PPP Loan Paperwork Requirements

Introduction to PPP Loan Paperwork Requirements

The Paycheck Protection Program (PPP) is a loan program established by the US government to help small businesses and other eligible entities keep their workers employed during the COVID-19 pandemic. The program is administered by the Small Business Administration (SBA) and provides loans with favorable terms, including a low interest rate and the possibility of loan forgiveness. To apply for a PPP loan, businesses must submit specific paperwork requirements, which can vary depending on the lender and the type of business. In this article, we will explore the PPP loan paperwork requirements in detail.

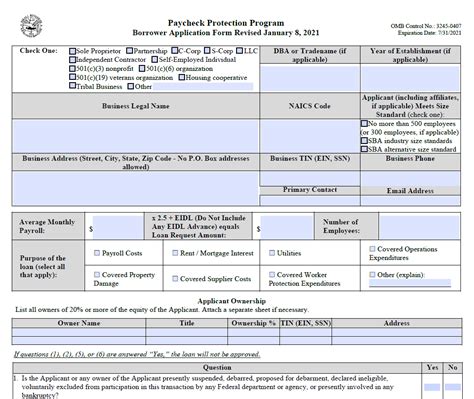

Eligibility Requirements

To be eligible for a PPP loan, businesses must meet certain requirements. These include: * Being a small business, nonprofit organization, veterans organization, or tribal business concern with 500 or fewer employees * Being a sole proprietor, independent contractor, or self-employed individual * Having been in operation on February 15, 2020 * Having paid salaries and payroll taxes or paid independent contractors * Not being a business that is ineligible for SBA loans, such as a business engaged in lending or a business that is primarily engaged in political or lobbying activities

Required Documents

To apply for a PPP loan, businesses will need to submit the following documents: * Application form: The application form for a PPP loan can be obtained from the SBA website or from a lender. * Payroll documentation: Businesses will need to provide documentation to support their payroll costs, such as: + Payroll registers + Payroll tax filings (Form 941) + Proof of payment of employee benefits, such as health insurance and retirement plans * Identification documents: Businesses will need to provide identification documents, such as: + Business license + Articles of incorporation + Driver’s license or passport * Financial statements: Businesses will need to provide financial statements, such as: + Balance sheet + Income statement + Cash flow statement * Tax returns: Businesses will need to provide tax returns, such as: + Business tax return (Form 1120) + Personal tax return (Form 1040)

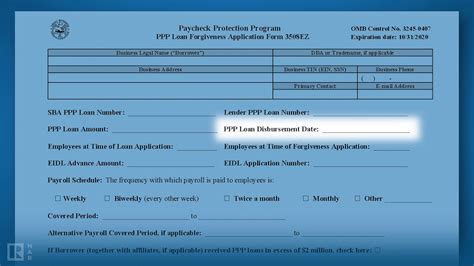

Loan Forgiveness Documentation

To be eligible for loan forgiveness, businesses will need to submit documentation to support their eligible expenses, such as: * Payroll costs: Businesses will need to provide documentation to support their payroll costs, such as: + Payroll registers + Payroll tax filings (Form 941) + Proof of payment of employee benefits, such as health insurance and retirement plans * Rent or lease payments: Businesses will need to provide documentation to support their rent or lease payments, such as: + Lease agreement + Rent payment receipts * Utilities payments: Businesses will need to provide documentation to support their utilities payments, such as: + Utility bills + Payment receipts * Mortgage interest payments: Businesses will need to provide documentation to support their mortgage interest payments, such as: + Mortgage statements + Payment receipts

📝 Note: Businesses should keep accurate records of their expenses and receipts, as this documentation will be required to support their loan forgiveness application.

Loan Application Process

The loan application process for a PPP loan typically involves the following steps: 1. Check eligibility: Businesses should check their eligibility for a PPP loan by reviewing the SBA’s eligibility requirements. 2. Gather required documents: Businesses should gather the required documents, such as payroll documentation, identification documents, financial statements, and tax returns. 3. Submit application: Businesses should submit their application to a lender, either online or in-person. 4. Review and approval: The lender will review the application and make a decision to approve or deny the loan. 5. Loan disbursement: If the loan is approved, the lender will disburse the loan funds to the business.

Conclusion

In summary, the PPP loan paperwork requirements include providing documentation to support payroll costs, identification documents, financial statements, and tax returns. Businesses should also keep accurate records of their expenses and receipts to support their loan forgiveness application. By following these steps and providing the required documentation, businesses can increase their chances of being approved for a PPP loan and taking advantage of the program’s benefits.

What is the purpose of the PPP loan program?

+

The purpose of the PPP loan program is to provide loans with favorable terms to small businesses and other eligible entities to help them keep their workers employed during the COVID-19 pandemic.

What are the eligibility requirements for a PPP loan?

+

To be eligible for a PPP loan, businesses must meet certain requirements, including being a small business, nonprofit organization, veterans organization, or tribal business concern with 500 or fewer employees, and having been in operation on February 15, 2020.

What documentation is required to apply for a PPP loan?

+

To apply for a PPP loan, businesses will need to submit documentation to support their payroll costs, identification documents, financial statements, and tax returns.