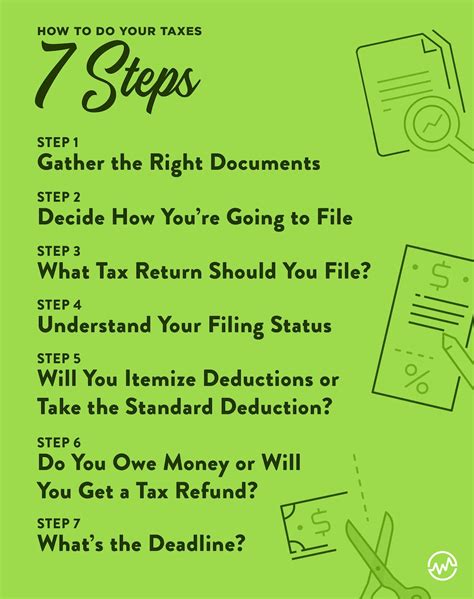

7 Tax Paperwork Steps

Understanding the Tax Paperwork Process

The tax season can be a daunting time for many individuals and businesses, especially when it comes to navigating the complex world of tax paperwork. With numerous forms to fill out and deadlines to meet, it’s easy to feel overwhelmed. However, by breaking down the process into manageable steps, you can ensure that your tax paperwork is completed accurately and efficiently. In this article, we will guide you through the 7 essential steps to help you stay on top of your tax paperwork.

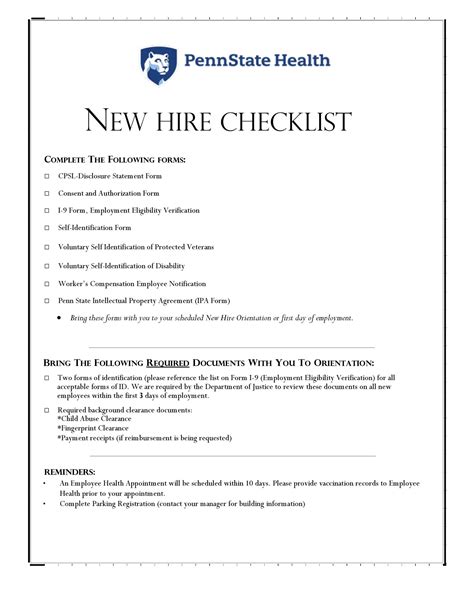

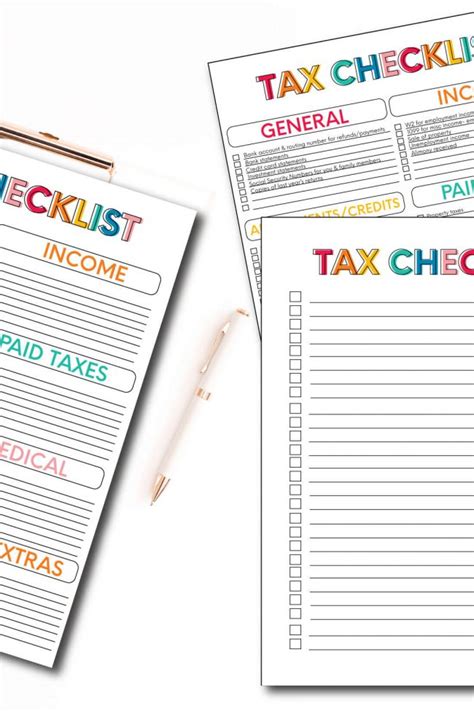

Step 1: Gather Necessary Documents

The first step in tackling your tax paperwork is to gather all the necessary documents. This includes: * W-2 forms from your employer, which show your income and taxes withheld * 1099 forms for any freelance or contract work * Interest statements from banks and investments * Charity donation receipts * Medical expense records * Business expense records, if applicable Having all these documents in one place will make it easier to fill out your tax forms and ensure that you don’t miss any important deductions.

Step 2: Choose a Filing Status

Your filing status determines which tax rates and deductions you’re eligible for. The most common filing statuses are: * Single * Married Filing Jointly * Married Filing Separately * Head of Household * Qualifying Widow(er) Choose the status that best applies to your situation, and make sure you understand the implications of each status on your tax liability.

Step 3: Determine Your Income

Your income is the foundation of your tax return. Make sure you include all sources of income, such as: * Salary and wages * Investment income * Self-employment income * Rental income * Other income, such as alimony or prizes Be accurate when reporting your income, as this will affect your tax liability and any potential refunds.

Step 4: Calculate Your Deductions

Deductions can significantly reduce your tax liability. Common deductions include: * Charitable donations * Medical expenses * Mortgage interest * Business expenses * Education expenses Keep receipts and records for all your deductions, and make sure you understand the rules and limits for each type of deduction.

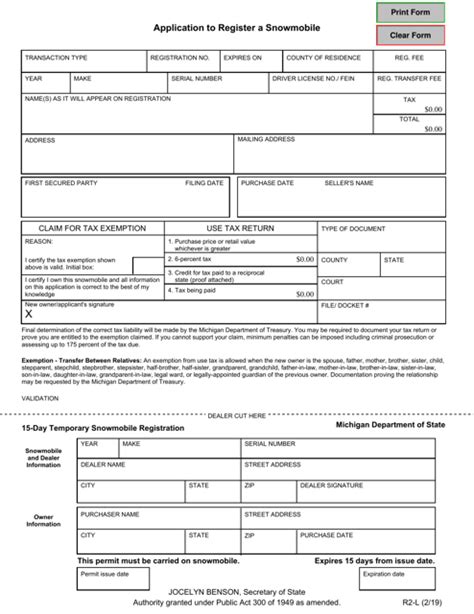

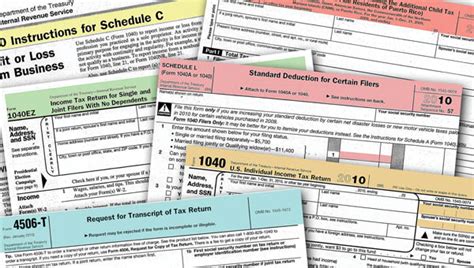

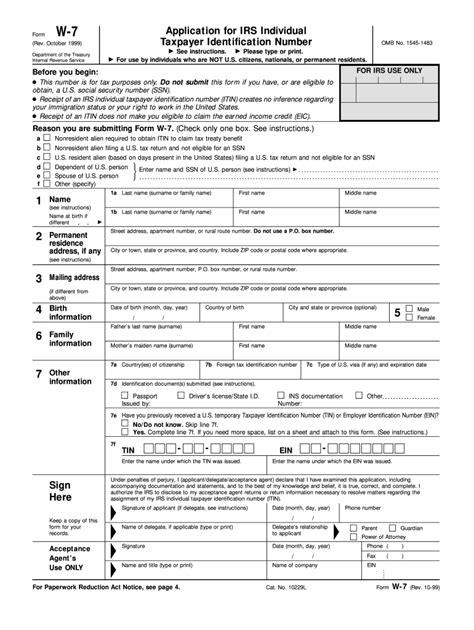

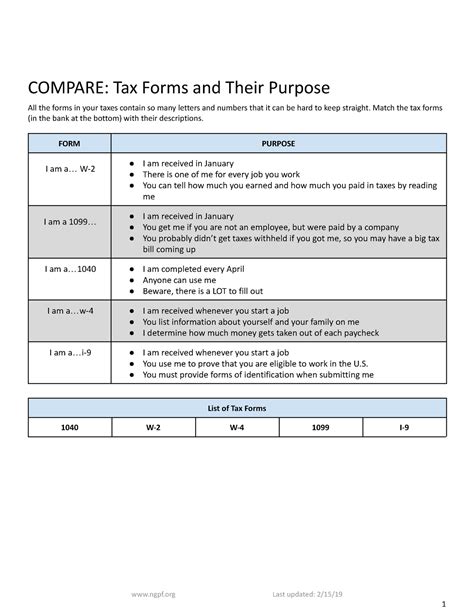

Step 5: Fill Out Tax Forms

With your documents and information in hand, it’s time to fill out your tax forms. The most common form is the 1040, which is used for personal income tax returns. You may also need to fill out additional forms, such as: * Schedule A for itemized deductions * Schedule C for business income and expenses * Form 8962 for premium tax credits Take your time and carefully follow the instructions for each form to ensure accuracy.

Step 6: Submit Your Return

Once you’ve completed your tax forms, it’s time to submit your return. You can: * E-file your return online, which is faster and more secure * Mail your return to the IRS, which may take longer to process Make sure you meet the deadline, which is typically April 15th for personal income tax returns.

Step 7: Review and Follow Up

After submitting your return, review it for any errors or discrepancies. If you notice any mistakes, you can: * Amend your return using Form 1040X * Contact the IRS for assistance and guidance Additionally, make sure you: * Keep records of your tax return and supporting documents * Follow up on any refunds or payments due

📝 Note: It's essential to stay organized and keep accurate records throughout the tax paperwork process to avoid any potential issues or delays.

As you complete these 7 steps, you’ll be well on your way to mastering the tax paperwork process. Remember to stay calm, take your time, and seek help if you need it. With careful planning and attention to detail, you can ensure that your tax paperwork is accurate, efficient, and stress-free.

To further illustrate the tax paperwork process, consider the following table:

| Step | Description |

|---|---|

| 1. Gather Documents | Collect all necessary tax documents, including W-2 forms, 1099 forms, and interest statements. |

| 2. Choose Filing Status | Determine your filing status, which affects your tax rates and deductions. |

| 3. Determine Income | Calculate your total income from all sources, including salary, investments, and self-employment. |

| 4. Calculate Deductions | Itemize your deductions, including charitable donations, medical expenses, and mortgage interest. |

| 5. Fill Out Tax Forms | Complete your tax forms, including the 1040 and any additional schedules or forms. |

| 6. Submit Your Return | Submit your tax return, either by e-filing or mailing it to the IRS. |

| 7. Review and Follow Up | Review your return for errors, amend if necessary, and follow up on any refunds or payments due. |

In the end, completing your tax paperwork requires patience, attention to detail, and a willingness to learn and adapt. By following these 7 steps and staying organized, you’ll be able to navigate the complex world of tax paperwork with confidence and ease.

What is the deadline for submitting my tax return?

+

The deadline for submitting your tax return is typically April 15th for personal income tax returns. However, this deadline may vary depending on your location and the type of return you’re filing.

Can I e-file my tax return?

+

Yes, you can e-file your tax return. In fact, e-filing is the fastest and most secure way to submit your return. You can use tax software or work with a tax professional to e-file your return.

What if I make a mistake on my tax return?

+

If you make a mistake on your tax return, you can amend it using Form 1040X. You’ll need to explain the changes you’re making and provide supporting documentation. It’s essential to correct any errors as soon as possible to avoid penalties and interest.