-

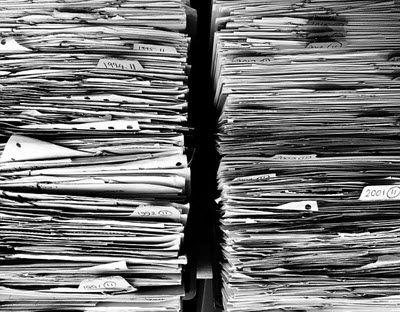

7 Tips Save Tax Papers

Save tax paperwork for at least 3-7 years, depending on audit risk, to ensure compliance with IRS regulations, supporting income tax returns, and deductions, including receipts, invoices, and W-2 forms for accurate record-keeping and potential audits.

Read More »