Tax Filing Paperwork Requirements

Introduction to Tax Filing Paperwork Requirements

The process of filing taxes involves a significant amount of paperwork, which can be overwhelming for many individuals and businesses. Understanding the requirements for tax filing paperwork is essential to ensure compliance with tax laws and regulations. In this article, we will delve into the world of tax filing paperwork, exploring the necessary documents, forms, and deadlines to help you navigate the tax filing process with ease.

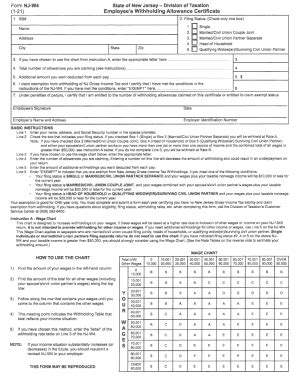

Understanding Tax Filing Status

Before diving into the paperwork requirements, it’s essential to understand your tax filing status. Your filing status determines the tax rates and deductions you’re eligible for. The most common filing statuses include: * Single * Married Filing Jointly * Married Filing Separately * Head of Household * Qualifying Widow(er) Each filing status has its unique set of rules and requirements, so it’s crucial to choose the correct status to avoid any errors or discrepancies in your tax return.

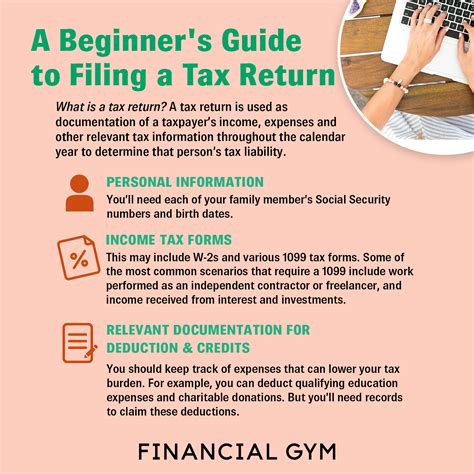

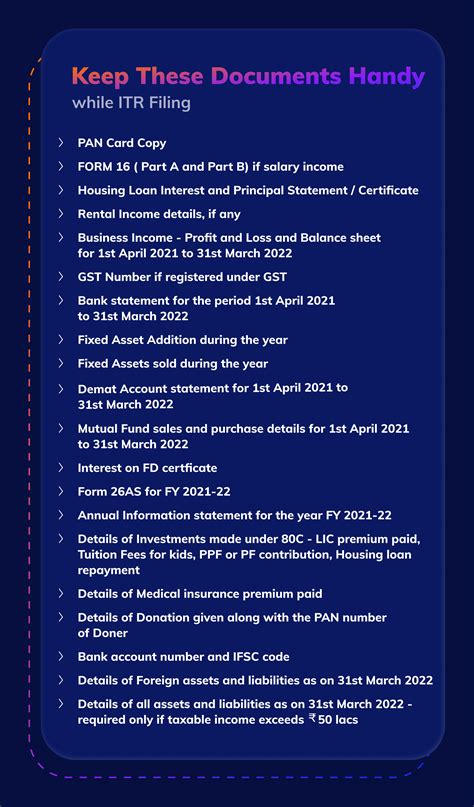

Gathering Necessary Documents

To complete your tax return, you’ll need to gather various documents, including: * W-2 forms from your employer, showing your income and taxes withheld * 1099 forms for freelance work, interest, dividends, and capital gains * Receipts for deductions, such as charitable donations, medical expenses, and business expenses * Interest statements from banks and investment accounts * Dividend statements from investments * Capital gains statements from investment sales * Business expense records, including receipts, invoices, and bank statements

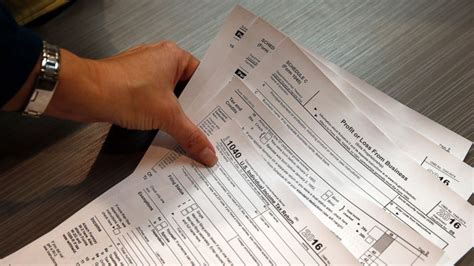

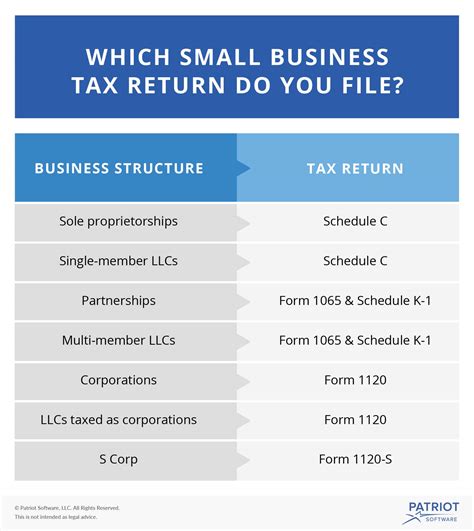

Tax Forms and Schedules

The IRS provides various tax forms and schedules to help you report your income, deductions, and credits. The most common forms include: * Form 1040: The standard form for personal income tax returns * Form 1040A: A simplified version of Form 1040, for those with straightforward tax situations * Form 1040EZ: A simplified version of Form 1040, for those with very basic tax situations * Schedule A: For itemizing deductions, such as medical expenses, mortgage interest, and charitable donations * Schedule B: For reporting interest and dividend income * Schedule C: For reporting business income and expenses * Schedule D: For reporting capital gains and losses

Deadlines and Extensions

It’s essential to meet the tax filing deadlines to avoid penalties and interest. The standard deadline for personal tax returns is April 15th of each year. However, you can request an automatic six-month extension by filing Form 4868 by the original deadline. This will give you until October 15th to file your tax return.

Tax Filing Options

You have several options for filing your tax return, including: * E-filing: Electronic filing, which is faster and more accurate than paper filing * Paper filing: Mailing your tax return to the IRS * Tax software: Using software, such as TurboTax or H&R Block, to prepare and file your tax return * Tax professional: Hiring a tax professional, such as a CPA or enrolled agent, to prepare and file your tax return

📝 Note: It's essential to choose the right tax filing option for your situation, considering factors such as complexity, accuracy, and cost.

Record Keeping and Organization

To make the tax filing process smoother, it’s crucial to maintain accurate and organized records throughout the year. This includes: * Keeping receipts and invoices for deductions and business expenses * Tracking income and expenses using a spreadsheet or accounting software * Storing tax-related documents in a secure and easily accessible location

| Document | Description |

|---|---|

| W-2 form | Shows income and taxes withheld from employer |

| 1099 form | Shows income from freelance work, interest, dividends, and capital gains |

| Receipts for deductions | Supports deductions for charitable donations, medical expenses, and business expenses |

Avoiding Common Mistakes

To avoid common mistakes and errors, it’s essential to: * Double-check math calculations * Verify Social Security numbers * Ensure correct filing status * Report all income * Claim eligible deductions and credits

In summary, understanding the tax filing paperwork requirements is crucial for a smooth and accurate tax filing process. By gathering necessary documents, using the correct tax forms and schedules, meeting deadlines, and maintaining organized records, you can ensure compliance with tax laws and regulations. Remember to choose the right tax filing option for your situation and avoid common mistakes to minimize errors and penalties.

What is the deadline for filing personal tax returns?

+

The standard deadline for personal tax returns is April 15th of each year.

What is the difference between e-filing and paper filing?

+

E-filing is electronic filing, which is faster and more accurate than paper filing, which involves mailing your tax return to the IRS.

What are the most common tax forms and schedules?

+

The most common tax forms and schedules include Form 1040, Form 1040A, Form 1040EZ, Schedule A, Schedule B, Schedule C, and Schedule D.