5 Tips on Paying New Hire Paperwork

Introduction to Paying New Hire Paperwork

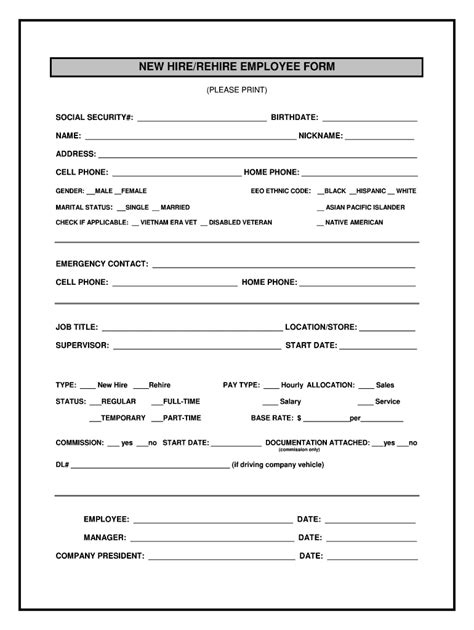

Paying new hire paperwork is a crucial step in the hiring process for any business. It involves completing and submitting various documents to ensure compliance with labor laws and regulations. The process can be overwhelming, especially for small businesses or startups with limited HR experience. In this article, we will explore five tips on paying new hire paperwork to help streamline the process and avoid potential pitfalls.

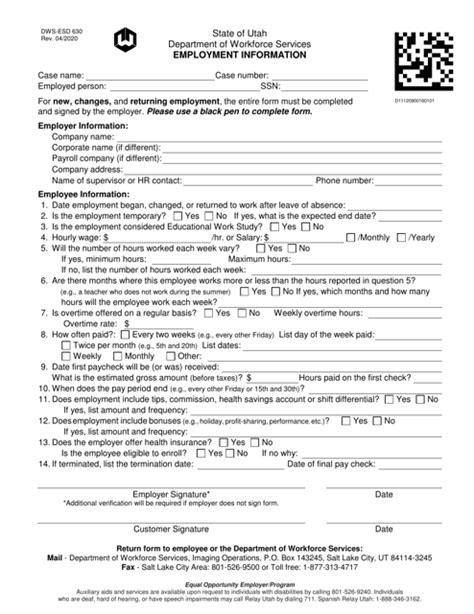

Tip 1: Understand the Requirements

Before hiring new employees, it’s essential to understand the requirements for paying new hire paperwork. This includes familiarizing yourself with federal, state, and local laws, as well as any industry-specific regulations. Some of the key documents required for new hires include: * Form I-9: Verification of identity and employment eligibility * Form W-4: Employee withholding certificate * State tax withholding forms: Vary by state, but typically require employees to provide withholding information * Worker’s compensation forms: Depending on the state and industry, may require additional paperwork

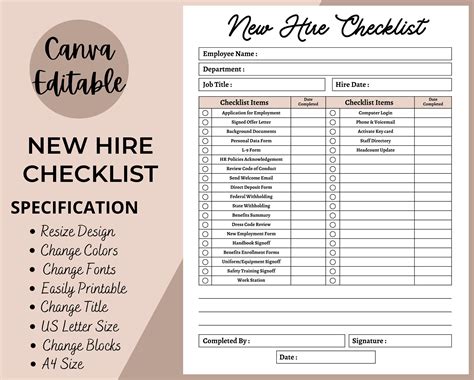

Tip 2: Use Electronic Onboarding Systems

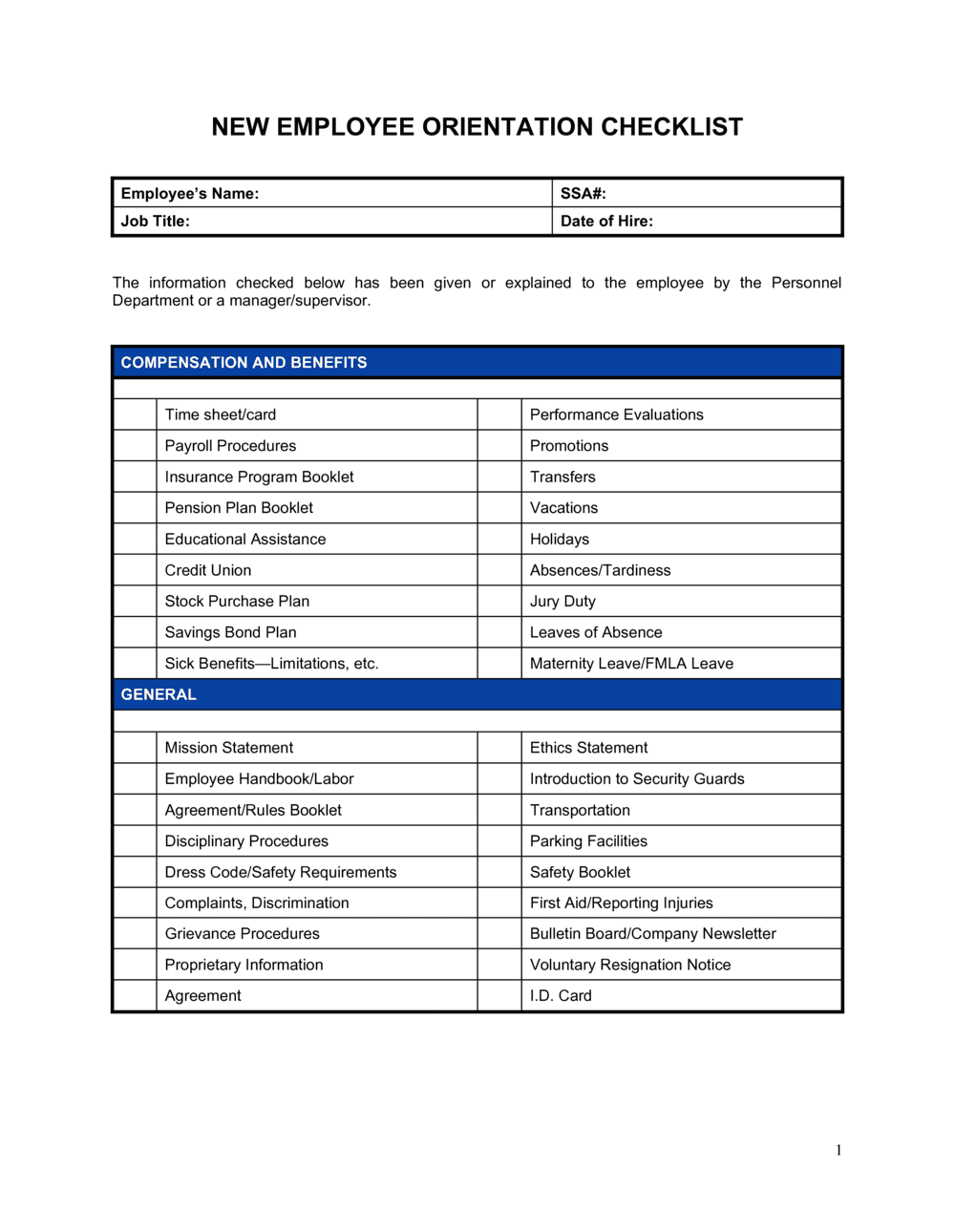

Electronic onboarding systems can simplify the process of paying new hire paperwork by automating many of the tasks involved. These systems can help with: * Online forms: Allow new hires to complete paperwork electronically, reducing errors and increasing efficiency * Automated workflows: Streamline the approval and submission process for new hire paperwork * Compliance tracking: Help ensure that all required documents are completed and submitted on time

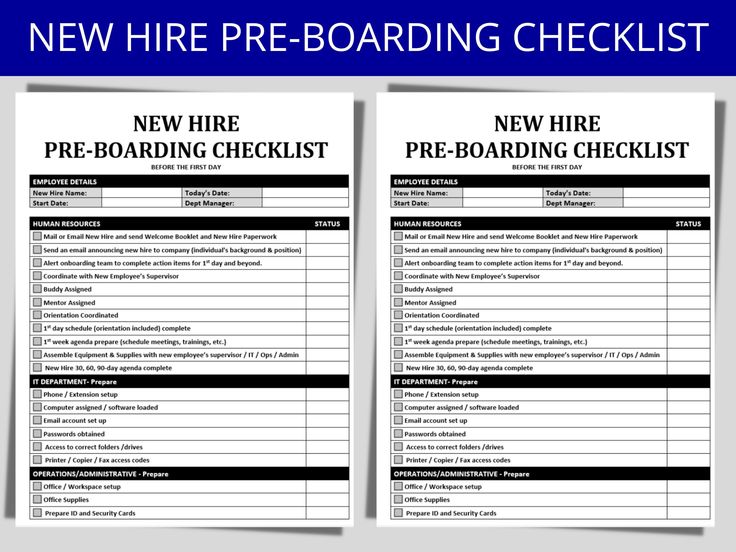

Tip 3: Provide Clear Instructions

Clear instructions are crucial when it comes to paying new hire paperwork. This includes providing new hires with detailed information on: * Required documents: Clearly outline the documents required for the onboarding process * Deadlines: Specify the deadlines for completing and submitting paperwork * Support: Offer support and resources for new hires who may have questions or concerns about the process

Tip 4: Review and Verify Information

Reviewing and verifying information is a critical step in the paying new hire paperwork process. This includes: * Verifying employee identity: Ensure that new hires provide accurate and valid identification documents * Reviewing tax withholding information: Verify that new hires have completed tax withholding forms correctly * Checking for errors: Review paperwork for errors or omissions before submitting to authorities

Tip 5: Maintain Accurate Records

Maintaining accurate records is essential for paying new hire paperwork. This includes: * Electronic storage: Store new hire paperwork electronically, using secure and compliant systems * Record retention: Ensure that records are retained for the required period, as specified by law or regulation * Audit preparedness: Regularly review and update records to ensure compliance and preparedness for audits

📝 Note: It's essential to stay up-to-date with changing regulations and laws regarding new hire paperwork to avoid potential penalties or fines.

In the end, paying new hire paperwork requires attention to detail, organization, and a thorough understanding of the requirements involved. By following these five tips, businesses can streamline the process, reduce errors, and ensure compliance with relevant laws and regulations. The key is to stay informed, use technology to your advantage, and maintain accurate records to avoid potential pitfalls. With the right approach, paying new hire paperwork can be a smooth and efficient process, allowing businesses to focus on what matters most – growing and succeeding.

What is the purpose of Form I-9?

+

Form I-9 is used to verify the identity and employment eligibility of new hires in the United States.

Can new hire paperwork be completed electronically?

+

Yes, many electronic onboarding systems allow new hires to complete paperwork electronically, reducing errors and increasing efficiency.

How long should new hire paperwork be retained?

+

The retention period for new hire paperwork varies depending on the type of document and applicable laws or regulations. It’s essential to consult with relevant authorities or experts to determine the specific retention requirements.

Related Terms:

- Is unpaid orientation legal