Home Equity Loan Paperwork Requirements

Understanding Home Equity Loan Paperwork Requirements

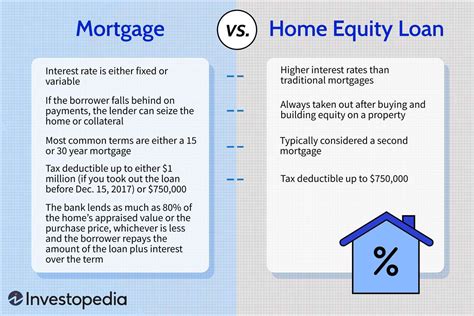

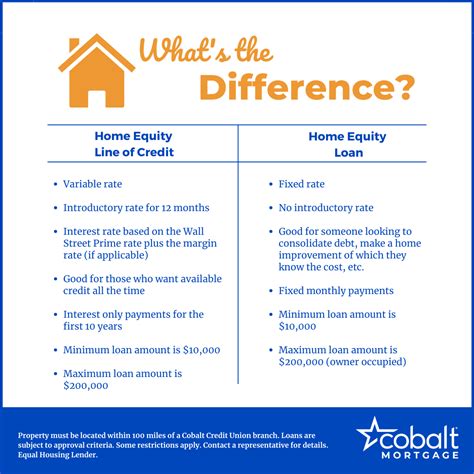

When considering a home equity loan, it’s essential to understand the paperwork requirements involved in the process. Home equity loans allow homeowners to borrow against the equity in their property, using the home as collateral. The lending process typically involves several steps, including application, credit check, appraisal, and closing. In this article, we will delve into the necessary paperwork required for a home equity loan, providing a comprehensive guide to help you navigate the process.

Initial Application and Pre-Approval

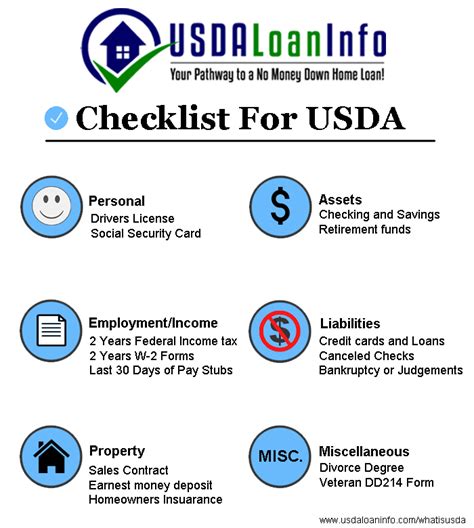

The first step in obtaining a home equity loan is to submit an application and receive pre-approval. During this stage, you will need to provide the lender with the following documents: * Identification: A valid government-issued ID, such as a driver’s license or passport * Income verification: Pay stubs, W-2 forms, or tax returns to demonstrate your income * Credit report: The lender will typically pull your credit report to assess your creditworthiness * Property information: Details about your property, including its address, value, and any outstanding mortgages

Appraisal and Valuation

To determine the amount of equity available in your home, the lender will require an appraisal. This involves hiring a professional appraiser to assess the value of your property. The appraiser will consider factors such as: * Property condition * Location * Comparative sales * Market trends The appraisal report will provide the lender with an estimate of your home’s value, which will be used to calculate the loan amount.

Loan Application and Underwriting

Once the appraisal is complete, you will need to submit a full loan application, which will include: * Personal financial information: Bank statements, investment accounts, and other financial documents * Employment verification: Proof of employment, such as a letter from your employer or a copy of your employment contract * Credit history: A detailed credit report, which may include information about your payment history, credit utilization, and any outstanding debts * Property title: A copy of the property title, which shows ownership and any liens on the property

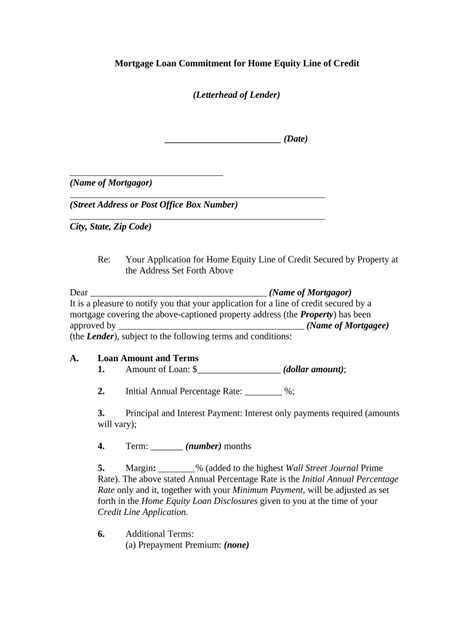

Closing and Funding

After the loan application has been approved, the lender will prepare the loan documents, which will include: * Loan agreement: A contract outlining the terms of the loan, including the interest rate, repayment terms, and any fees * Note: A promissory note, which is a promise to repay the loan * Mortgage or deed of trust: A document that secures the loan with the property * Disclosure forms: Documents that provide information about the loan, such as the annual percentage rate (APR) and any prepayment penalties

📝 Note: It's essential to carefully review the loan documents before signing, as they are a binding contract.

Additional Requirements

Depending on the lender and the specific loan program, you may need to provide additional documentation, such as: * Flood determination: A report that indicates whether the property is located in a flood zone * Environmental reports: Documents that assess the property’s environmental condition, such as the presence of hazardous materials * Inspections: Reports from inspectors, such as termite or septic inspections

| Document | Description |

|---|---|

| Identification | Valid government-issued ID |

| Income verification | Pay stubs, W-2 forms, or tax returns |

| Credit report | Assesses creditworthiness |

| Property information | Details about the property |

To ensure a smooth and efficient loan process, it’s crucial to provide all required documentation in a timely manner. By understanding the paperwork requirements for a home equity loan, you can better prepare yourself for the application and approval process.

As you move forward with the loan process, it’s essential to carefully review and understand all the documents involved. This will help you make informed decisions and avoid any potential issues or delays. By being prepared and knowledgeable about the paperwork requirements, you can confidently navigate the home equity loan process and achieve your financial goals.

In the end, obtaining a home equity loan can be a complex process, but being aware of the necessary paperwork requirements can make all the difference. By following the guidelines outlined in this article and providing all required documents, you can ensure a successful loan application and take the first step towards achieving your financial objectives.

What is the typical interest rate for a home equity loan?

+

The typical interest rate for a home equity loan varies depending on the lender, loan amount, and borrower’s creditworthiness. However, interest rates can range from 4% to 12% or more.

How long does the home equity loan process take?

+

The home equity loan process can take anywhere from a few weeks to several months, depending on the lender, loan complexity, and borrower’s responsiveness to documentation requests.

Can I use a home equity loan for any purpose?

+

While home equity loans can be used for various purposes, such as home improvements, debt consolidation, or major purchases, it’s essential to check with the lender for any specific restrictions or requirements.