Property Sale Paperwork Guide

Introduction to Property Sale Paperwork

When it comes to selling a property, there are numerous documents and paperwork involved that can be overwhelming for both the buyer and the seller. The process of transferring ownership of a property from one party to another requires a significant amount of documentation, which is crucial for a smooth and legally binding transaction. In this guide, we will walk you through the essential paperwork required for a property sale, highlighting the key documents, their importance, and the steps involved in the process.

Pre-Sale Paperwork

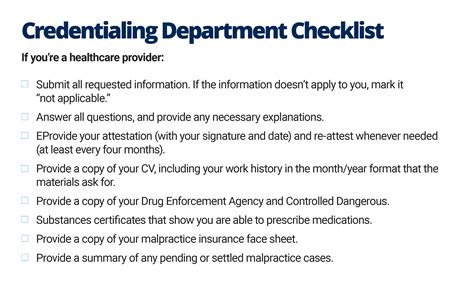

Before the sale of a property, there are several documents that need to be prepared and reviewed. These include: * Property Title: This document proves the seller’s ownership of the property and is essential for transferring the title to the buyer. * Property Deeds: These deeds provide detailed information about the property, including its boundaries, dimensions, and any easements or restrictions. * Mortgage Statements: If the property has an outstanding mortgage, the seller will need to provide statements showing the current balance and any arrears. * Property Tax Records: The seller should provide records of paid property taxes to ensure the buyer is aware of any tax liabilities.

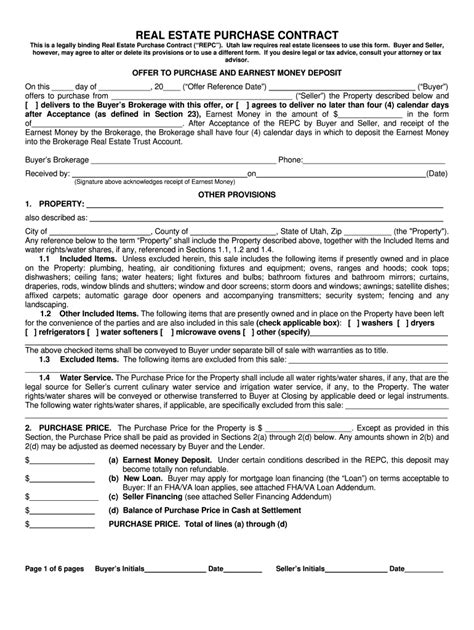

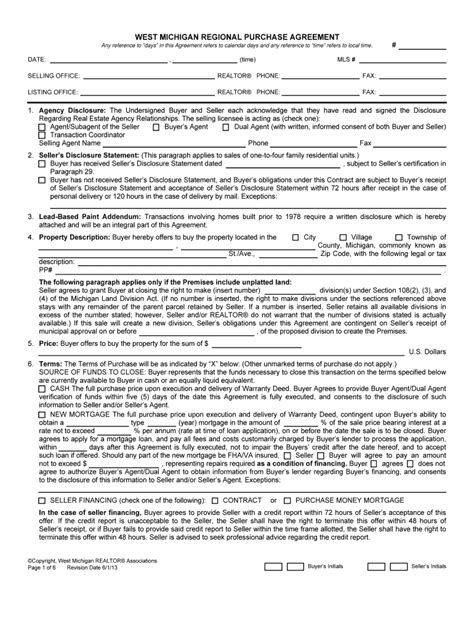

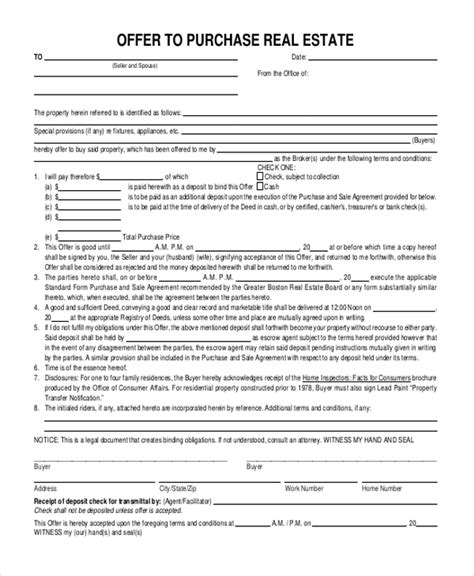

Sale Agreement Paperwork

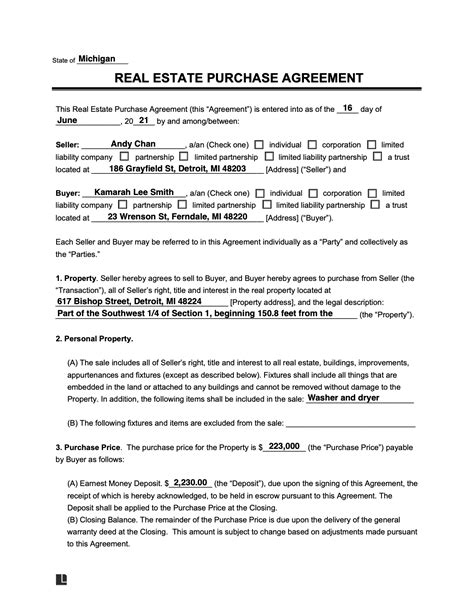

Once the buyer and seller have agreed on the terms of the sale, the following documents are typically prepared: * Sale Agreement: This document outlines the terms of the sale, including the purchase price, payment terms, and any conditions of the sale. * Deposit Receipt: When the buyer pays a deposit, a receipt is issued to acknowledge the payment and confirm the sale. * Disclosure Statements: The seller may be required to provide disclosure statements regarding the property’s condition, any known defects, and any environmental or health concerns.

Financing and Loan Paperwork

If the buyer is financing the purchase through a loan, additional paperwork will be required: * Loan Application: The buyer will need to apply for a loan, providing financial information and proof of income. * Loan Approval: The lender will issue a loan approval letter, outlining the terms of the loan, including the interest rate, repayment terms, and any conditions. * Mortgage Documents: The lender will prepare mortgage documents, which the buyer will need to sign, outlining the terms of the loan and the security provided.

Settlement and Transfer Paperwork

At the settlement stage, the following documents are typically prepared: * Settlement Statement: This document outlines the final settlement figures, including the purchase price, adjustments, and any taxes or fees. * Transfer of Title: The seller will transfer the title of the property to the buyer, and the buyer will receive the keys to the property. * Notification of Change of Ownership: The buyer will need to notify the relevant authorities, such as the local council and utility providers, of the change of ownership.

| Document | Purpose |

|---|---|

| Property Title | Proves ownership of the property |

| Property Deeds | Provides detailed information about the property |

| Sale Agreement | Outlines the terms of the sale |

| Loan Application | Applies for a loan to finance the purchase |

| Settlement Statement | Outlines the final settlement figures |

📝 Note: It is essential to review and understand all the documents involved in the property sale process to avoid any disputes or issues that may arise during or after the sale.

As we can see, the property sale paperwork process involves a significant amount of documentation, which can be complex and time-consuming. However, by understanding the key documents and their purposes, buyers and sellers can navigate the process with confidence. Whether you are a first-time buyer or an experienced seller, it is crucial to seek professional advice to ensure a smooth and successful transaction.

In the end, the successful sale of a property relies on the accuracy and completeness of the paperwork involved. By being aware of the essential documents and their importance, parties can avoid common pitfalls and ensure a hassle-free transaction. The key to a successful property sale is to be informed, prepared, and patient, and to seek professional advice when needed. With the right guidance and support, buyers and sellers can navigate the complex world of property sale paperwork with ease and confidence.

What is the purpose of a property title?

+

The purpose of a property title is to prove ownership of the property and to transfer the title to the buyer during the sale process.

What documents are required for a loan application?

+

The documents required for a loan application typically include proof of income, identification, and credit history, as well as details of the property being purchased.

What is a settlement statement?

+

A settlement statement is a document that outlines the final settlement figures, including the purchase price, adjustments, and any taxes or fees, and is typically prepared by the seller’s solicitor or conveyancer.