5 Tips At Mortgage Closing

Understanding the Mortgage Closing Process

The mortgage closing process, also known as settlement, is the final step in purchasing a home. It’s a critical phase where the ownership of the property is transferred from the seller to the buyer. During this process, the buyer signs the loan documents, and the seller transfers the ownership of the property. As a buyer, it’s essential to be prepared and understand the process to avoid any last-minute issues. Here are five tips to help you navigate the mortgage closing process smoothly.

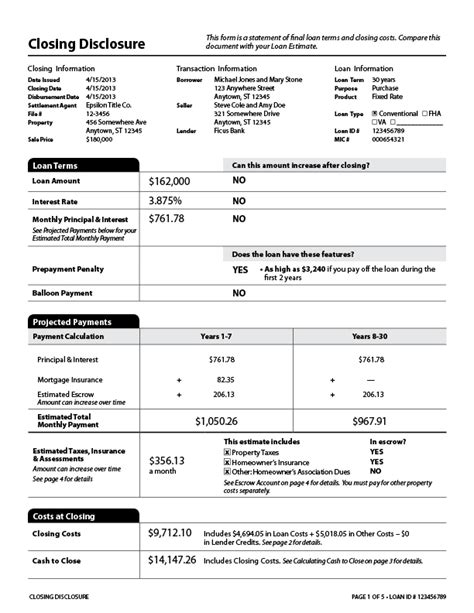

Tip 1: Review the Loan Documents Carefully

Before attending the closing meeting, it’s crucial to review the loan documents carefully. The lender will provide you with a packet of documents, including the note and mortgage or deed of trust. The note outlines the terms of the loan, including the interest rate, loan amount, and repayment terms. The mortgage or deed of trust secures the loan with the property. Review these documents to ensure that the terms match what you agreed upon with the lender. Pay attention to the interest rate, loan amount, and repayment terms.

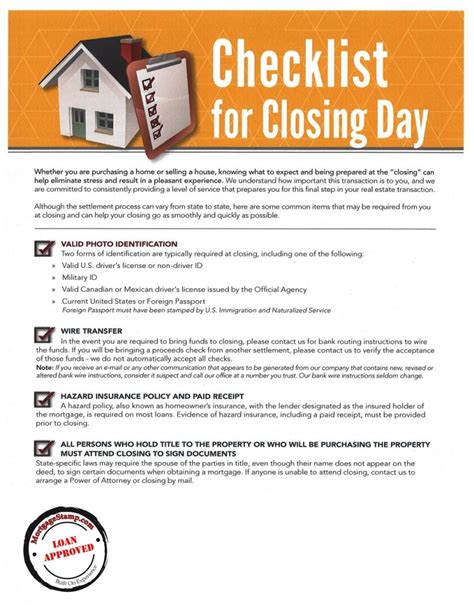

Tip 2: Bring Required Documents and Funds

At the closing meeting, you’ll need to bring certain documents and funds to complete the transaction. Typically, you’ll need to bring:

- Government-issued ID

- Proof of insurance

- Proof of income and employment

- Cashier’s check or wire transfer for the down payment and closing costs

Tip 3: Understand the Closing Costs

Closing costs can range from 2% to 5% of the purchase price of the home. These costs include:

- Title insurance and escrow fees

- Loan origination fees

- Appraisal fees

- Inspection fees

Tip 4: Conduct a Final Walk-Through

Before closing, it’s a good idea to conduct a final walk-through of the property to ensure that it’s in the condition you agreed upon with the seller. Check for any damage or issues that may have arisen since the inspection. This is also an opportunity to verify that any agreed-upon repairs have been made.

Tip 5: Ask Questions and Seek Clarification

If you’re unsure about any aspect of the mortgage closing process, don’t hesitate to ask questions. The lender, title company, and real estate agent are all there to help you navigate the process. Seek clarification on any terms or conditions that you don’t understand. Remember, this is a significant investment, and it’s essential to be informed and comfortable with the process.

📝 Note: It's crucial to read and understand all the documents before signing, as they are legally binding.

As you complete the mortgage closing process, you’ll be one step closer to owning your new home. By following these tips, you’ll be better prepared to navigate the process and avoid any potential issues. Remember to stay organized, ask questions, and seek clarification when needed.

In the end, the mortgage closing process is a critical step in purchasing a home. By understanding the process and being prepared, you can ensure a smooth and successful transaction. The key is to stay informed, ask questions, and seek clarification when needed. With these tips, you’ll be well on your way to completing the mortgage closing process and owning your new home.

What is the typical duration of the mortgage closing process?

+

The typical duration of the mortgage closing process can range from 30 to 60 days, depending on the complexity of the transaction and the efficiency of the parties involved.

What are the most common closing costs?

+

The most common closing costs include title insurance and escrow fees, loan origination fees, appraisal fees, and inspection fees. These costs can range from 2% to 5% of the purchase price of the home.

Can I negotiate the closing costs with the seller?

+

Yes, you can negotiate the closing costs with the seller. In some cases, the seller may be willing to pay some or all of the closing costs as a concession to the buyer.