage. Some common motivations include: - Lowering monthly payments by securing a lower interest rate. - Switching loan types, such as moving from an adjustable-rate mortgage to a fixed-rate mortgage for stability. - Tapping into home equity to fund home improvements, pay off high-interest debt, or cover significant expenses. - Removing private mortgage insurance (PMI) if the original loan had a low down payment.

Refinance Mortgage Paperwork Needed

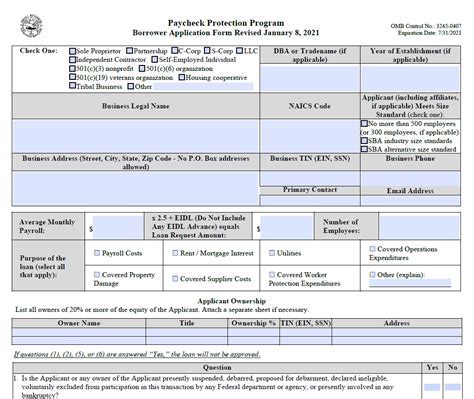

The specific documents required for refinancing can vary depending on your financial situation, the type of property, and the lender’s policies. However, here are some of the most commonly needed documents: - Identification: A valid government-issued ID, such as a driver’s license or passport. - Income Documentation: - Pay stubs from the last 30 days. - W-2 forms from the last two years. - Tax returns, personal and business if applicable, for the last two years. - Asset Documentation: - Bank statements for checking and savings accounts. - Investment account statements. - Retirement account statements. - Credit Reports: Your lender will likely pull your credit report, but having a copy can be helpful. - Property-Related Documents: - Deed to your property. - Title report or title insurance. - Appraisal (may be required by the lender, especially for certain types of loans or properties). - Mortgage Statements: Recent statements for your current mortgage. - Homeowners Insurance: Proof of insurance that covers the property.

Streamlining the Process

To make the refinancing process as efficient as possible, consider the following tips: - Gather documents early to avoid delays. - Check your credit report beforehand to address any errors or issues. - Shop around for lenders to find the best rates and terms. - Consider working with a mortgage broker who can guide you through the process and help you find the most suitable loan options.

Common Challenges and Solutions

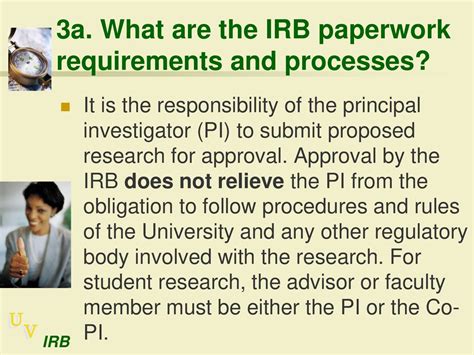

Some homeowners may encounter challenges during the refinancing process, such as: - Credit score issues: Working on improving your credit score before applying can help. - Income verification: Be prepared to provide detailed income documentation, especially if you’re self-employed. - Appraisal problems: If the appraisal value comes in lower than expected, you may need to negotiate with your lender or consider a different loan product.

📝 Note: Keeping detailed records of all correspondence and submissions to your lender can help track the progress of your application and resolve any issues that may arise.

Conclusion and Next Steps

Refinancing a mortgage requires careful consideration and preparation, especially when it comes to gathering the necessary paperwork. By understanding what documents you’ll need and being proactive in addressing any potential challenges, you can navigate the process more smoothly. Remember, the goal of refinancing is often to improve your financial situation, whether through lower monthly payments, accessing equity, or securing a more favorable loan term. By taking the time to get everything in order, you can set yourself up for success and make the most of your refinancing opportunity.

What are the main reasons for refinancing a mortgage?

+

The main reasons for refinancing a mortgage include lowering monthly payments, switching from an adjustable-rate to a fixed-rate loan, tapping into home equity, and removing private mortgage insurance (PMI).

What documents do I need to refinance my mortgage?

+

To refinance your mortgage, you’ll typically need identification, income documentation (pay stubs, W-2 forms, tax returns), asset documentation (bank statements, investment accounts), credit reports, property-related documents (deed, title report, appraisal), mortgage statements, and homeowners insurance.

How can I make the refinancing process smoother?

+

To make the refinancing process smoother, gather all necessary documents early, check your credit report for errors, shop around for lenders, and consider working with a mortgage broker who can guide you through the process.