Paperwork

7 Tips Save Tax Papers

Introduction to Tax Paper Management

Managing tax papers effectively is crucial for individuals and businesses alike, as it helps in avoiding penalties, reducing stress, and ensuring compliance with tax laws. Proper management of tax documents involves maintaining accurate records, organizing paperwork, and understanding what needs to be saved. In this article, we will explore 7 tips to save tax papers efficiently, ensuring that you are well-prepared for tax season.

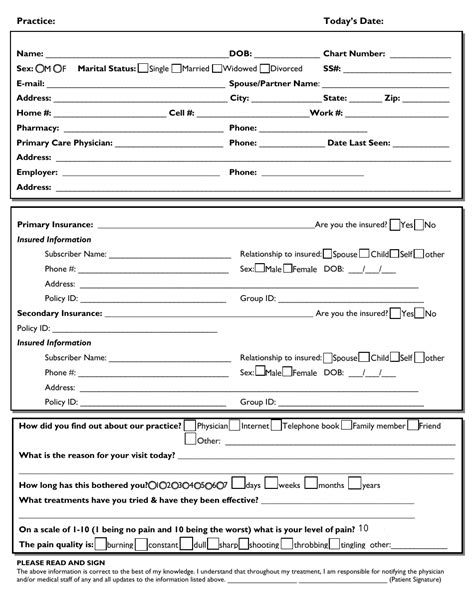

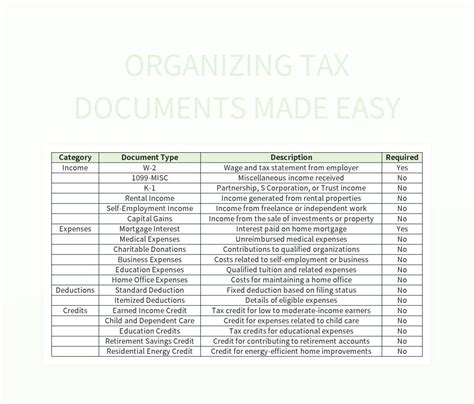

Understanding What to Save

Before diving into the tips, it’s essential to understand what tax papers you need to save. These typically include: - W-2 forms from your employer - 1099 forms for freelance or contract work - Receipts for deductions, such as charitable donations or medical expenses - Bank statements showing income and expenses - Tax returns from previous years

Tips for Saving Tax Papers

Here are seven tips to help you save and manage your tax papers more efficiently: 1. Go Digital: Consider scanning your tax papers and saving them digitally. This not only saves physical space but also makes it easier to organize and search for specific documents. 2. Create a Filing System: Use a filing cabinet or digital folder system to keep your tax papers organized. This could include separate folders for different types of documents, such as income, expenses, and deductions. 3. Use Cloud Storage: Storing your tax papers in the cloud (e.g., Google Drive, Dropbox) allows you to access them from anywhere and reduces the risk of losing them due to physical damage or theft. 4. Set Reminders: Set reminders for when certain tax documents are due to arrive, such as W-2 forms, and for tax filing deadlines. 5. Hire a Professional: If managing your tax papers becomes too overwhelming, consider hiring a tax professional or accountant who can help with organization and filing. 6. Secure Your Documents: Ensure that your tax papers, especially digital versions, are secure. Use strong passwords, enable two-factor authentication, and consider encrypting sensitive documents. 7. Review and Update: Regularly review your tax papers to ensure everything is up to date and accurate. This is also a good time to update your filing system or digital storage to reflect any changes in your tax situation.

Benefits of Efficient Tax Paper Management

Efficiently managing your tax papers offers several benefits, including: - Reduced Stress: Knowing where all your tax documents are and being organized can significantly reduce stress during tax season. - Saved Time: An organized system saves time when preparing for tax filing, as all necessary documents are easily accessible. - Avoided Penalties: Proper management of tax papers helps in avoiding penalties for missing documents or late filings. - Improved Accuracy: With all documents in order, there’s less chance of error in tax returns, which can lead to audits or further complications.

💡 Note: Always check the current tax year's requirements and deadlines, as these can change from year to year.

Conclusion and Final Thoughts

In conclusion, saving tax papers efficiently is a crucial part of personal and business finance management. By understanding what needs to be saved, implementing a robust filing system, and leveraging digital tools, individuals can make tax season less daunting. Remember, the key to successful tax paper management is consistency, organization, and attention to detail. By following these 7 tips, you’ll be better equipped to handle your tax obligations, reducing stress and potential penalties, and ensuring you’re making the most of your tax deductions.

What are the most important tax papers to save?

+

The most important tax papers to save include W-2 forms, 1099 forms, receipts for deductions, bank statements, and previous years’ tax returns.

How long should I keep my tax papers?

+

It’s generally recommended to keep tax papers for at least three years from the date of filing, but this can vary depending on the type of document and your specific tax situation.

Is it safe to store tax papers digitally?

+

Yes, storing tax papers digitally can be safe if you use secure methods such as strong passwords, two-factor authentication, and consider encrypting sensitive documents. Using reputable cloud storage services can also provide an additional layer of security.