Paperwork

5 Mortgage Paperwork Tips

Understanding the Mortgage Process

When navigating the complex world of real estate and mortgages, it’s essential to be well-informed about the various steps involved, particularly when it comes to paperwork. The mortgage process can be overwhelming, with numerous documents to sign and terms to understand. However, being prepared and knowledgeable can make a significant difference in ensuring a smooth transaction. In this article, we will delve into the intricacies of mortgage paperwork, providing you with valuable tips to help you through this critical phase of purchasing or refinancing a home.

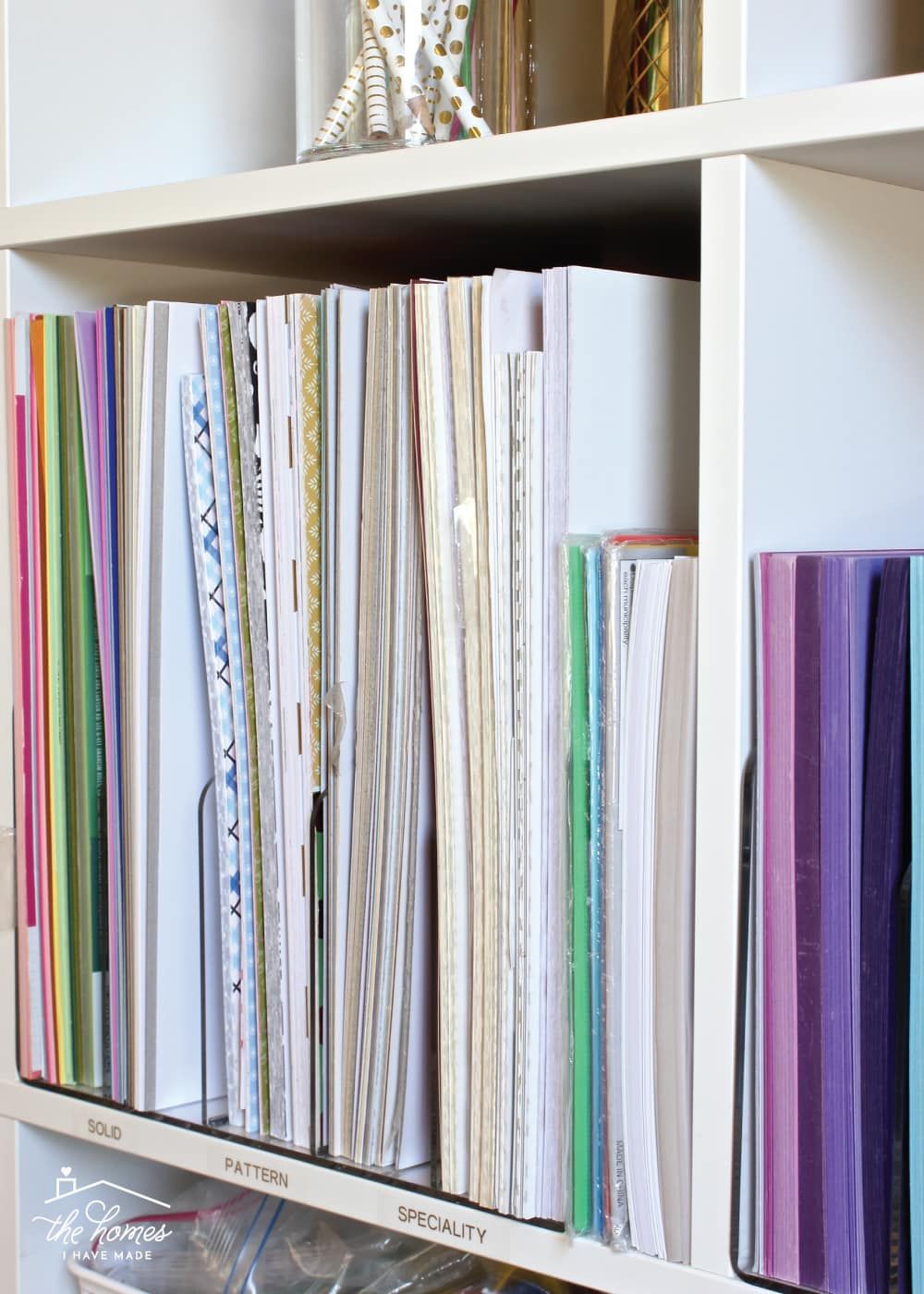

Tip 1: Organize Your Financial Documents

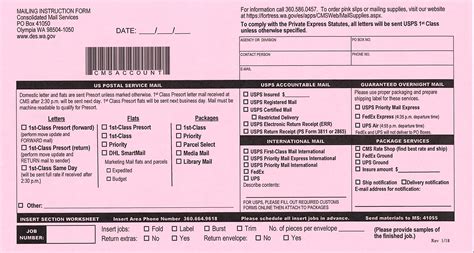

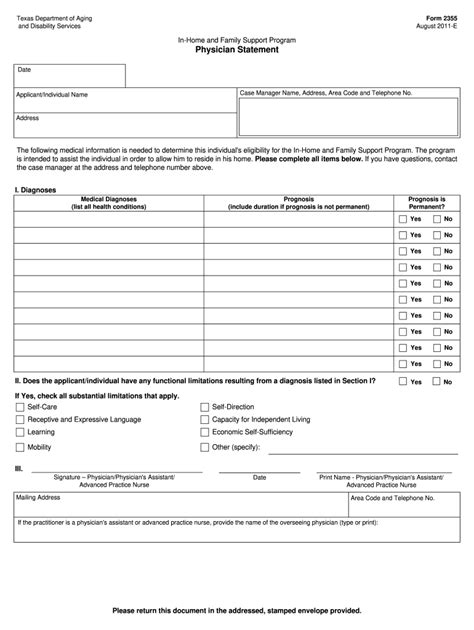

Before applying for a mortgage, it’s crucial to have all your financial documents in order. This includes pay stubs, bank statements, tax returns, and any other relevant financial information. Lenders require these documents to assess your creditworthiness and ability to repay the loan. Ensuring that your documents are up-to-date and easily accessible can significantly expedite the mortgage application process.

Tip 2: Understand Your Credit Report

Your credit report plays a vital role in determining the interest rate you’ll qualify for and whether you’ll be approved for a mortgage. It’s essential to obtain a copy of your credit report from the three major credit reporting agencies: Equifax, Experian, and TransUnion. Review your report carefully to identify any errors or negative marks that could impact your credit score. Disputing inaccuracies and working to improve your credit score can help you secure better mortgage terms.

Tip 3: Know the Types of Mortgage Loans

Familiarizing yourself with the different types of mortgage loans available can help you make an informed decision about which one suits your needs best. The most common types include: - Fixed-Rate Mortgages: Offer a fixed interest rate for the entire loan term. - Adjustable-Rate Mortgages: Have interest rates that can fluctuate over time. - Government-Backed Loans (FHA, VA, USDA): Offer favorable terms for specific groups of borrowers. Understanding the pros and cons of each can help you choose the mortgage that best aligns with your financial situation and goals.

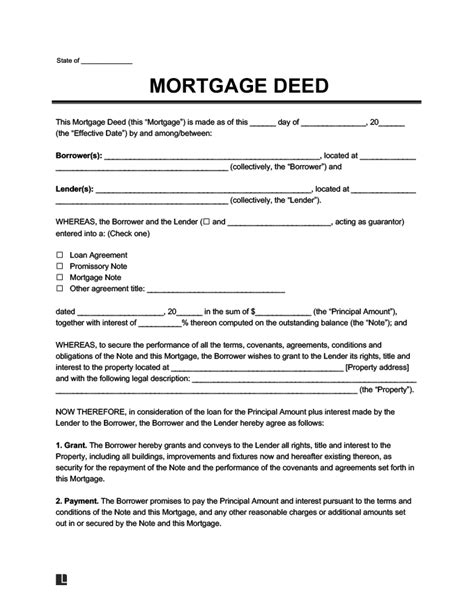

Tip 4: Review and Understand Mortgage Paperwork

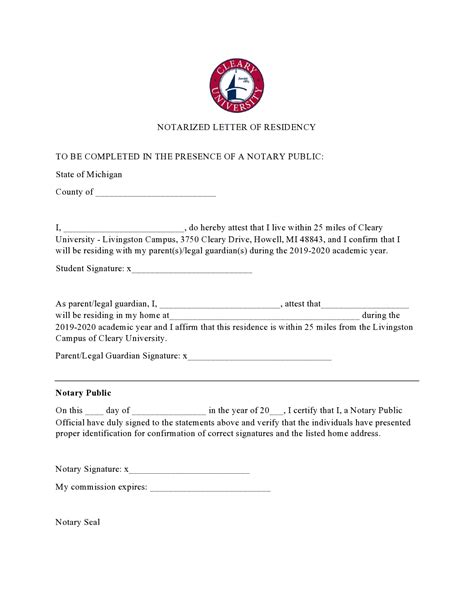

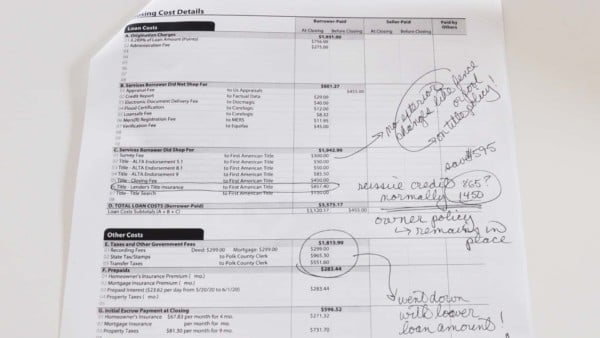

The mortgage paperwork process involves signing numerous documents, each with its own set of terms and conditions. It’s vital to read and understand every document before signing. Key documents include the Good Faith Estimate (GFE), Truth-in-Lending (TIL) disclosure, and the loan estimate. These documents outline the loan terms, including the interest rate, monthly payments, and closing costs. Don’t hesitate to ask questions if you’re unsure about any aspect of the mortgage.

Tip 5: Seek Professional Advice

Navigating the mortgage process can be complex, and seeking advice from professionals can be incredibly beneficial. Mortgage brokers and financial advisors can provide valuable insights and help you find the best mortgage options tailored to your financial situation. They can also guide you through the paperwork, ensuring you understand each document and making the process less daunting.

📝 Note: Always keep a copy of all signed documents for your records, as they will be crucial for future reference, especially when it comes to tax deductions and potential refinancing.

Mortgage Paperwork Checklist

To ensure you’re prepared, consider the following checklist of documents and steps: - Pre-approval letter - Identification documents (driver’s license, passport, etc.) - Proof of income (pay stubs, W-2 forms) - Proof of assets (bank statements, investment accounts) - Credit reports - Appraisal report (if required) - Title report and insurance - Loan estimate and closing disclosure

| Document | Purpose |

|---|---|

| Good Faith Estimate (GFE) | Outlines loan terms and estimated costs |

| Truth-in-Lending (TIL) disclosure | Provides information on the loan's annual percentage rate and total costs |

| Loan Estimate | Replaces GFE, providing a detailed estimate of loan terms and costs |

In the end, managing mortgage paperwork effectively is about being informed, organized, and proactive. By understanding the process, preparing your financial documents, and seeking professional advice when needed, you can navigate the mortgage journey with confidence. Whether you’re a first-time homebuyer or refinancing your current home, knowledge is your most powerful tool in securing the best possible mortgage terms.