PPP Loan Forgiveness Paperwork Needed

Introduction to PPP Loan Forgiveness

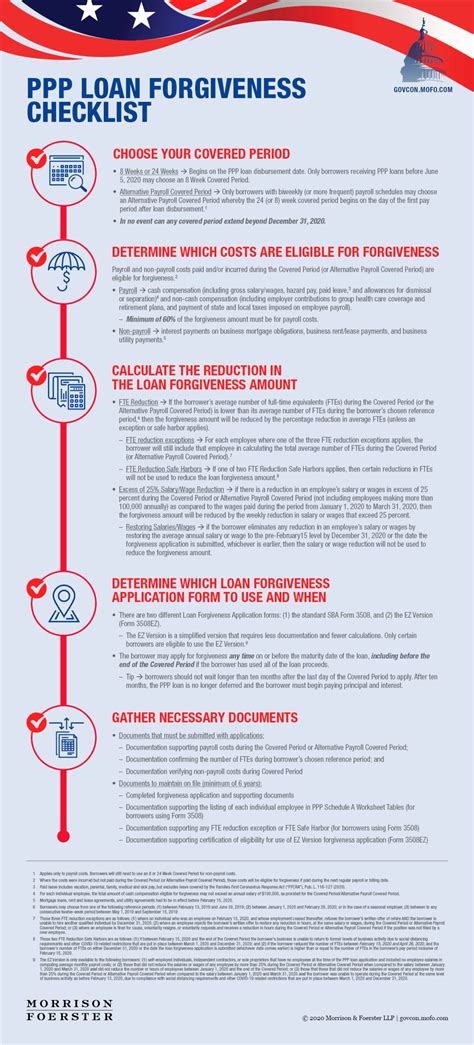

The Paycheck Protection Program (PPP) was designed to provide financial assistance to small businesses and other eligible organizations during the COVID-19 pandemic. One of the key benefits of the PPP is the potential for loan forgiveness, allowing businesses to receive the necessary funding without the burden of repayment. To take advantage of this benefit, businesses must navigate the PPP loan forgiveness application process, which requires careful preparation and submission of specific paperwork.

Understanding PPP Loan Forgiveness Eligibility

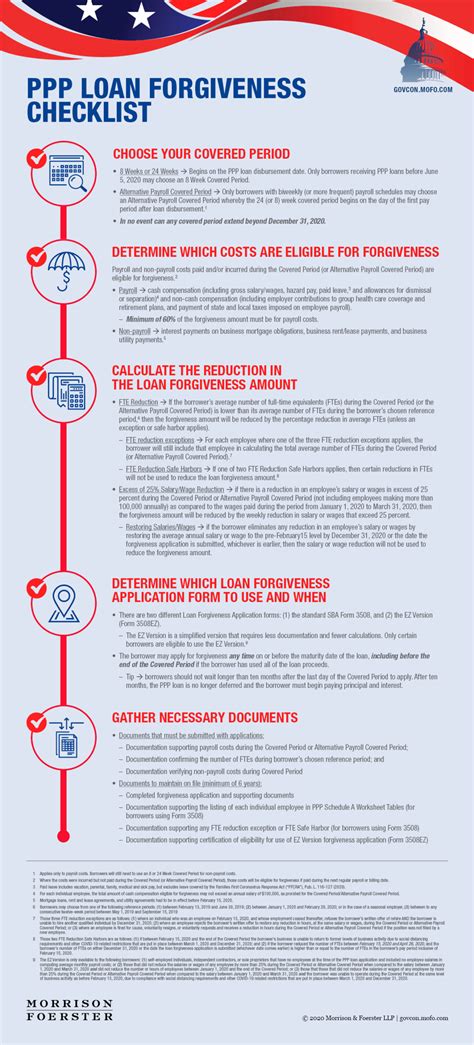

Before diving into the necessary paperwork, it’s essential to understand the eligibility criteria for PPP loan forgiveness. The Small Business Administration (SBA) and the Treasury Department have established guidelines to determine which loans qualify for forgiveness. Generally, businesses can qualify for full or partial loan forgiveness if they use the loan proceeds for eligible expenses, such as:

- Payroll costs, including salaries, wages, and benefits

- Rent or lease payments

- Utilities, including electricity, gas, water, and internet services

- Mortgage interest payments

- Certain operational expenses, such as software and accounting services

Gathering Required Documentation

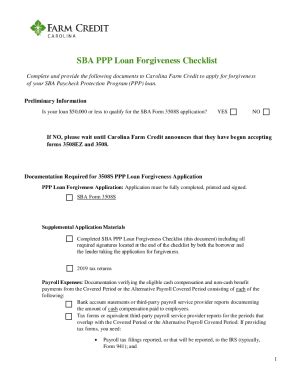

To apply for PPP loan forgiveness, businesses must gather and submit specific documentation to their lender. The required paperwork may vary depending on the lender and the business’s circumstances, but the following documents are commonly needed:

| Document | Description |

|---|---|

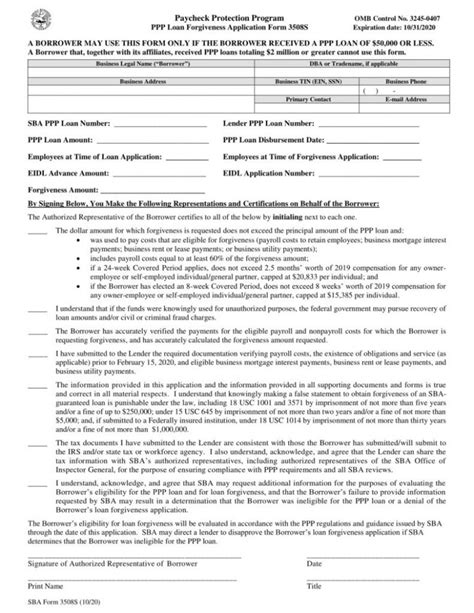

| PPP Loan Forgiveness Application (SBA Form 3508) | The standard application form for loan forgiveness, which includes calculations and certifications |

| Payroll Documentation | Records of payroll costs, including payroll registers, tax filings, and payment receipts |

| Non-Payroll Documentation | Records of non-payroll expenses, such as rent or lease agreements, utility bills, and mortgage statements |

| Employee Headcount and Compensation Records | Documentation to support the maintenance of employee headcount and compensation levels |

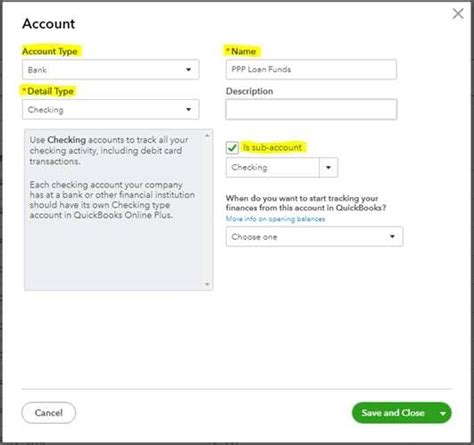

Completing the PPP Loan Forgiveness Application

Once the necessary documentation is gathered, businesses can complete the PPP loan forgiveness application (SBA Form 3508). The application requires:

- Business information, including name, address, and tax identification number

- Loan information, including loan number and amount

- Eligible expense calculations, including payroll and non-payroll costs

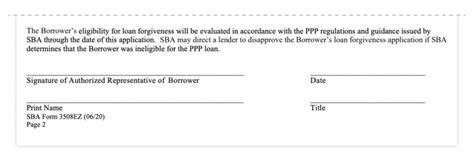

- Certifications and representations, including compliance with program requirements

📝 Note: Businesses should consult with their lender and/or a financial advisor to ensure they have the most up-to-date information and guidance on the loan forgiveness application process.

Submitting the Application and Supporting Documentation

After completing the application, businesses must submit it to their lender, along with the required supporting documentation. The lender will review the application and documentation to determine eligibility for loan forgiveness. The lender may request additional information or clarification, so it’s essential to respond promptly and provide any necessary documentation.

Loan Forgiveness Review and Approval Process

The lender will review the application and documentation to determine eligibility for loan forgiveness. The SBA may also review the application and conduct an audit to ensure compliance with program requirements. If the application is approved, the lender will notify the business, and the SBA will forgive the loan, in whole or in part, depending on the business’s eligibility.

In summary, to navigate the PPP loan forgiveness application process, businesses must understand the eligibility criteria, gather required documentation, complete the application, and submit it to their lender. By carefully following these steps and seeking guidance as needed, businesses can ensure a smooth and successful loan forgiveness experience.

The process of applying for PPP loan forgiveness can be complex, but with the right guidance and preparation, businesses can successfully navigate the application process and receive the financial relief they need to recover from the pandemic. As the economy continues to evolve, it’s essential for businesses to stay informed about the latest developments and updates on the PPP loan forgiveness program.

What is the deadline for applying for PPP loan forgiveness?

+

The deadline for applying for PPP loan forgiveness varies depending on the lender and the business’s circumstances. Businesses should consult with their lender to determine the specific deadline for their loan.

What happens if my PPP loan forgiveness application is denied?

+

If a PPP loan forgiveness application is denied, the business will be required to repay the loan, including interest. Businesses may appeal the denial, but they must provide additional documentation and evidence to support their eligibility for loan forgiveness.

Can I apply for PPP loan forgiveness if I have already received an Economic Injury Disaster Loan (EIDL)?

+

Yes, businesses that have received an EIDL can still apply for PPP loan forgiveness. However, they must ensure that they are using the funds for different purposes and that they are not duplicating expenses.