5 Steps DCU Car Loan

Introduction to DCU Car Loans

Digital Federal Credit Union, commonly referred to as DCU, offers a range of financial services, including car loans, designed to help members achieve their goals of purchasing a vehicle. With competitive rates and flexible terms, DCU car loans are an attractive option for those looking to finance their new or used car. This guide will walk you through the 5 steps to apply for a DCU car loan, making the process as smooth and understandable as possible.

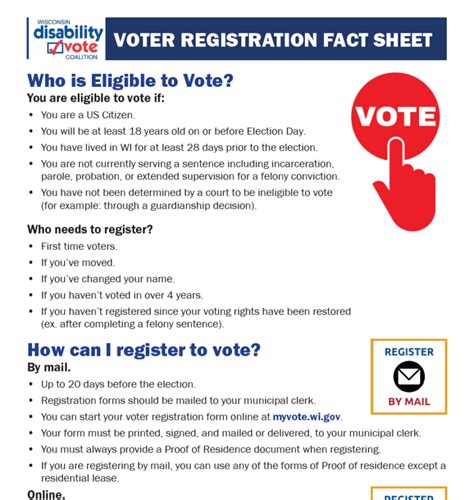

Step 1: Check Your Eligibility

Before applying for a DCU car loan, it’s essential to understand the eligibility criteria. DCU membership is required to apply for a car loan. Membership eligibility is typically based on your employer, family relationship, or residence in a specific area. You can check the DCU website for detailed information on eligibility criteria. Additionally, your credit score plays a significant role in determining the interest rate you’ll qualify for. A good credit score can help you secure a lower interest rate, which means lower monthly payments.

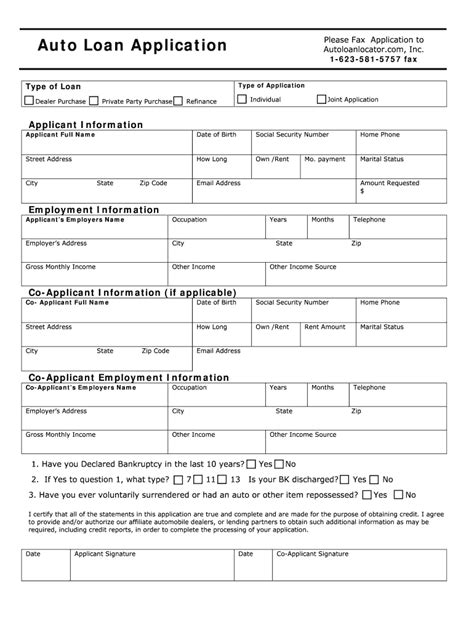

Step 2: Gather Required Documents

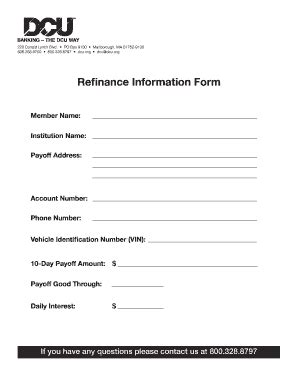

To apply for a DCU car loan, you’ll need to gather several documents. These typically include: - Identification: A valid government-issued ID, such as a driver’s license or passport. - Proof of Income: Pay stubs, W-2 forms, or tax returns to verify your income. - Proof of Insurance: You’ll need to have insurance for the vehicle before the loan can be finalized. - Vehicle Information: The make, model, year, and Vehicle Identification Number (VIN) of the car you wish to purchase. Having these documents ready will expedite the application process.

Step 3: Apply for the Loan

DCU provides a convenient online application process for car loans. You can apply directly through their website or visit a branch in person. The application will ask for personal and financial information, including the loan amount you’re requesting, the vehicle details, and your employment information. Be prepared to provide detailed financial information to facilitate the application process. After submitting your application, DCU will review your creditworthiness and may request additional information.

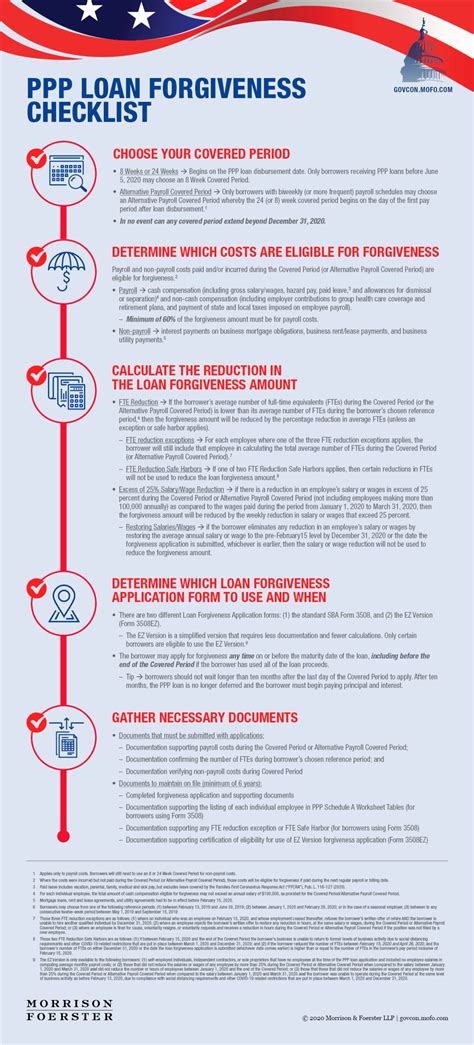

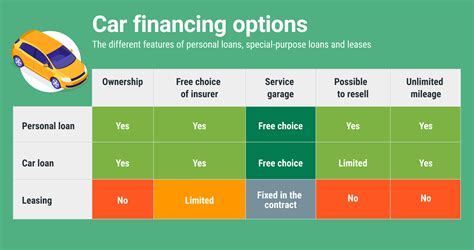

Step 4: Review and Accept the Loan Terms

Once your application is approved, DCU will provide you with the loan terms, including the interest rate, repayment term, and monthly payment amount. It’s crucial to carefully review these terms to ensure they fit your budget and financial goals. Consider factors such as the total cost of the loan, including interest, and whether you can afford the monthly payments. If everything meets your expectations, you can accept the loan offer and proceed with the loan process.

Step 5: Finalize the Loan and Purchase the Vehicle

After accepting the loan terms, the final step involves completing the purchase of the vehicle. DCU will guide you through the process of finalizing the loan, which may include signing loan documents and ensuring the vehicle is titled in your name. It’s essential to read and understand all documents before signing. Once the loan is finalized, you can complete the purchase of the vehicle, and the loan funds will be disbursed accordingly.

📝 Note: Always review the terms and conditions of the loan carefully before signing any documents to ensure you understand your obligations and the total cost of the loan.

In summary, applying for a DCU car loan involves checking your eligibility, gathering necessary documents, applying for the loan, reviewing and accepting the loan terms, and finalizing the loan to purchase the vehicle. By following these steps and being informed about the process, you can make a well-educated decision about your car financing options.

What are the benefits of choosing a DCU car loan?

+

DCU car loans offer competitive rates, flexible terms, and a straightforward application process, making them a beneficial choice for those looking to finance a vehicle.

How do I become a member of DCU to apply for a car loan?

+

You can become a DCU member by meeting their eligibility criteria, which includes being an employee of a partner company, a family member of a current member, or residing in a specific area. Visit the DCU website for detailed information on membership eligibility.

Can I apply for a DCU car loan if I have a poor credit score?

+

While a poor credit score may affect the interest rate you qualify for, it’s not necessarily a barrier to applying for a DCU car loan. DCU considers various factors during the application process, and they may still offer you a loan, albeit possibly at a higher interest rate.