Paperwork

Tesla Tax Paperwork Needed

Introduction to Tesla Tax Incentives

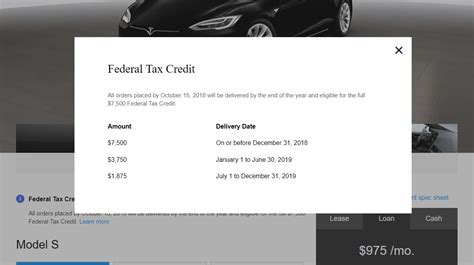

As the world shifts towards more sustainable and environmentally friendly modes of transportation, electric vehicles (EVs) like those produced by Tesla have become increasingly popular. One of the key benefits of purchasing an EV is the potential for tax incentives, which can help offset the costs of buying and owning an electric vehicle. In the United States, for example, the federal government offers a tax credit of up to $7,500 for the purchase of a qualifying electric vehicle. However, navigating the paperwork and eligibility requirements for these incentives can be complex and time-consuming.

Understanding Tax Credits for Electric Vehicles

To qualify for the federal tax credit, the vehicle must meet certain requirements, such as having a battery with a minimum capacity of 4 kilowatt-hours and being used primarily for personal use. Additionally, the credit begins to phase out once the manufacturer has sold 200,000 qualifying vehicles in the United States. It’s essential to check the current eligibility status of the vehicle you’re interested in, as well as any other local or state incentives that may be available.

Tax Paperwork Required for Tesla Owners

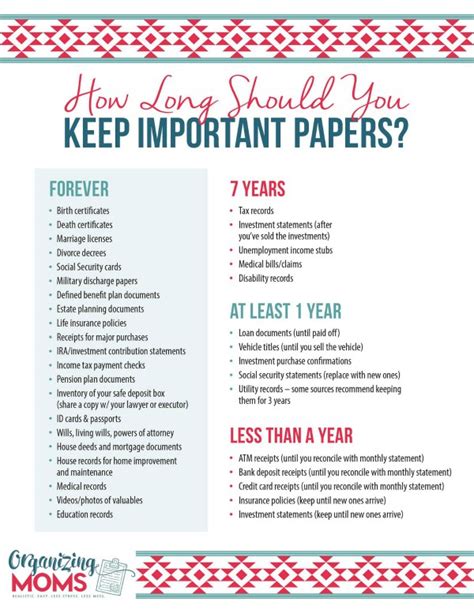

To claim the federal tax credit, Tesla owners will need to complete and submit Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit, with their tax return. This form requires information about the vehicle, including its make, model, and Vehicle Identification Number (VIN), as well as the date of purchase and the cost of the vehicle. It’s crucial to keep accurate records and documentation, including the sales contract and any other relevant paperwork, to support your claim for the tax credit.

Additional Tax Incentives for Tesla Owners

In addition to the federal tax credit, many states and local governments offer their own incentives for electric vehicle owners. These may include rebates, tax credits, or exemptions from certain fees or taxes. For example, some states offer a state tax credit of up to $5,000 for the purchase of an electric vehicle, while others may provide free or reduced-fee parking for EV owners. Researching and understanding these local incentives can help Tesla owners maximize their savings and benefits.

Table of Tax Incentives for Electric Vehicles

| Incentive | Federal | State | Local |

|---|---|---|---|

| Tax Credit | Up to $7,500 | Varies by state | Varies by locality |

| Rebate | None | Varies by state | Varies by locality |

| Exemptions | None | Varies by state | Varies by locality |

📝 Note: The tax incentives and eligibility requirements for electric vehicles are subject to change, so it's essential to check the current status and requirements before making a purchase.

Conclusion and Final Thoughts

In conclusion, while navigating the tax paperwork and incentives for Tesla owners can be complex, the potential benefits and savings make it well worth the effort. By understanding the eligibility requirements, completing the necessary forms, and researching local incentives, Tesla owners can maximize their savings and enjoy the many benefits of owning an electric vehicle. As the world continues to shift towards more sustainable transportation options, it’s likely that we’ll see even more incentives and benefits for electric vehicle owners in the future.

What is the federal tax credit for electric vehicles?

+

The federal tax credit for electric vehicles is up to $7,500 for the purchase of a qualifying vehicle.

How do I claim the federal tax credit for my Tesla?

+

To claim the federal tax credit, you’ll need to complete and submit Form 8936 with your tax return.

Are there any additional tax incentives for Tesla owners?

+

Yes, many states and local governments offer their own incentives for electric vehicle owners, including rebates, tax credits, and exemptions from certain fees or taxes.