5 Mortgage Paper Tips

Understanding the Basics of Mortgage Papers

When it comes to purchasing a home, one of the most critical documents you will encounter is the mortgage paper. This document outlines the terms and conditions of your loan, including the interest rate, repayment terms, and any penalties associated with late payments. It is essential to carefully review and understand the contents of your mortgage paper to avoid any potential pitfalls or surprises down the line. In this article, we will provide you with five valuable tips to help you navigate the complex world of mortgage papers.

Tips for Reviewing Mortgage Papers

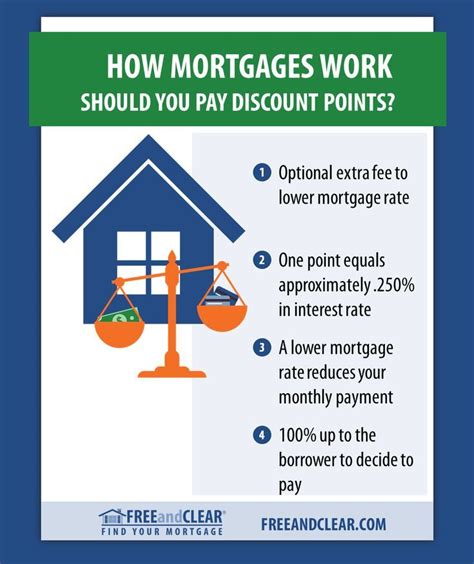

Here are five tips to keep in mind when reviewing your mortgage papers: * Read the fine print: Mortgage papers can be lengthy and filled with complex legal jargon. It is crucial to take the time to read through the entire document, paying close attention to any sections that outline fees, penalties, or other potential costs. * Understand the interest rate: The interest rate on your mortgage can have a significant impact on your monthly payments and the overall cost of the loan. Make sure you understand the type of interest rate you are being offered, whether it is fixed or variable, and how it may change over time. * Review the repayment terms: The repayment terms of your mortgage will outline how much you need to pay each month and for how long. Be sure to review these terms carefully to ensure you can afford the monthly payments and that the repayment period is reasonable. * Check for any penalties or fees: Some mortgage papers may include penalties or fees for late payments, early repayment, or other actions. It is essential to understand these penalties and fees to avoid any unexpected costs. * Seek professional advice: If you are unsure about any aspect of your mortgage paper, it is always a good idea to seek professional advice. A financial advisor or lawyer can help you review the document and ensure you understand all the terms and conditions.

Common Mistakes to Avoid

When reviewing mortgage papers, there are several common mistakes to avoid. These include: * Failing to read the fine print: As mentioned earlier, it is crucial to read through the entire document, including any sections that may be written in complex legal language. * Not understanding the interest rate: Make sure you understand the type of interest rate you are being offered and how it may change over time. * Not reviewing the repayment terms: Be sure to review the repayment terms carefully to ensure you can afford the monthly payments and that the repayment period is reasonable. * Not checking for penalties or fees: Some mortgage papers may include penalties or fees for late payments, early repayment, or other actions. It is essential to understand these penalties and fees to avoid any unexpected costs. * Not seeking professional advice: If you are unsure about any aspect of your mortgage paper, it is always a good idea to seek professional advice.

Benefits of Carefully Reviewing Mortgage Papers

Carefully reviewing your mortgage papers can have several benefits, including: * Avoiding unexpected costs: By understanding the terms and conditions of your mortgage, you can avoid any unexpected costs or penalties. * Ensuring affordability: Reviewing the repayment terms can help you ensure that you can afford the monthly payments and that the repayment period is reasonable. * Reducing stress: Understanding the terms and conditions of your mortgage can help reduce stress and anxiety, allowing you to enjoy your new home without worrying about the financial implications. * Making informed decisions: Carefully reviewing your mortgage papers can help you make informed decisions about your finances and ensure that you are getting the best possible deal.

| Tip | Description |

|---|---|

| Read the fine print | Take the time to read through the entire document, paying close attention to any sections that outline fees, penalties, or other potential costs. |

| Understand the interest rate | Make sure you understand the type of interest rate you are being offered, whether it is fixed or variable, and how it may change over time. |

| Review the repayment terms | Be sure to review the repayment terms carefully to ensure you can afford the monthly payments and that the repayment period is reasonable. |

| Check for any penalties or fees | Some mortgage papers may include penalties or fees for late payments, early repayment, or other actions. It is essential to understand these penalties and fees to avoid any unexpected costs. |

| Seek professional advice | If you are unsure about any aspect of your mortgage paper, it is always a good idea to seek professional advice. |

📝 Note: It is essential to carefully review and understand the contents of your mortgage paper to avoid any potential pitfalls or surprises down the line.

In summary, carefully reviewing your mortgage papers is crucial to ensuring that you understand the terms and conditions of your loan. By following the five tips outlined in this article, you can avoid any potential pitfalls or surprises and ensure that you are getting the best possible deal. Remember to read the fine print, understand the interest rate, review the repayment terms, check for any penalties or fees, and seek professional advice if needed.

What is a mortgage paper?

+

A mortgage paper is a document that outlines the terms and conditions of a mortgage loan, including the interest rate, repayment terms, and any penalties associated with late payments.

Why is it essential to carefully review mortgage papers?

+

Carefully reviewing mortgage papers is essential to ensure that you understand the terms and conditions of your loan and can avoid any potential pitfalls or surprises down the line.

What are some common mistakes to avoid when reviewing mortgage papers?

+

Common mistakes to avoid when reviewing mortgage papers include failing to read the fine print, not understanding the interest rate, not reviewing the repayment terms, not checking for penalties or fees, and not seeking professional advice.