Banks Handle House Paperwork

Introduction to Bank-Handled House Paperwork

When it comes to buying or selling a house, the process can be complex and involves a significant amount of paperwork. One of the key players in this process is the bank, which handles various aspects of the transaction, including the financing and the transfer of ownership. In this article, we will delve into the world of bank-handled house paperwork, exploring the different types of documents involved, the role of the bank, and the benefits of using a bank to handle the paperwork.

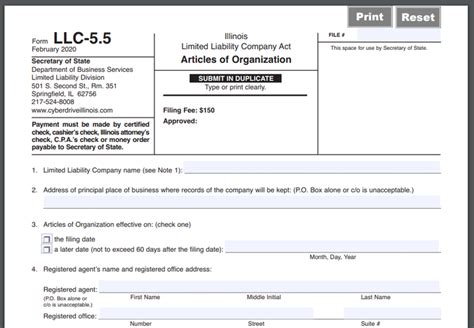

Types of Documents Involved

The paperwork involved in buying or selling a house is extensive and includes various documents, such as: * Deeds: These documents transfer the ownership of the property from the seller to the buyer. * Mortgage agreements: These documents outline the terms and conditions of the loan, including the interest rate, repayment terms, and any penalties for late payment. * Title reports: These documents provide a detailed history of the property’s ownership and any outstanding liens or encumbrances. * Appraisal reports: These documents provide an independent assessment of the property’s value. * Inspection reports: These documents highlight any potential issues with the property, such as structural damage or needed repairs.

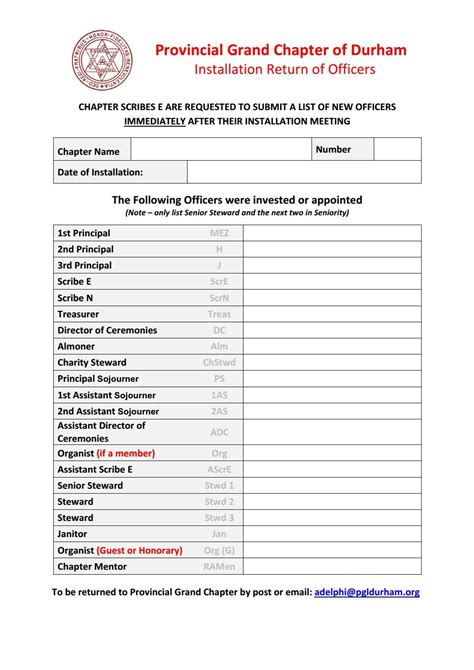

The Role of the Bank

The bank plays a crucial role in the house buying and selling process, handling various aspects of the transaction, including: * Financing: The bank provides the loan to the buyer, which is used to purchase the property. * Verification of documents: The bank verifies the accuracy and completeness of the documents involved in the transaction. * Transfer of ownership: The bank facilitates the transfer of ownership from the seller to the buyer. * Disbursement of funds: The bank disburses the loan funds to the seller, and the buyer repays the loan over time.

Benefits of Using a Bank to Handle Paperwork

Using a bank to handle the paperwork involved in buying or selling a house has several benefits, including: * Convenience: The bank handles all aspects of the transaction, making the process easier and less stressful for the buyer and seller. * Expertise: The bank has extensive experience in handling real estate transactions, ensuring that the process is smooth and efficient. * Security: The bank ensures that all documents are verified and accurate, reducing the risk of errors or fraud. * Time-saving: The bank handles all the paperwork, saving the buyer and seller time and effort.

📝 Note: It's essential to choose a reputable bank with experience in handling real estate transactions to ensure a smooth and efficient process.

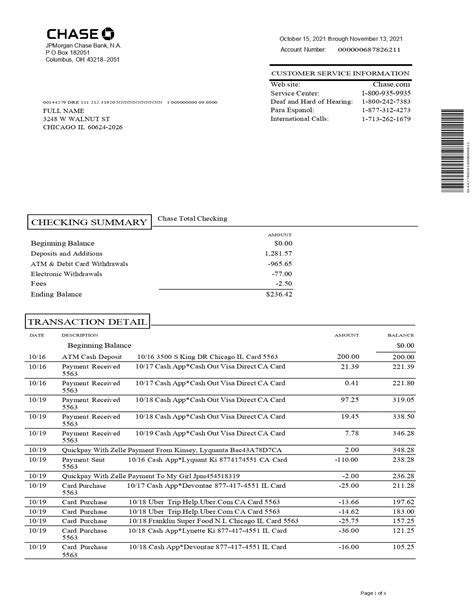

How the Bank Handles Paperwork

The bank handles the paperwork involved in buying or selling a house by: * Reviewing and verifying all documents involved in the transaction * Ensuring that all documents are complete and accurate * Facilitating the transfer of ownership from the seller to the buyer * Disbursing the loan funds to the seller * Providing the buyer with a detailed breakdown of the loan terms and conditions

| Document | Description |

|---|---|

| Deed | Transfers ownership of the property from the seller to the buyer |

| Mortgage agreement | Outlines the terms and conditions of the loan |

| Title report | Provides a detailed history of the property's ownership and any outstanding liens or encumbrances |

Common Challenges and Solutions

Despite the benefits of using a bank to handle the paperwork, there are common challenges that may arise, such as: * Delays in the transaction process: This can be caused by incomplete or inaccurate documents. * Disputes over the property’s value: This can be resolved by obtaining an independent appraisal report. * Issues with the property’s title: This can be resolved by working with the bank and the seller to clear any outstanding liens or encumbrances.

In summary, the bank plays a vital role in handling the paperwork involved in buying or selling a house. By understanding the different types of documents involved, the role of the bank, and the benefits of using a bank to handle the paperwork, buyers and sellers can navigate the process with confidence. The bank’s expertise and experience ensure that the transaction is smooth, efficient, and secure. As the process comes to a close, it’s clear that working with a bank to handle house paperwork is a smart decision, saving time, effort, and reducing the risk of errors or fraud.

What is the role of the bank in handling house paperwork?

+

The bank plays a crucial role in handling the paperwork involved in buying or selling a house, including financing, verification of documents, transfer of ownership, and disbursement of funds.

What are the benefits of using a bank to handle house paperwork?

+

The benefits of using a bank to handle house paperwork include convenience, expertise, security, and time-saving.

What documents are involved in the house buying and selling process?

+

The documents involved in the house buying and selling process include deeds, mortgage agreements, title reports, appraisal reports, and inspection reports.