Paperwork

PPP Loan Paperwork Due Date

Introduction to PPP Loan Paperwork Due Date

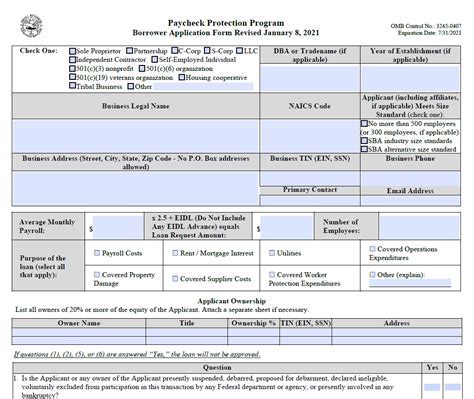

The Paycheck Protection Program (PPP) was established by the CareS Act to provide financial assistance to small businesses, self-employed individuals, and certain non-profit organizations affected by the COVID-19 pandemic. One of the critical aspects of the PPP loan is meeting the required paperwork due date to ensure loan forgiveness. In this article, we will discuss the PPP loan paperwork due date, the required documents, and the steps to follow for a smooth loan forgiveness process.

Understanding PPP Loan Forgiveness

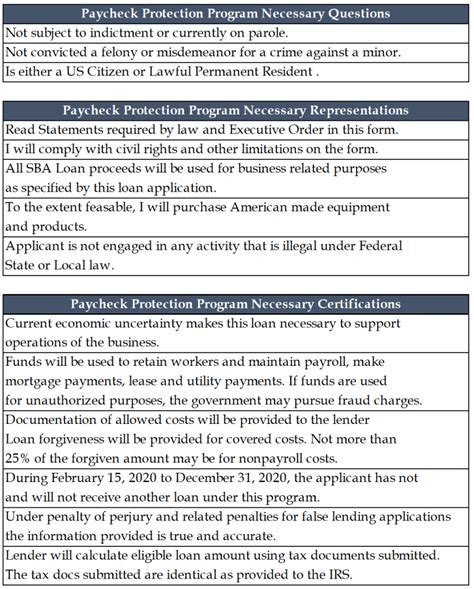

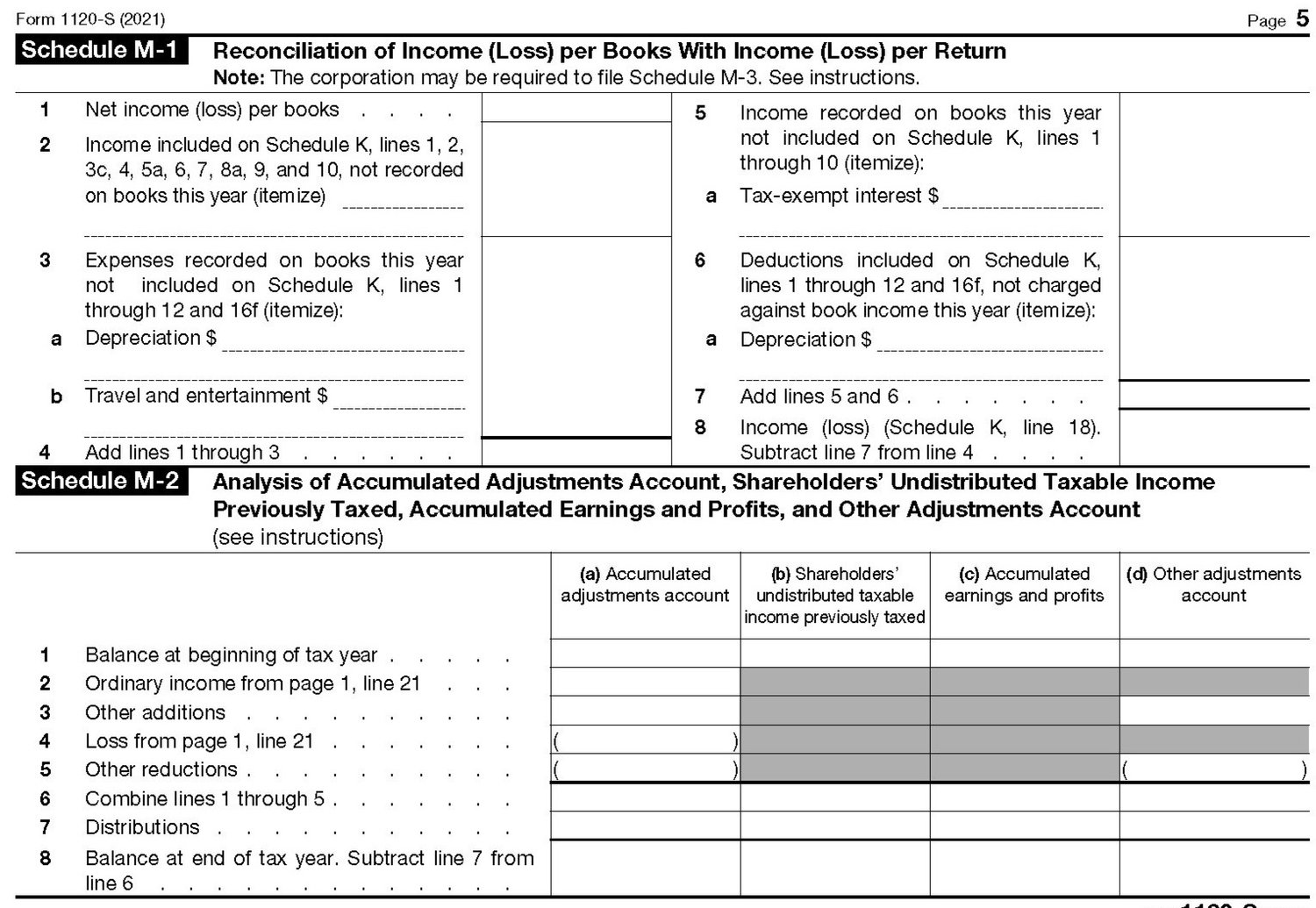

To qualify for PPP loan forgiveness, borrowers must use the loan proceeds for eligible expenses, such as payroll costs, rent, utilities, and mortgage interest. The loan forgiveness amount is based on the borrower’s actual expenses during the covered period, which is either 8 or 24 weeks, depending on the borrower’s choice. It is essential to maintain accurate records of expenses and supporting documentation to ensure a successful loan forgiveness application.

Required Documents for PPP Loan Forgiveness

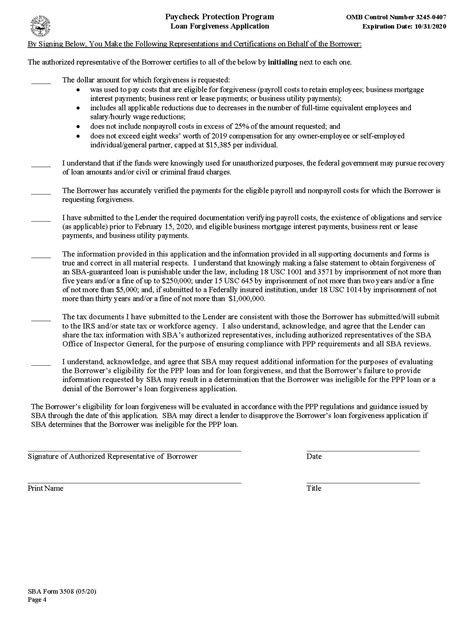

To apply for PPP loan forgiveness, borrowers must submit the following documents to their lender: * PPP Loan Forgiveness Application (SBA Form 3508): This form requires borrowers to provide information about their loan, including the loan amount, loan number, and borrower’s contact information. * Documentation of payroll costs: Borrowers must provide documentation to support their payroll costs, including payroll registers, payroll tax filings, and payment receipts. * Documentation of non-payroll costs: Borrowers must provide documentation to support their non-payroll costs, including rent, utilities, and mortgage interest. * Certifications and representations: Borrowers must certify that they have used the loan proceeds for eligible expenses and that they have maintained the required documentation.

PPP Loan Paperwork Due Date

The PPP loan paperwork due date varies depending on the borrower’s loan disbursement date. Generally, borrowers have 10 months from the end of their covered period to apply for loan forgiveness. For example, if a borrower’s covered period ends on December 31, 2022, their loan forgiveness application is due by October 31, 2023.

📝 Note: Borrowers should check with their lender for specific guidance on the loan forgiveness application process and required documents.

Steps to Follow for PPP Loan Forgiveness

To ensure a smooth loan forgiveness process, borrowers should follow these steps: * Review the loan forgiveness application: Borrowers should carefully review the loan forgiveness application to ensure they understand the requirements and documentation needed. * Gather required documents: Borrowers should gather all required documents, including payroll registers, payroll tax filings, and payment receipts. * Submit the loan forgiveness application: Borrowers should submit the completed loan forgiveness application and supporting documentation to their lender. * Follow up with the lender: Borrowers should follow up with their lender to ensure their application is being processed and to address any issues or concerns.

Conclusion and Next Steps

In conclusion, meeting the PPP loan paperwork due date is critical to ensuring loan forgiveness. Borrowers must carefully review the loan forgiveness application, gather required documents, and submit their application to their lender. By following these steps and maintaining accurate records, borrowers can ensure a smooth loan forgiveness process and maximize their loan forgiveness amount. It is essential for borrowers to stay informed about the loan forgiveness process and to seek guidance from their lender or a qualified professional if they have any questions or concerns.

What is the PPP loan paperwork due date?

+

The PPP loan paperwork due date varies depending on the borrower’s loan disbursement date. Generally, borrowers have 10 months from the end of their covered period to apply for loan forgiveness.

What documents are required for PPP loan forgiveness?

+

Borrowers must submit the PPP Loan Forgiveness Application (SBA Form 3508), documentation of payroll costs, documentation of non-payroll costs, and certifications and representations.

How do I apply for PPP loan forgiveness?

+

Borrowers should review the loan forgiveness application, gather required documents, submit the completed application to their lender, and follow up with the lender to ensure their application is being processed.