Paperwork

After Death Paperwork Retention Period

Introduction to After Death Paperwork Retention Period

When a loved one passes away, the last thing on anyone’s mind is the paperwork and administrative tasks that need to be taken care of. However, it is essential to understand the importance of retaining certain documents and the length of time they should be kept. In this blog post, we will explore the various types of paperwork that need to be retained after someone’s death and the recommended retention periods.

Types of Paperwork to Retain

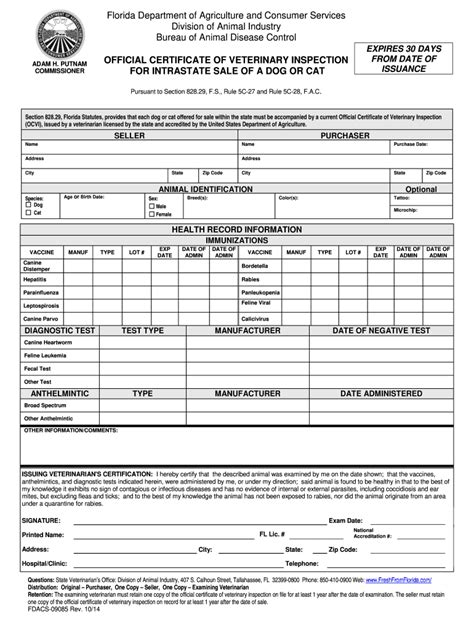

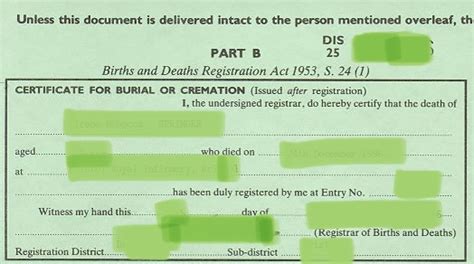

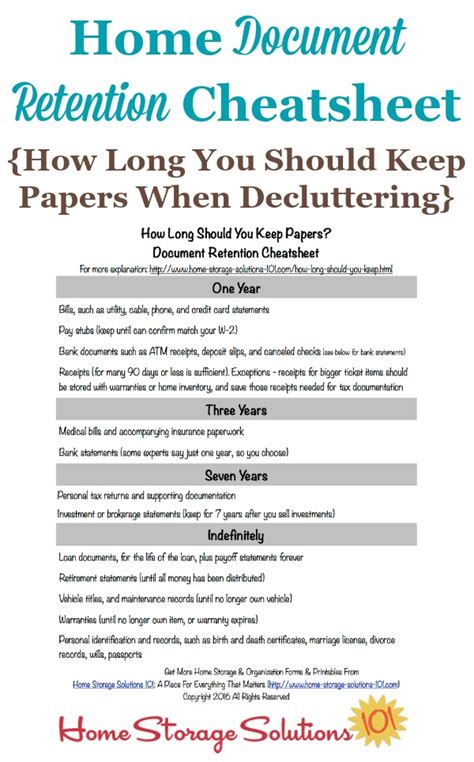

After someone’s death, there are several types of paperwork that need to be retained, including: * Death certificate: This is a crucial document that serves as proof of death and is required for various administrative tasks, such as claiming life insurance benefits and closing bank accounts. * Will and testament: If the deceased person had a will, it is essential to retain it, as it outlines their wishes regarding the distribution of their assets. * Probate documents: If the estate needs to go through probate, it is necessary to retain all relevant documents, including the probate petition, inventory, and accounting. * Tax returns: The deceased person’s tax returns should be retained for a minimum of three years, in case of an audit. * Bank statements and financial records: It is recommended to retain bank statements and financial records for at least a year, to ensure that all assets are accounted for and all debts are paid. * Insurance policies: Life insurance policies, as well as other types of insurance policies, should be retained, as they may provide benefits to the beneficiaries.

Retention Periods

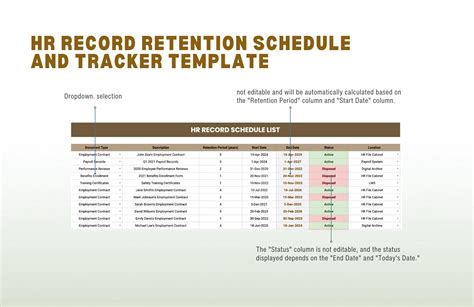

The retention period for after death paperwork varies depending on the type of document and the jurisdiction. Here are some general guidelines: * Death certificate: Permanent retention * Will and testament: Permanent retention * Probate documents: 5-10 years * Tax returns: 3-7 years * Bank statements and financial records: 1-3 years * Insurance policies: Permanent retention

💡 Note: The retention periods mentioned above are general guidelines and may vary depending on the specific circumstances and jurisdiction. It is always best to consult with a lawyer or financial advisor to determine the appropriate retention period for each type of document.

Best Practices for Retaining Paperwork

To ensure that all necessary paperwork is retained and easily accessible, it is recommended to: * Create a centralized filing system, either physical or digital, to store all relevant documents. * Make copies of important documents, such as the death certificate and will, and store them in a safe and secure location. * Scan and digitize documents, to create a backup and make them easily accessible. * Consider using a secure online storage service, such as a cloud storage provider, to store sensitive documents.

Benefits of Proper Paperwork Retention

Proper retention of after death paperwork can provide several benefits, including: * Reduced stress and anxiety: Having all necessary documents in order can reduce the stress and anxiety associated with administering an estate. * Increased efficiency: Having easy access to all relevant documents can streamline the administrative process and reduce delays. * Improved accuracy: Retaining accurate and complete records can help ensure that all assets are accounted for and all debts are paid. * Reduced risk of disputes: Having clear and concise records can help reduce the risk of disputes among beneficiaries and heirs.

Conclusion

In conclusion, retaining after death paperwork is an essential task that requires careful consideration and attention to detail. By understanding the types of paperwork that need to be retained, the recommended retention periods, and best practices for retaining paperwork, individuals can ensure that they are prepared to handle the administrative tasks associated with someone’s death. By taking the time to properly retain and organize paperwork, individuals can reduce stress and anxiety, increase efficiency, and improve accuracy, ultimately providing a smoother and more efficient experience for all parties involved.

What is the purpose of retaining a death certificate?

+

The death certificate serves as proof of death and is required for various administrative tasks, such as claiming life insurance benefits and closing bank accounts.

How long should tax returns be retained after someone’s death?

+

Tax returns should be retained for a minimum of three years, in case of an audit.

What is the best way to store and retain after death paperwork?

+

It is recommended to create a centralized filing system, either physical or digital, to store all relevant documents, and consider using a secure online storage service to store sensitive documents.