5 Ways Pay Workers Comp

Introduction to Workers Compensation

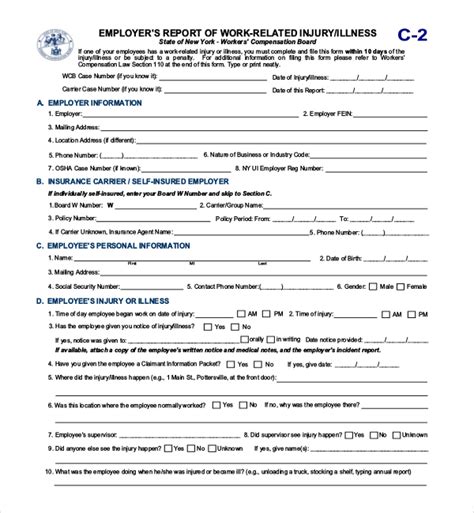

Workers compensation is a type of insurance that provides financial benefits to employees who are injured on the job or become ill as a result of their job. The goal of workers compensation is to ensure that employees who are injured or ill receive the medical care and financial support they need to recover and return to work. In this article, we will discuss the different ways that employers can pay for workers compensation insurance.

Understanding the Importance of Workers Compensation

Workers compensation is an important aspect of employment law, as it provides a safety net for employees who are injured or ill due to their job. Without workers compensation, employees might not have the financial resources to pay for medical care and other expenses related to their injury or illness. Employers also benefit from workers compensation, as it can help to reduce the risk of lawsuits and provide a way to manage the costs associated with workplace injuries and illnesses.

5 Ways to Pay Workers Comp

There are several ways that employers can pay for workers compensation insurance. Here are five common methods: * Self-Insurance: Some employers choose to self-insure, which means that they pay for workers compensation claims directly rather than purchasing insurance. This approach can be cost-effective for large employers with a low risk of workplace injuries and illnesses. * Private Insurance: Many employers purchase private insurance to cover workers compensation claims. This approach provides a way to manage the risk of workplace injuries and illnesses, and can help to reduce the financial burden on the employer. * State Insurance Funds: Some states offer insurance funds that provide workers compensation coverage to employers. These funds are often subsidized by the state, which can make them a more affordable option for small employers or those in high-risk industries. * Professional Employer Organizations (PEOs): PEOs provide a range of services, including workers compensation insurance, to small and medium-sized businesses. This approach can be a good option for employers who want to outsource their workers compensation management. * Captive Insurance: Captive insurance is a type of self-insurance where a group of employers pool their resources to form an insurance company. This approach can provide a way for employers to manage their workers compensation risks and reduce their costs.

Benefits and Drawbacks of Each Method

Each of the methods for paying workers comp has its own benefits and drawbacks. Here are some key considerations: * Self-Insurance: Benefits: cost-effective, flexible. Drawbacks: high-risk, requires significant financial resources. * Private Insurance: Benefits: manages risk, provides financial protection. Drawbacks: can be expensive, may have limited coverage. * State Insurance Funds: Benefits: subsidized by the state, can be more affordable. Drawbacks: may have limited coverage, can be subject to state regulations. * PEOs: Benefits: provides a range of services, can be cost-effective. Drawbacks: may have limited flexibility, can be subject to fees. * Captive Insurance: Benefits: provides a way to manage risk, can be cost-effective. Drawbacks: requires significant financial resources, can be subject to regulatory requirements.

| Method | Benefits | Drawbacks |

|---|---|---|

| Self-Insurance | cost-effective, flexible | high-risk, requires significant financial resources |

| Private Insurance | manages risk, provides financial protection | can be expensive, may have limited coverage |

| State Insurance Funds | subsidized by the state, can be more affordable | may have limited coverage, can be subject to state regulations |

| PEOs | provides a range of services, can be cost-effective | may have limited flexibility, can be subject to fees |

| Captive Insurance | provides a way to manage risk, can be cost-effective | requires significant financial resources, can be subject to regulatory requirements |

💡 Note: Employers should carefully consider their options and choose the method that best fits their needs and budget.

In summary, there are several ways that employers can pay for workers compensation insurance, each with its own benefits and drawbacks. By understanding the different options and considering their own needs and budget, employers can make an informed decision about how to manage their workers compensation risks.

To recap, the key points are: * Workers compensation is an important aspect of employment law * There are several ways to pay for workers compensation insurance, including self-insurance, private insurance, state insurance funds, PEOs, and captive insurance * Each method has its own benefits and drawbacks * Employers should carefully consider their options and choose the method that best fits their needs and budget

As we reflect on the importance of workers compensation, it’s clear that employers have a range of options for managing their risks and providing financial support to injured or ill employees. By choosing the right approach, employers can help to ensure that their employees receive the care and support they need, while also managing their own financial risks.

What is workers compensation insurance?

+

Workers compensation insurance is a type of insurance that provides financial benefits to employees who are injured on the job or become ill as a result of their job.

What are the benefits of self-insurance?

+

The benefits of self-insurance include cost-effectiveness and flexibility.

What is captive insurance?

+

Captive insurance is a type of self-insurance where a group of employers pool their resources to form an insurance company.