Paperwork

LLC Paperwork Retention Period

Introduction to LLC Paperwork Retention

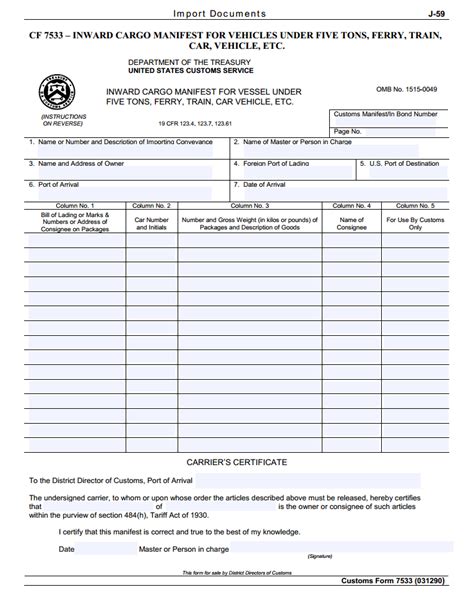

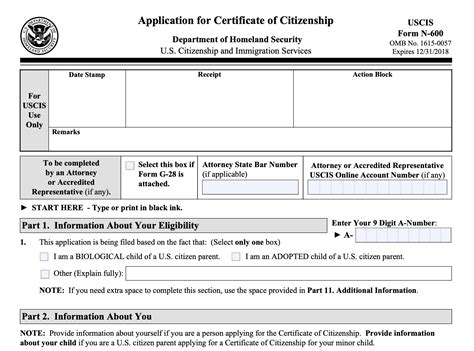

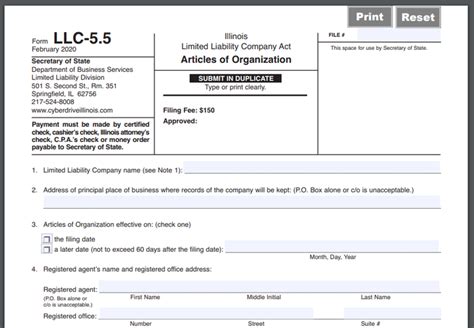

When establishing and maintaining a Limited Liability Company (LLC), it’s essential to understand the importance of retaining paperwork. LLC paperwork includes various documents, such as articles of organization, operating agreements, meeting minutes, and tax returns. These documents serve as proof of the company’s existence, its structure, and its compliance with regulatory requirements. Retaining these documents for the appropriate period is crucial for audits, lawsuits, and other business purposes.

Why Retain LLC Paperwork?

There are several reasons why retaining LLC paperwork is vital: * Tax Audits: The IRS requires businesses to keep records for a certain period in case of an audit. LLCs must retain tax returns, financial statements, and other supporting documents. * Compliance: LLCs must comply with state and federal regulations. Retaining paperwork, such as articles of organization and annual reports, helps demonstrate compliance. * Litigation: In the event of a lawsuit, LLC paperwork can serve as evidence. Retaining documents, such as meeting minutes and contracts, can help protect the company’s interests. * Business Operations: LLC paperwork, such as operating agreements and meeting minutes, helps guide business operations and ensures that all members are on the same page.

Retention Period for LLC Paperwork

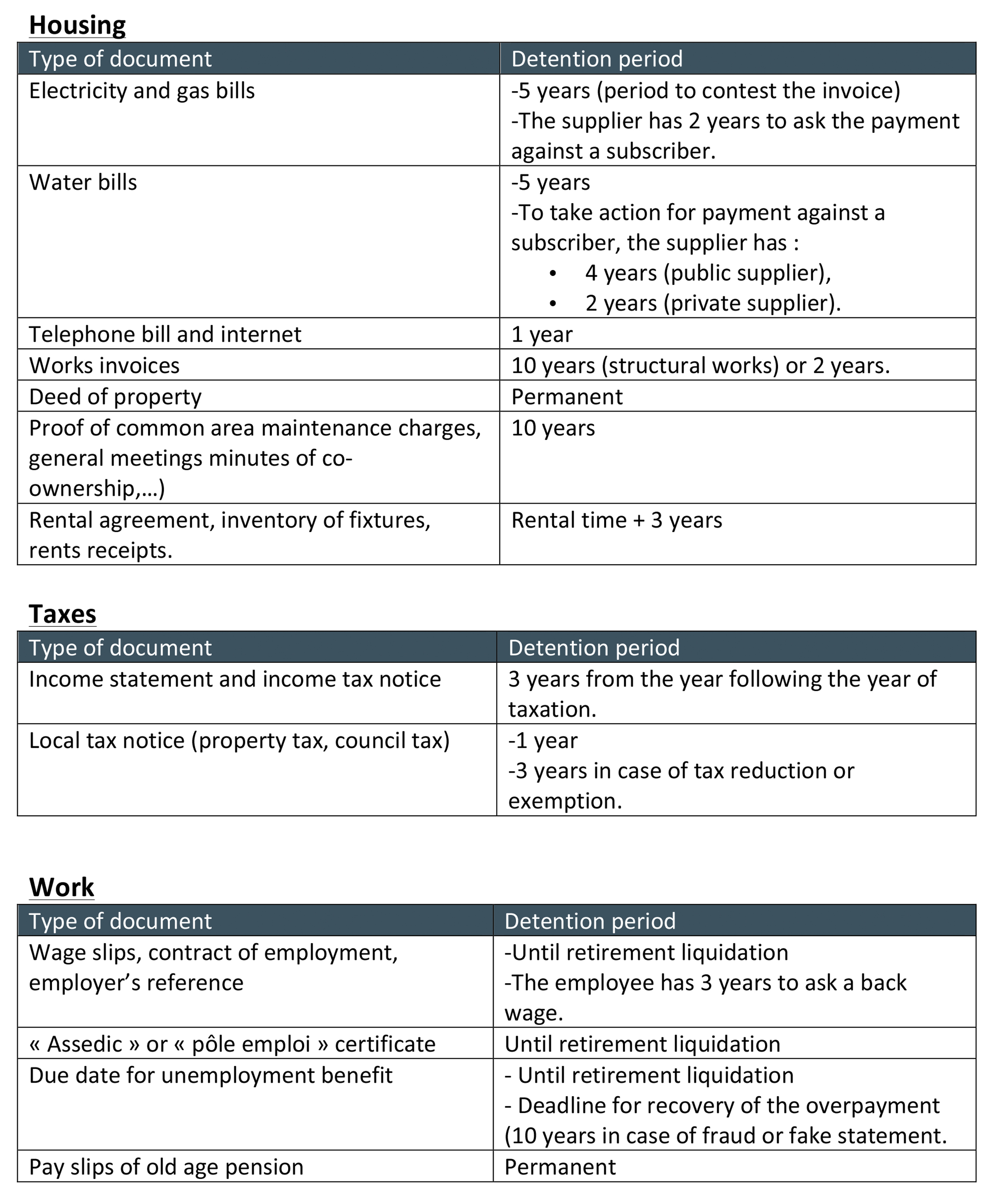

The retention period for LLC paperwork varies depending on the type of document and the purpose it serves. Here are some general guidelines: * Tax Returns: The IRS recommends retaining tax returns for at least three years from the date of filing. * Financial Statements: Financial statements, such as balance sheets and income statements, should be retained for at least seven years. * Meeting Minutes: Meeting minutes should be retained for at least seven years, as they provide a record of important business decisions. * Contracts: Contracts should be retained for at least seven years, or for the duration of the contract, whichever is longer. * Articles of Organization: Articles of organization should be retained permanently, as they provide proof of the company’s existence. * Operating Agreements: Operating agreements should be retained permanently, as they outline the company’s structure and operations.

Best Practices for Retaining LLC Paperwork

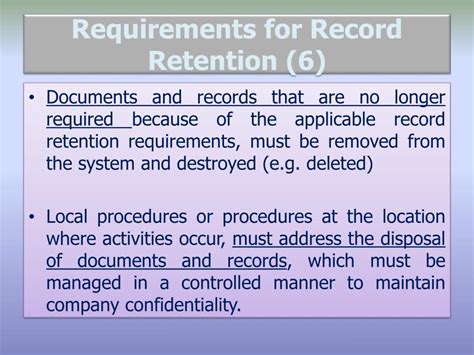

To ensure that LLC paperwork is retained properly, follow these best practices: * Use a Secure Storage System: Use a secure storage system, such as a fireproof safe or a cloud-based storage service, to store LLC paperwork. * Organize Documents: Organize documents in a logical and consistent manner, making it easy to locate specific documents when needed. * Limit Access: Limit access to LLC paperwork to authorized personnel only, to prevent unauthorized access or tampering. * Regularly Review and Update: Regularly review and update LLC paperwork to ensure that it remains accurate and compliant with regulatory requirements.

Conclusion

Retaining LLC paperwork is essential for ensuring compliance with regulatory requirements, protecting the company’s interests, and guiding business operations. By understanding the retention period for different types of documents and following best practices for retention, LLCs can ensure that they are well-organized and prepared for any situation that may arise.

📝 Note: It is essential to consult with a legal or financial professional to determine the specific retention period for LLC paperwork, as it may vary depending on the company's location and industry.

What is the purpose of retaining LLC paperwork?

+

The purpose of retaining LLC paperwork is to ensure compliance with regulatory requirements, protect the company’s interests, and guide business operations.

How long should LLC tax returns be retained?

+

LLC tax returns should be retained for at least three years from the date of filing.

What is the best way to store LLC paperwork?

+

The best way to store LLC paperwork is to use a secure storage system, such as a fireproof safe or a cloud-based storage service.