7 Papers to Keep

Introduction to Essential Documents

When it comes to organizing our personal and financial lives, it’s easy to get overwhelmed by the sheer amount of paperwork we accumulate. From tax returns to medical records, knowing which documents to keep and for how long can be a daunting task. In this article, we’ll explore the top 7 papers to keep, and provide guidance on how to manage them effectively.

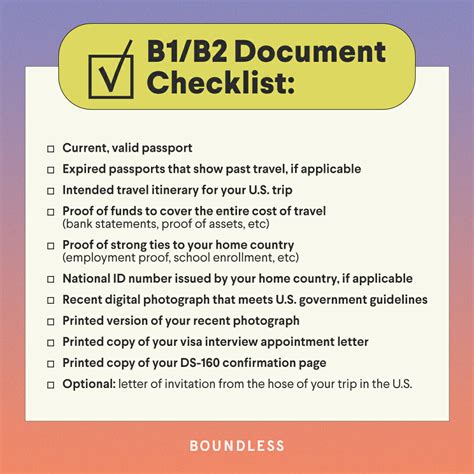

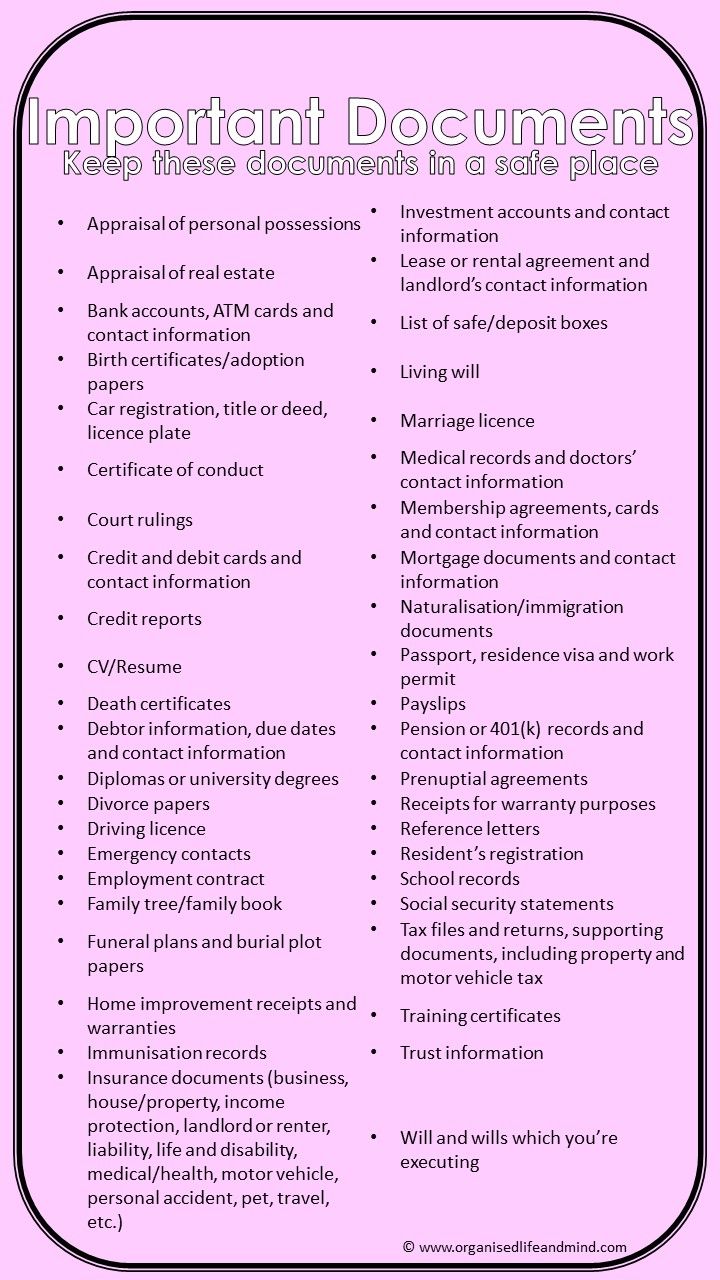

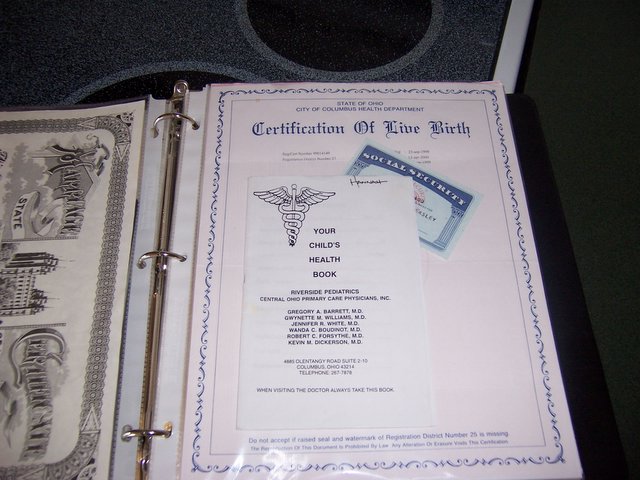

1. Identification Documents

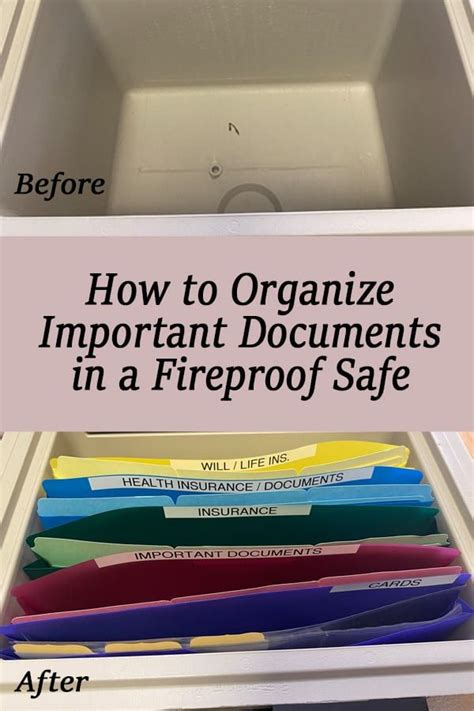

Identification documents, such as passports, driver’s licenses, and social security cards, are crucial for proving our identity and citizenship. It’s essential to keep these documents safe and secure, as losing them can lead to significant inconvenience and even identity theft. Make sure to store them in a fireproof safe or a secure online storage service.

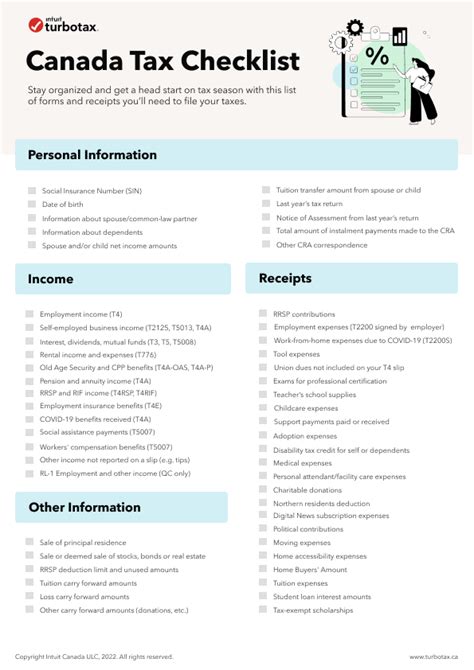

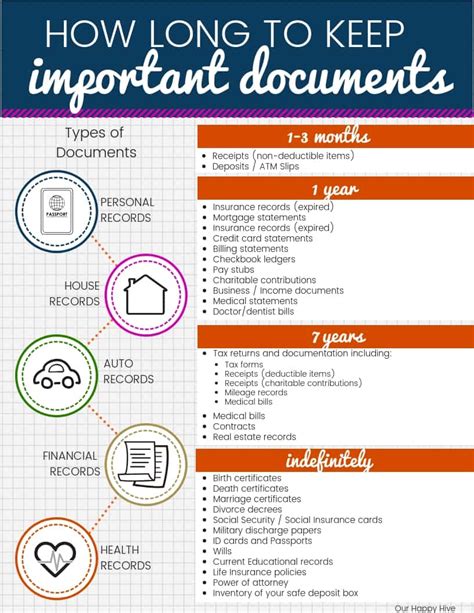

2. Tax Returns

Tax returns are an important part of our financial records, and it’s recommended to keep them for at least 7 years in case of an audit. This includes all supporting documents, such as W-2 forms, 1099 forms, and receipts for deductions. Consider scanning these documents and storing them electronically to save space and reduce clutter.

3. Medical Records

Medical records are sensitive and confidential documents that require special care. It’s essential to keep them for an indefinite period, as they may be needed to establish medical history or prove insurance claims. Make sure to store them in a secure location, such as a locked file cabinet or a password-protected digital storage service.

4. Insurance Policies

Insurance policies, including life, health, and auto insurance, are critical documents that require careful management. Keep them for as long as the policy is active, and store them in a secure location, such as a fireproof safe or a secure online storage service. Make sure to review and update these policies regularly to ensure they remain relevant and effective.

5. Property Deeds

Property deeds are essential documents that prove ownership of real estate. It’s crucial to keep them for an indefinite period, as they may be needed to establish ownership or settle disputes. Store them in a secure location, such as a locked file cabinet or a password-protected digital storage service.

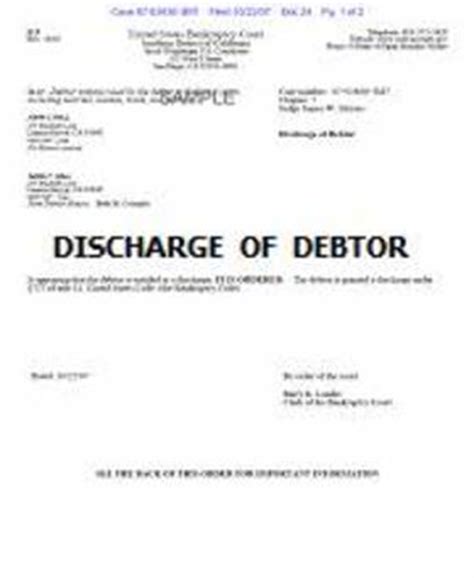

6. Wills and Estate Planning Documents

Wills and estate planning documents, such as powers of attorney and living wills, are sensitive and confidential documents that require special care. It’s essential to keep them for an indefinite period, as they may be needed to establish the wishes of the deceased or settle estate disputes. Store them in a secure location, such as a locked file cabinet or a password-protected digital storage service.

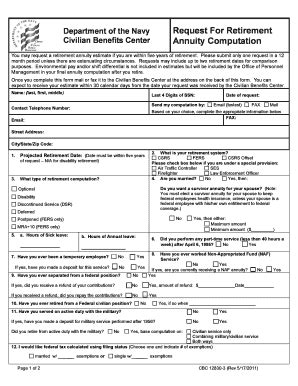

7. Retirement Account Documents

Retirement account documents, such as 401(k) and IRA statements, are critical documents that require careful management. Keep them for as long as the account is active, and store them in a secure location, such as a fireproof safe or a secure online storage service. Make sure to review and update these documents regularly to ensure they remain relevant and effective.

📝 Note: It's essential to review and update these documents regularly to ensure they remain relevant and effective.

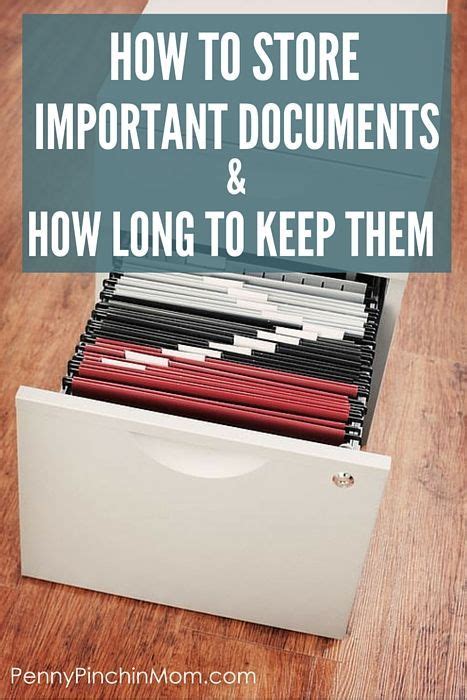

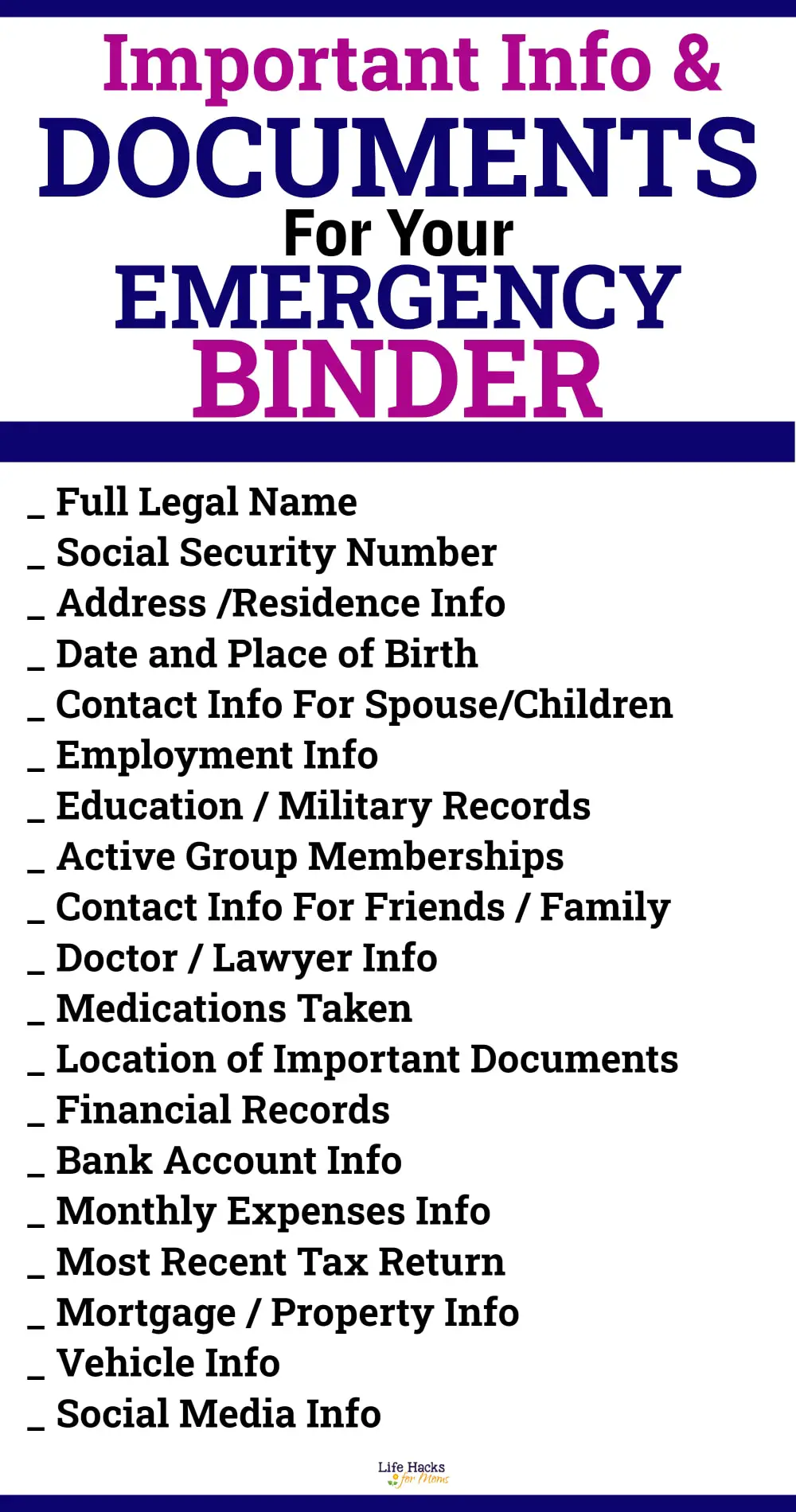

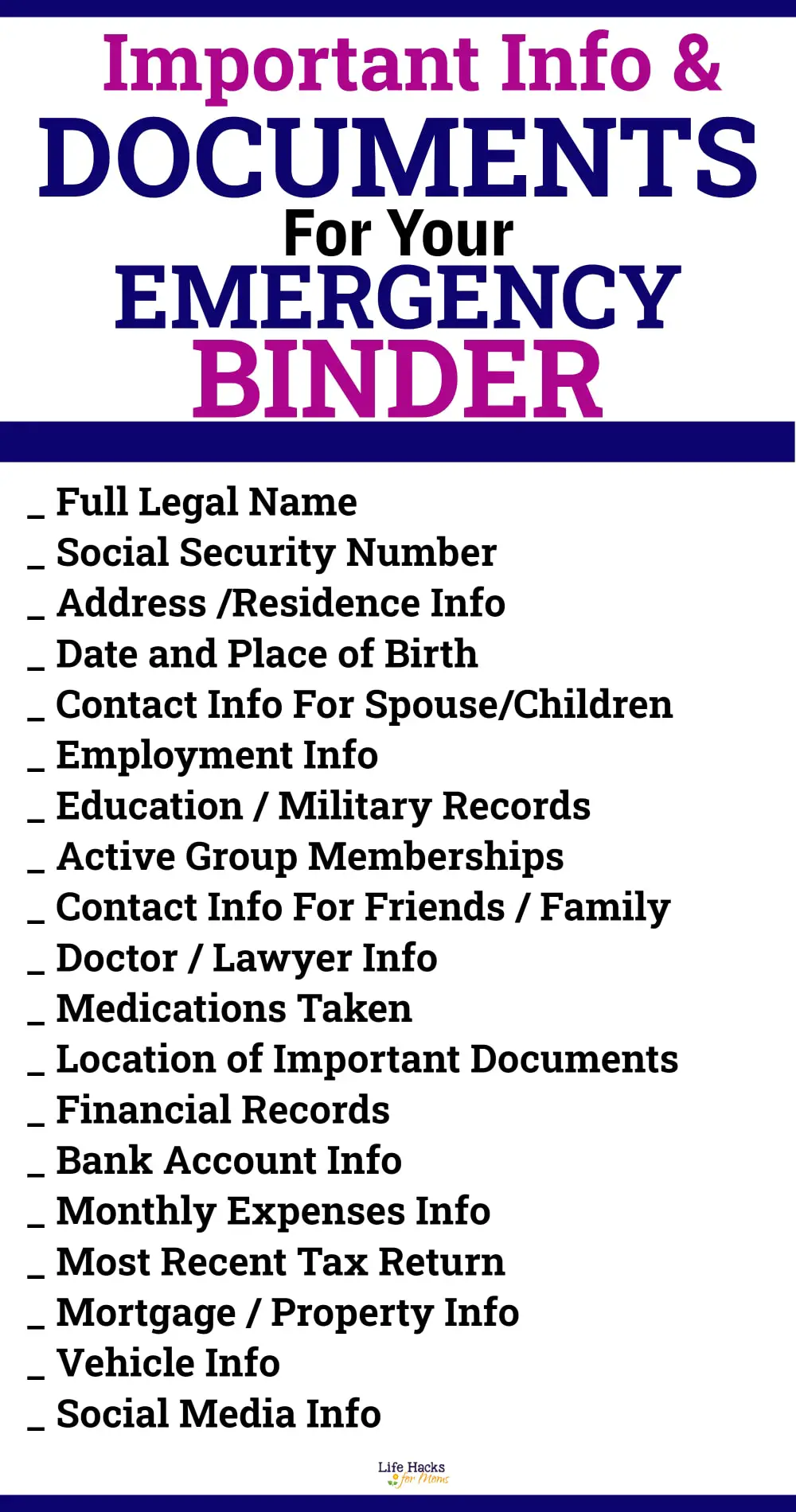

Best Practices for Managing Essential Documents

To manage essential documents effectively, consider the following best practices: * Store documents in a secure location, such as a fireproof safe or a password-protected digital storage service. * Scan documents and store them electronically to save space and reduce clutter. * Review and update documents regularly to ensure they remain relevant and effective. * Consider using a document management service to help organize and store documents securely.

| Document Type | Retention Period | Storage Location |

|---|---|---|

| Identification Documents | Indefinite | Fireproof Safe or Secure Online Storage Service |

| Tax Returns | 7 years | Locked File Cabinet or Password-Protected Digital Storage Service |

| Medical Records | Indefinite | Locked File Cabinet or Password-Protected Digital Storage Service |

| Insurance Policies | Active Policy Period | Fireproof Safe or Secure Online Storage Service |

| Property Deeds | Indefinite | Locked File Cabinet or Password-Protected Digital Storage Service |

| Wills and Estate Planning Documents | Indefinite | Locked File Cabinet or Password-Protected Digital Storage Service |

| Retirement Account Documents | Active Account Period | Fireproof Safe or Secure Online Storage Service |

In summary, managing essential documents requires careful planning and attention to detail. By following the best practices outlined in this article, individuals can ensure their documents are safe, secure, and easily accessible when needed. Remember to review and update documents regularly to ensure they remain relevant and effective.

What is the best way to store essential documents?

+

The best way to store essential documents is in a secure location, such as a fireproof safe or a password-protected digital storage service.

How long should I keep tax returns?

+

It’s recommended to keep tax returns for at least 7 years in case of an audit.

What is the best way to manage medical records?

+

The best way to manage medical records is to store them in a secure location, such as a locked file cabinet or a password-protected digital storage service, and to review and update them regularly.

How often should I review and update my essential documents?

+

It’s recommended to review and update essential documents regularly, such as every 6-12 months, to ensure they remain relevant and effective.

What is the best way to protect my essential documents from damage or loss?

+

The best way to protect essential documents from damage or loss is to store them in a secure location, such as a fireproof safe or a password-protected digital storage service, and to make electronic copies to ensure they can be recovered in case of an emergency.