Paperwork

Michigan Inheritance Tax Paperwork Requirements

Introduction to Michigan Inheritance Tax Paperwork Requirements

When a person passes away, their estate is subject to certain taxes and requirements. In Michigan, there is no state inheritance tax, but the estate may still be subject to federal estate taxes. The paperwork requirements for Michigan inheritance tax can be complex, and it’s essential to understand the process to ensure that the estate is handled correctly. In this article, we will guide you through the Michigan inheritance tax paperwork requirements and provide you with the necessary information to navigate the process.

Understanding Michigan Inheritance Tax Laws

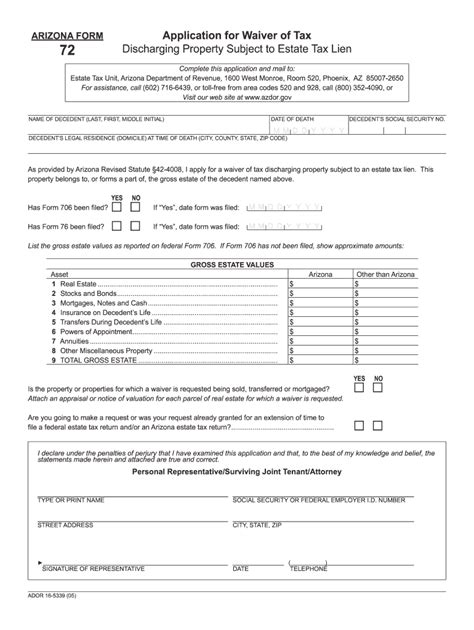

Michigan does not have a state inheritance tax, which means that beneficiaries do not have to pay taxes on the assets they inherit. However, the estate may still be subject to federal estate taxes if the value of the estate exceeds the federal exemption limit. The federal estate tax exemption limit is subject to change, so it’s crucial to stay up-to-date with the latest information. Federal estate taxes can be complex, and it’s recommended that you consult with a tax professional or attorney to ensure that you comply with all the requirements.

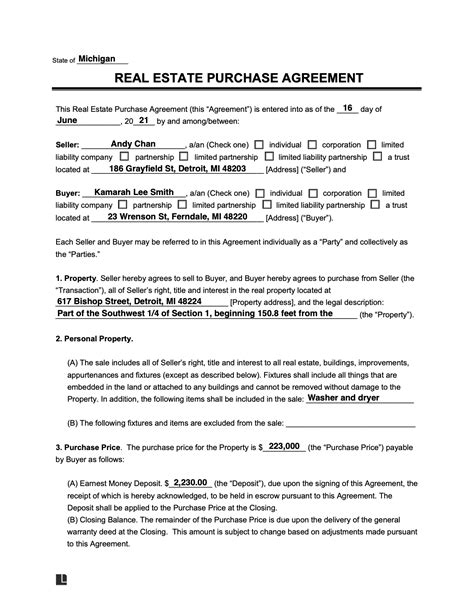

Gathering Necessary Documents

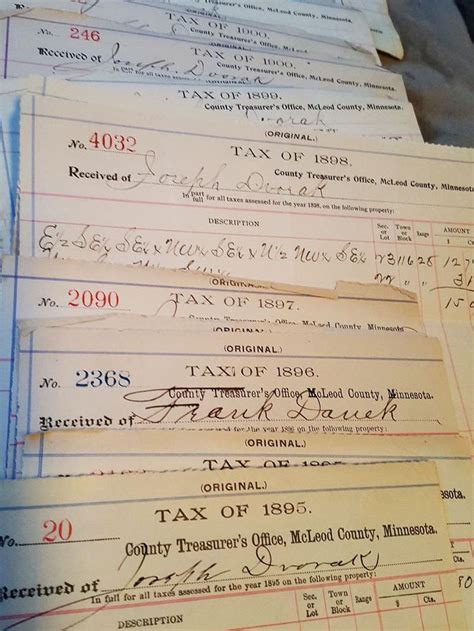

To begin the process of handling the estate, you will need to gather certain documents. These documents may include: * The will, if the deceased person had one * Death certificate * Proof of assets, such as bank statements, property deeds, and investment accounts * Tax returns, including federal and state tax returns for the previous year * Insurance policies, if applicable * Retirement accounts, such as 401(k) or IRA statements It’s essential to gather all the necessary documents to ensure that the estate is handled correctly and that all taxes are paid.

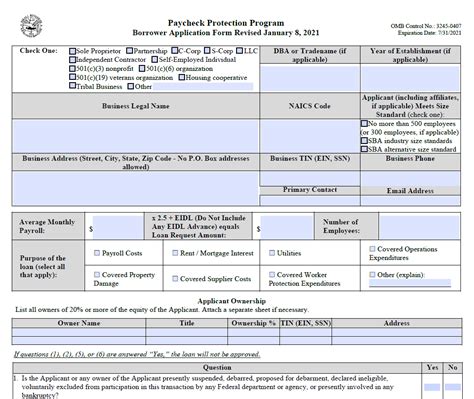

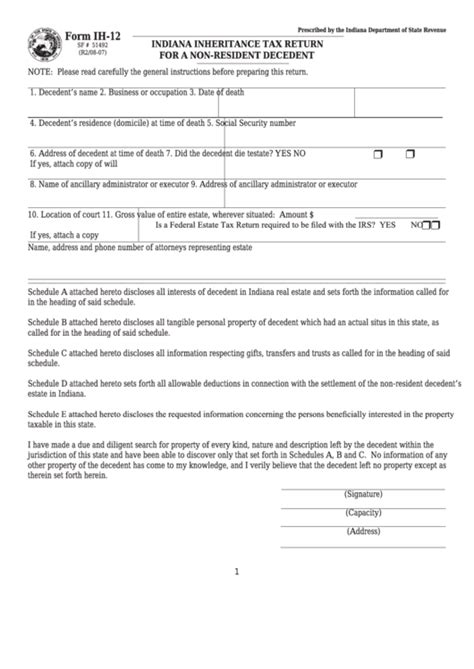

Filing Federal Estate Tax Return

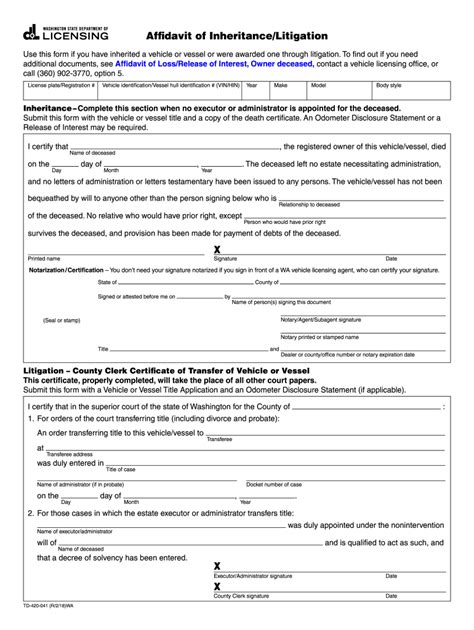

If the value of the estate exceeds the federal exemption limit, you will need to file a federal estate tax return, Form 706. This form is used to report the value of the estate and calculate the federal estate tax owed. The form must be filed within nine months of the date of death, and it’s recommended that you consult with a tax professional or attorney to ensure that you complete the form correctly.

Michigan Estate Administration

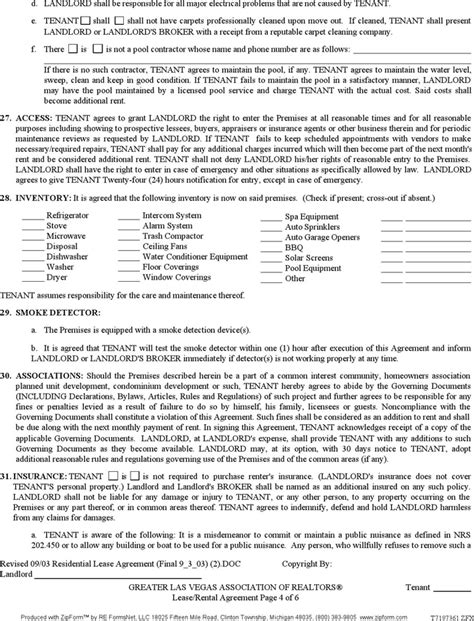

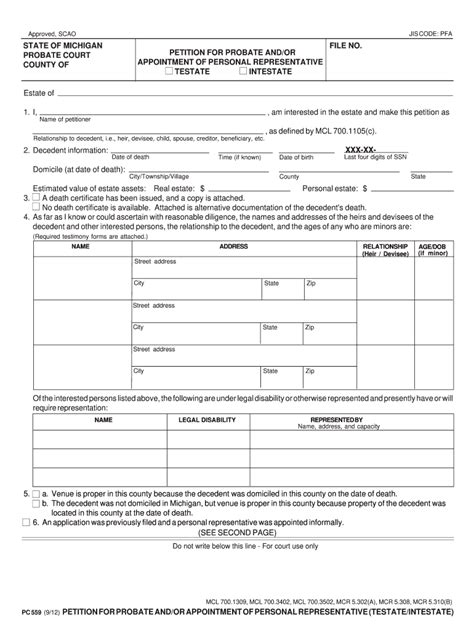

In Michigan, the estate administration process is handled through the probate court. The probate court is responsible for overseeing the distribution of the estate’s assets and ensuring that all debts and taxes are paid. The personal representative of the estate, also known as the executor, is responsible for managing the estate and ensuring that all requirements are met.

Paperwork Requirements

The following paperwork requirements must be completed: * Petition for Probate: This document is used to open the probate estate and appoint a personal representative. * Inventory: This document is used to list all the assets of the estate. * Accounting: This document is used to report all the income and expenses of the estate. * Distribution: This document is used to distribute the assets of the estate to the beneficiaries. It’s essential to complete all the necessary paperwork to ensure that the estate is handled correctly and that all taxes are paid.

Timeline for Filing Paperwork

The timeline for filing paperwork in Michigan is as follows: * Petition for Probate: Must be filed within 4 months of the date of death * Inventory: Must be filed within 91 days of the appointment of the personal representative * Accounting: Must be filed annually, or as required by the probate court * Distribution: Must be filed after all debts and taxes have been paid It’s crucial to meet all the deadlines to avoid any penalties or fines.

Conclusion and Final Thoughts

In conclusion, handling the estate of a deceased person can be a complex and time-consuming process. It’s essential to understand the Michigan inheritance tax paperwork requirements and to complete all the necessary documents to ensure that the estate is handled correctly. If you’re unsure about any aspect of the process, it’s recommended that you consult with a tax professional or attorney to ensure that you comply with all the requirements. By following the guidelines outlined in this article, you can ensure that the estate is handled correctly and that all taxes are paid.

What is the federal estate tax exemption limit?

+

The federal estate tax exemption limit is subject to change, but as of 2022, it is $12.06 million per individual.

Do I need to file a federal estate tax return if the value of the estate is below the exemption limit?

+

No, if the value of the estate is below the exemption limit, you do not need to file a federal estate tax return.

How long does the probate process take in Michigan?

+

The probate process in Michigan can take several months to several years, depending on the complexity of the estate and the efficiency of the personal representative.