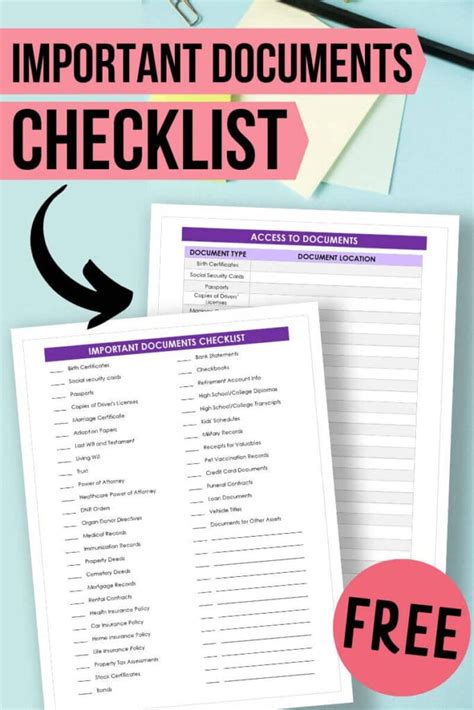

5 Documents Needed

Introduction to Essential Documents

When it comes to legal, financial, and personal matters, having the right documents in order can make a significant difference. These documents not only help in times of need but also ensure that your wishes are respected and your loved ones are protected. In this article, we will discuss five essential documents that everyone should have, and why they are crucial for a secure and peaceful life.

1. Last Will and Testament

A Last Will and Testament is a legal document that outlines how you want your assets to be distributed after your death. It allows you to appoint an executor, name beneficiaries, and even specify how you want your funeral to be conducted. Without a will, the state will decide how your assets are distributed, which may not align with your wishes. This document is especially important if you have minor children, as it allows you to name a guardian for them.

2. Power of Attorney

A Power of Attorney (POA) is a document that grants someone you trust the authority to act on your behalf in legal and financial matters. This can be especially useful if you become incapacitated or unable to make decisions for yourself. There are different types of POA, including: * General POA: Grants broad powers to the agent. * Special POA: Limits the agent’s powers to specific areas. * Durable POA: Remains in effect even if you become incapacitated. Having a POA in place ensures that your financial and legal affairs are managed according to your wishes, even if you are unable to manage them yourself.

3. Advance Directive

An Advance Directive, also known as a living will, is a document that outlines your wishes for end-of-life medical care. It specifies the types of treatment you want to receive or refuse if you become terminally ill or unable to communicate. This document is crucial in ensuring that your wishes are respected, even if you are unable to express them yourself. It also helps to reduce the burden on your loved ones, who may otherwise have to make difficult decisions on your behalf.

4. Life Insurance Policy

A Life Insurance Policy is a contract between you and an insurance company, where the company agrees to pay a death benefit to your beneficiaries in exchange for premium payments. This document provides financial protection for your loved ones, ensuring that they are taken care of in the event of your death. There are different types of life insurance policies, including: * Term Life Insurance: Provides coverage for a specified period. * Whole Life Insurance: Provides lifetime coverage, as long as premiums are paid. * Universal Life Insurance: Combines a death benefit with a savings component.

5. Health Insurance Policy

A Health Insurance Policy is a contract between you and an insurance company, where the company agrees to pay for your medical expenses in exchange for premium payments. This document provides financial protection against unexpected medical bills, ensuring that you receive the care you need without breaking the bank. There are different types of health insurance policies, including: * Individual Health Insurance: Covers one person. * Family Health Insurance: Covers multiple people. * Group Health Insurance: Covers a group of people, often through an employer.

💡 Note: It's essential to review and update your documents regularly to ensure they remain relevant and effective.

In summary, having the right documents in place can provide peace of mind and financial security for you and your loved ones. By understanding the importance of these documents and taking the time to create them, you can ensure that your wishes are respected and your loved ones are protected.

What is the purpose of a Last Will and Testament?

+

The purpose of a Last Will and Testament is to outline how you want your assets to be distributed after your death, and to appoint an executor and guardian for minor children.

What is the difference between a Power of Attorney and an Advance Directive?

+

A Power of Attorney grants someone the authority to act on your behalf in legal and financial matters, while an Advance Directive outlines your wishes for end-of-life medical care.

Why is it important to have a Life Insurance Policy?

+

A Life Insurance Policy provides financial protection for your loved ones, ensuring that they are taken care of in the event of your death.