File Paperwork for LLC

Understanding the Process of Filing Paperwork for an LLC

Filing paperwork for a Limited Liability Company (LLC) is a crucial step in establishing a business. It involves several steps, including choosing a business name, registering the LLC with the state, and obtaining necessary licenses and permits. LLC formation can be a complex process, but with the right guidance, it can be completed efficiently.

Step 1: Choose a Business Name

The first step in filing paperwork for an LLC is to choose a unique and available business name. The name must comply with the state’s naming requirements, which typically include the following: * The name must contain the words “Limited Liability Company” or the abbreviation “LLC” * The name must be distinguishable from other business names in the state * The name must not contain certain restricted words, such as “bank” or “insurance”

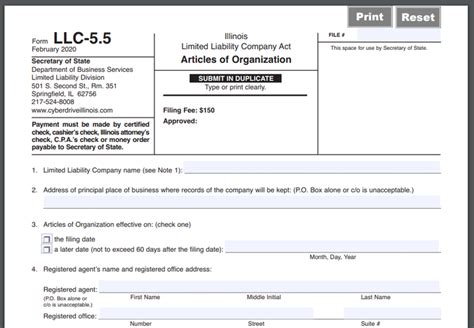

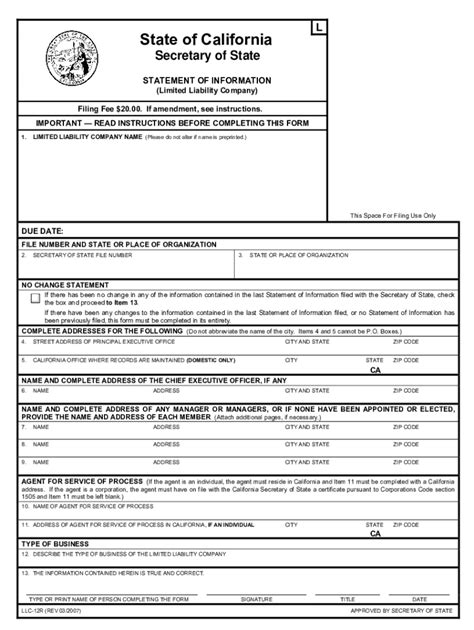

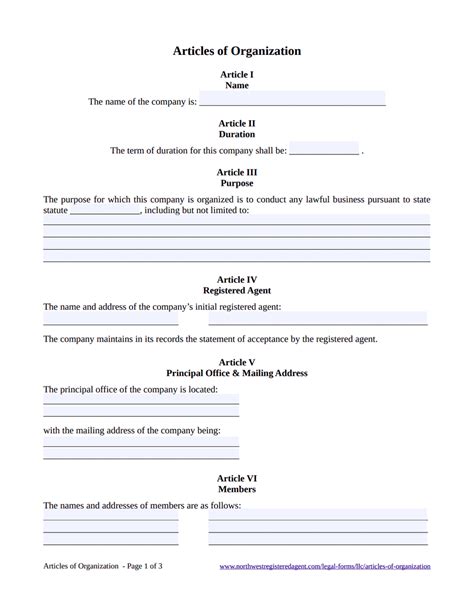

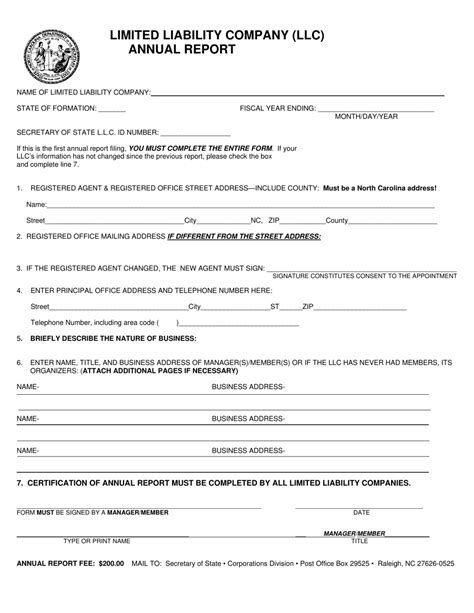

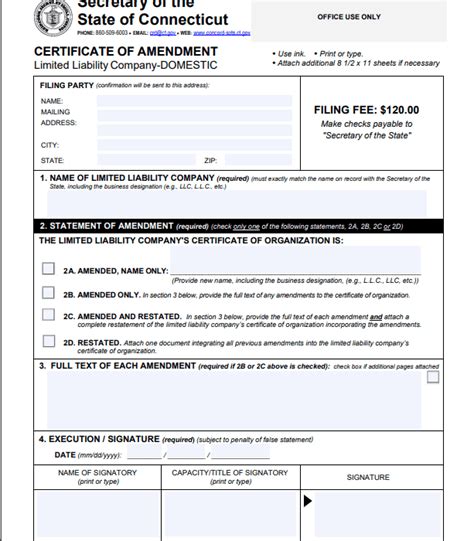

Step 2: Register the LLC with the State

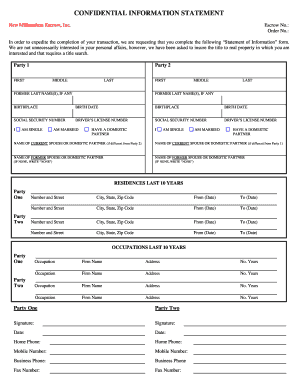

Once a business name has been chosen, the next step is to register the LLC with the state. This involves filing Articles of Organization with the state’s business registration office. The Articles of Organization must include the following information: * The business name and address * The purpose of the LLC * The names and addresses of the LLC’s members and managers * The name and address of the LLC’s registered agent

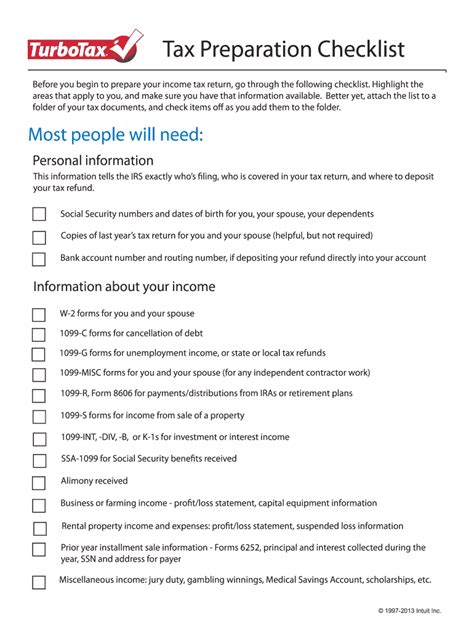

Step 3: Obtain Necessary Licenses and Permits

After registering the LLC with the state, the next step is to obtain necessary licenses and permits. The types of licenses and permits required will depend on the type of business and the state in which it is located. Some common licenses and permits include: * Business license: required for all businesses * Sales tax permit: required for businesses that sell taxable goods or services * Employer identification number: required for businesses that hire employees

Step 4: Create an Operating Agreement

An operating agreement is a document that outlines the ownership and management structure of the LLC. It should include the following information: * The ownership percentage of each member * The roles and responsibilities of each member and manager * The procedure for making decisions and resolving disputes * The procedure for adding or removing members

📝 Note: An operating agreement is not required by law, but it is highly recommended to avoid disputes and ensure the smooth operation of the business.

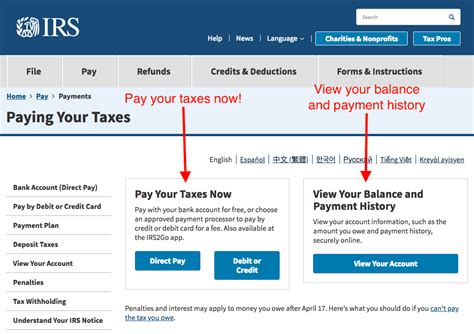

Step 5: Obtain an Employer Identification Number

An Employer Identification Number (EIN) is a unique number assigned to the LLC by the IRS. It is used to identify the business for tax purposes and to open a business bank account. The EIN can be obtained by filing Form SS-4 with the IRS.

Benefits of Forming an LLC

Forming an LLC provides several benefits, including: * Personal liability protection: the owners of the LLC are not personally responsible for the debts and liabilities of the business * Tax benefits: the LLC can elect to be taxed as a pass-through entity, which means that the business income is only taxed at the individual level * Flexibility: the LLC can be managed by its members or by a board of directors

| State | Filing Fee | Annual Report Fee |

|---|---|---|

| California | $70 | $20 |

| New York | $200 | $9 |

| Florida | $125 | $138.75 |

In summary, filing paperwork for an LLC involves several steps, including choosing a business name, registering the LLC with the state, obtaining necessary licenses and permits, creating an operating agreement, and obtaining an Employer Identification Number. By following these steps, businesses can ensure that they are properly established and compliant with state and federal regulations.

To finalize the process, it is essential to review and understand all the requirements and regulations involved in forming an LLC. This will help to avoid any potential issues or penalties and ensure the success of the business.

What is the difference between an LLC and a corporation?

+

An LLC and a corporation are both business structures, but they have different ownership and management requirements. An LLC is a pass-through entity, meaning that the business income is only taxed at the individual level, while a corporation is a separate tax entity and is subject to double taxation.

How long does it take to form an LLC?

+

The time it takes to form an LLC varies by state, but it typically takes several days to several weeks. Some states offer expedited filing options, which can reduce the processing time to as little as 24 hours.

Do I need to hire an attorney to form an LLC?

+

No, you do not need to hire an attorney to form an LLC. However, it is highly recommended to consult with an attorney or a business formation service to ensure that the LLC is properly established and compliant with state and federal regulations.